- FedEx reported mixed results for fiscal-Q4 2023

- Company disappointed with fiscal-2024 forecasts as pandemic boom fades

- FedEx sees challenging demand environment ahead

- Plans to ground more plans than it did in fiscal-2023

- Conservative forecast aimed at avoiding last year's mistake

- Stock pulls back from $231-235 resistance zone

FedEx (FDX.US) is trading lower today, following a disappointing forecast release yesterday in the evening. This deserves attention as FedEx, being one of the largest logistics companies in the United States, is often seen as one of the bellwethers for the US economy. Let's take a look at recent earnings and forecasts from the company.

Mixed earnings for fiscal-Q4 2023

FedEx published its earnings report for fiscal-Q4 2023 (quarter ended on May 31, 2023) on Tuesday after the close of the Wall Street session. Results turned out to be mixed - revenue missed estimates while earnings turned out to be slightly higher than expected. Nevertheless, both sales and earnings were much lower compared to a year-ago period. FedEx said that results for the quarter were negatively impacted by continued weakness in demand as well as by cost inflation.

Company noted that lower global volumes contributed to weaker operating results in its Express unit while the Freight segment was negatively impacted by decreased shipments as well as lower weight per shipment. Operating results in the Ground unit improved thanks to higher revenue per package as well as enacted cost-reduction measures.

Fiscal-Q4 results snapshot

Overall

- Revenue: $21.9 billion vs $22.65 billion expected (-10.2% YoY)

- Adjusted operating income: $1.77 billion vs $1.69 billion expected (-20.6% YoY)

- Adjusted operating margin: 8.1% vs 9.2% in fiscal-Q4 2022

- Adjusted net income: $1.25 billion vs $1.24 billion expected (-30.5% YoY)

- Adjusted EPS: $4.94 vs $4.88 expected (-28.1% YoY)

Express unit results

- Revenue: $10.4 billion (-13% YoY)

- Average price per package: -3% YoY

- Package volume: -7% YoY

Ground unit results

- Revenue: $8.3 billion (-2.3% YoY)

- Average price per package:+4.9% YoY

- Package volume: -6% YoY

Full-year fiscal-2023 results

- Revenue: $90.2 billion (-3.5% YoY)

- Adjusted operating income: $5.37 billion (-21.8% YoY)

- Adjusted operating margin: 6.0% vs 7.3% in fiscal-2022

- Adjusted net income: $3.84 billion (-30.2% YoY)

- Adjusted EPS: $14.96 (-27.4% YoY)

- Capital spending: $6.2 billion

- Dividends: $1.2 billion

- Buybacks: $1.5 billion

Financial dashboard for FedEx. Source: Bloomberg, XTB

Disappointing forecasts for fiscal-2024

Fiscal-Q4 2023 results from FedEx were mixed but outlook for full fiscal-2024 (June 2023- May 2024 period) has been considered disappointing. Company expects adjusted EPS to fall into the $16.50-18.50 range. While this points to earnings growth in fiscal-2024, the midpoint of the range at $17.50 is below analysts' median estimate of $18.31. Capital spending in fiscal-2024 is expected to be $0.5 billion lower than in fiscal-2023 at $5.7 billion, and the company said that it will focus on investments that improve efficiency and automation. On a positive note, FedEx expects to avoid revenue drop in fiscal-2024 with sales expected to be either flat or slightly higher.

- Revenue growth: flat to low-single digit

- Permanent cost reductions from DRIVE transformation programme: $1.8 billion

- Adjusted EPS: $16.50-18.50 vs $18.31 expected

- Capital spending: $5.7 billion

FedEx has experienced a decelerating revenue growth for 2 years already but the company expects things to change in fiscal-2024. Source: Bloomberg, XTB

FedEx has experienced a decelerating revenue growth for 2 years already but the company expects things to change in fiscal-2024. Source: Bloomberg, XTB

FedEx will ground more aircraft in fiscal-2024

Deterioration in the company's business is driven by a fading post-pandemic boom. Customers increased their online spending on goods during Covid-19 pandemic as lockdowns and other restrictions were preventing them from making purchases in brick-and-mortar shops. However, as lockdowns are a thing of the past, it can be spotted that entertainment and services spending is on the rise at the expense of online goods shopping. This is creating a challenging demand environment for FedEx and contributes to a rather weakish outlook. As a result of challenging demand conditions, FedEx said that it plans to ground 29 more aircraft in the fiscal-2024, on top of 18 aircraft already grounded in fiscal-2023.

