Super Micro Computer: Will the AI Infrastructure Provider Become the Next Tech Giant – or Is It Just Hype?

In just two years, Super Micro Computer (SMCI) has transformed from a niche server manufacturer into one of the most exciting companies on the U.S. stock market. For many investors, SMCI has become a symbol of a new wave of “AI infrastructure” — companies that don’t build artificial intelligence models themselves but provide the hardware on which those models run.

Unlike well-known giants such as Nvidia or AMD, Super Micro operates more quietly, focusing on designing, assembling, and delivering servers, GPU systems, liquid cooling solutions, and infrastructure for data centers. That hasn’t stopped it from gaining the trust of major clients such as Microsoft, Meta, Oracle, and Tesla. As global companies pour billions into AI data centers, SMCI is becoming one of the first to benefit from this trend.

But does the company’s current valuation truly reflect its long-term potential — or have investors been swept up in a wave of hype similar to the dot-com era? In this article, we’ll take a closer look at SMCI’s operations, financials, valuation, growth scenarios, and the risks that could shape the future of this fast-moving company.

What Does Super Micro Computer Do?

Super Micro Computer (SMCI) is primarily a manufacturer of high-performance servers and computer systems, used mainly in data centers, cloud computing services, and, most recently, in the fast-growing artificial intelligence (AI) sector. The company specializes in delivering end-to-end hardware solutions — from motherboards and liquid cooling systems to advanced GPU-optimized server platforms.

A key differentiator for SMCI is its ability to rapidly tailor products to the specific needs of customers such as hyperscalers (e.g., Microsoft, Meta, Oracle) and companies developing advanced AI models. This has made Super Micro a preferred partner for projects where time-to-market and hardware performance are critical. Notably, SMCI doesn’t just sell off-the-shelf servers — it often engages in the design and integration process to build solutions customized for each client, setting it apart from larger, more generalized IT hardware manufacturers.

Macro Trends Driving Super Micro Computer

The data center and AI infrastructure market is booming, driven by three major trends:

-

Explosion of AI and Large Language Models (LLMs) – The rapid growth of AI applications is driving massive demand for computing power, which in turn is fueling the need for specialized servers equipped with GPU processors.

-

Expansion of Global Data Center Infrastructure – Hyperscalers such as Microsoft, Amazon, Meta, and Google are investing billions of dollars to expand their data centers, particularly in the U.S., Europe, and Asia, to meet increasing computational demands.

-

Technological Advancements in Cooling and Energy Efficiency – As demand for performance grows, so does the need to reduce energy consumption. SMCI stands out by delivering cutting-edge liquid cooling systems that allow for more efficient and eco-friendly server temperature management.

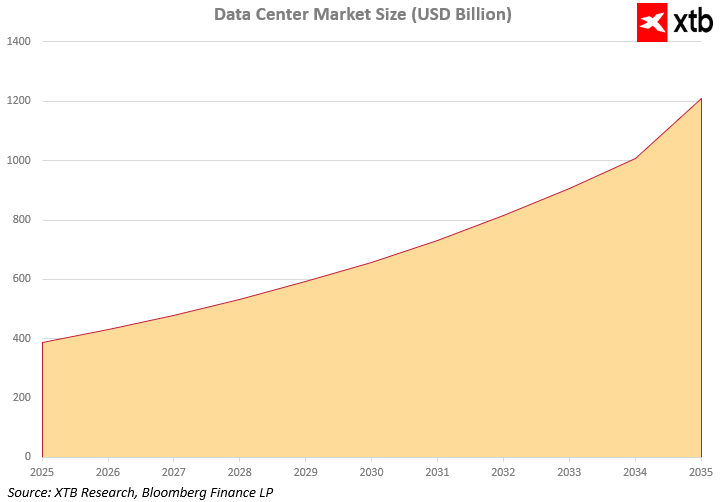

The data center market is growing at an extraordinary pace. Forecasts suggest its value will surge from just under $400 billion in 2025 to over $1.2 trillion by 2035. This presents a massive opportunity for Super Micro Computer. The rising demand for advanced hardware solutions places the company in a strong position to sustain revenue and profit growth. As a result, SMCI is solidifying its role as a key player in one of the fastest-growing global industries.