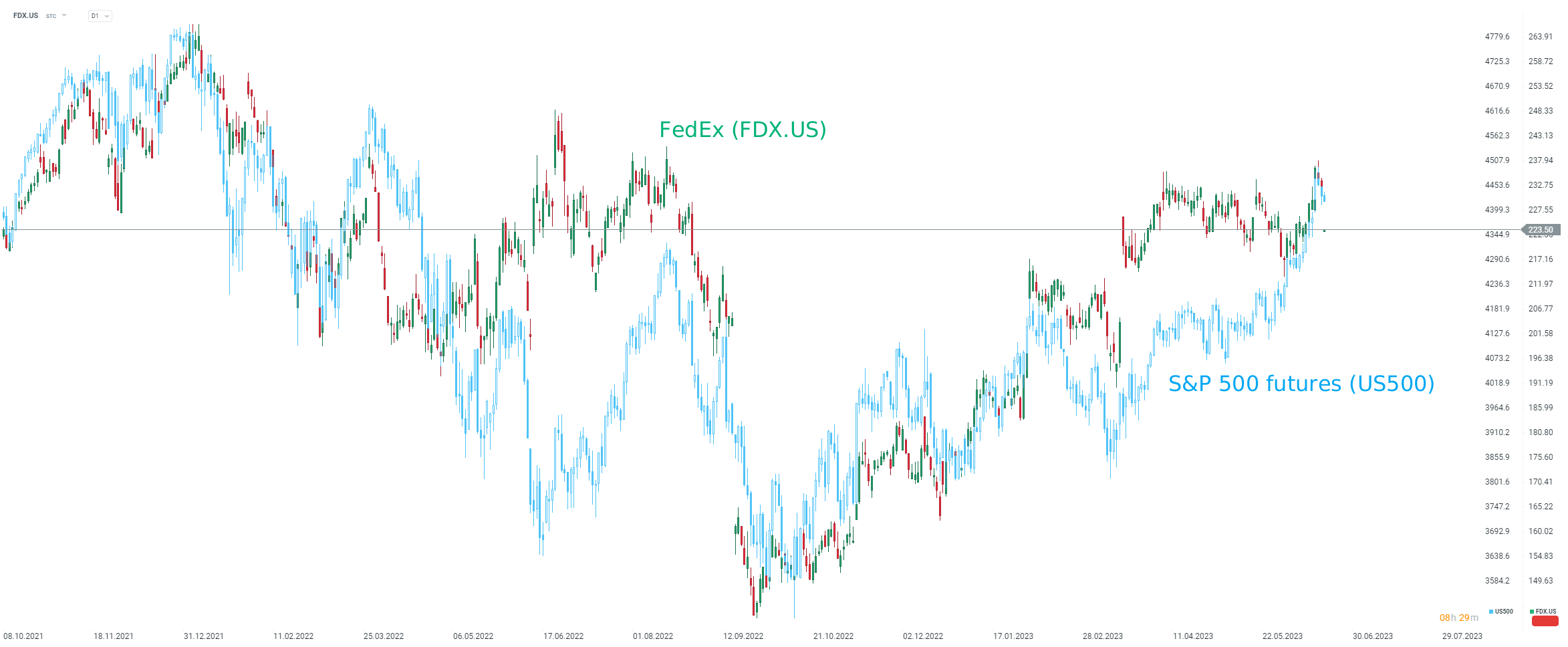

FedEx is considered to be one of the bellwethers for the US economy and a significant correlation can be spotted between its share price (FDX.US) and S&P 500 futures (US500, blue overlay). Source: xStation5

FedEx is considered to be one of the bellwethers for the US economy and a significant correlation can be spotted between its share price (FDX.US) and S&P 500 futures (US500, blue overlay). Source: xStation5

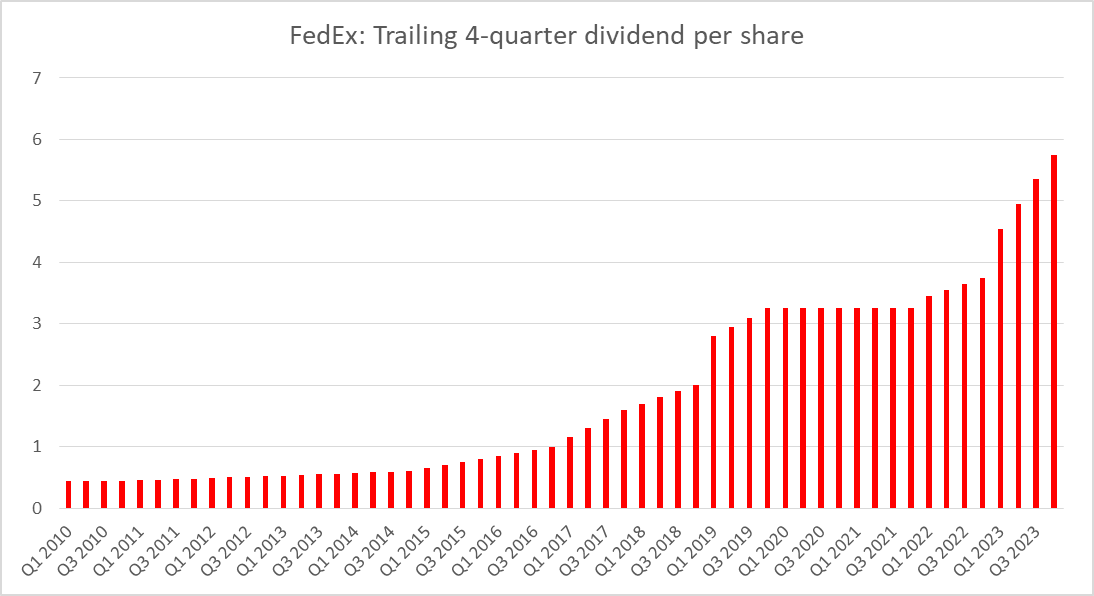

FedEx plans to increase capital distribution in fiscal-2024

While FedEx is not expecting to grow its business as fast as it did during the post-pandemic boom, it still plans to continue to increase capital distributions at a rather quick pace. Company said that it plans to purchase $2.0 billion during fiscal-2024, a 25% increase from $1.5 billion spent on share repurchases in fiscal-2023. A $1.5 billion in fiscal-2023 buybacks led to repurchases of over 9 million shares, reducing the number of shares outstanding by 4% and creating upward pressure on EPS. Company also plans a 10% dividend increase in the fiscal year.

Fiscal-2024 plans

-

Buybacks: $2.0 billion (+25% YoY)

-

Dividend: $5.04 per share (+10% YoY)

FedEx plans to continue with a quick pace of dividend increases in the current fiscal year. Data on the chart also includes not only regular dividends but also special dividends. Source: XTB, Bloomberg

FedEx plans to continue with a quick pace of dividend increases in the current fiscal year. Data on the chart also includes not only regular dividends but also special dividends. Source: XTB, Bloomberg

A look at the chart

Shares of FedEx (FDX.US) launched today's trading lower following the release of disappointing fiscal-2024 forecasts yesterday evening. Taking a look at the chart at D1 interval, we can see that the price continues to pull back after a failure to break above the resistance zone marked with 38.2% retracement of the post-pandemic rally ($231-235 area). While the miss in EPS forecast can be seen as worrying, FedEx likely decided on a conservative forecast in order not to repeat last year's mistakes when the ambitious full-year forecast had to be cut in September, triggering a slump in company's share price (orange circle). Should the ongoing pullback deepen, bears may target the $215 zone as the first major support.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.