Financial Analysis

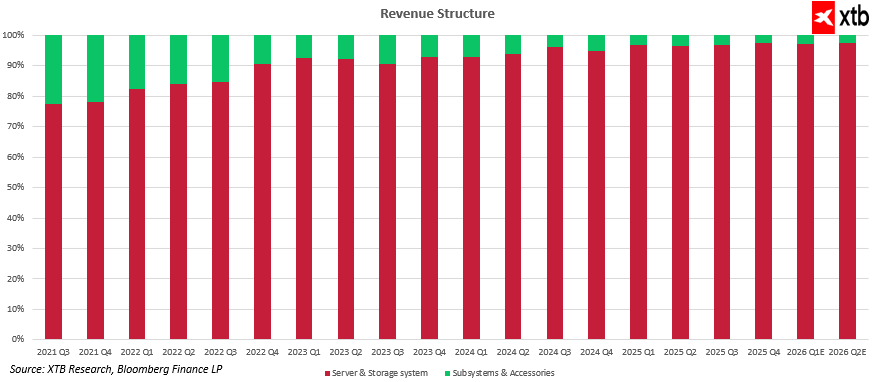

Super Micro Computer’s business model is heavily focused on its Server & Storage Systems segment, which accounts for over 85–90% of total company revenue. This segment involves the production of complete, integrated server systems used primarily in data centers, AI projects, cloud environments, and high-performance computing (HPC) solutions.

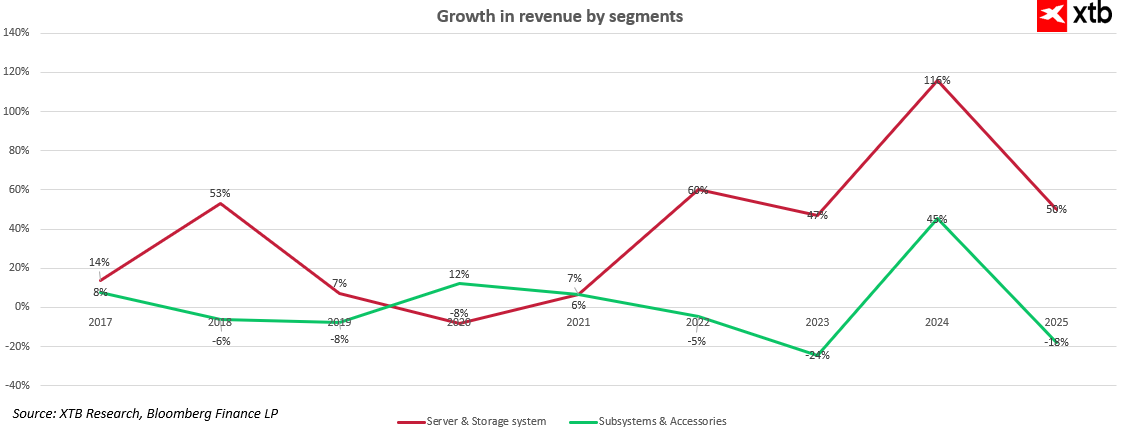

Since 2021, this segment has grown at a blistering pace — from around $693 million in Q3 2021 to a projected $7.4 billion in Q2 2026. That’s more than a tenfold increase in under five years. The growth rate accelerated sharply in the second half of 2023, driven by the AI infrastructure boom and rising demand from global hyperscalers. Annual revenue growth data supports this trend: the Server & Storage Systems segment has consistently seen double-digit increases — +60% in 2022, +47% in 2023, +116% in 2024, and an estimated +50% in 2025.

Meanwhile, the Subsystems & Accessories segment — which includes server components, accessories, and system expansion parts — remains smaller and relatively stable, generating around $150–200 million quarterly. This segment’s revenue share is gradually declining, with uneven growth: +45% in 2024, but -24% in 2023 and -18% in 2025. As such, it plays a complementary role rather than being a key growth driver.

This high concentration of revenue in one rapidly expanding segment offers both significant scalability potential and heightened vulnerability to shifts in that market. However, given the growing demand for AI infrastructure and data centers, the outlook for Server & Storage Systems remains highly favorable.

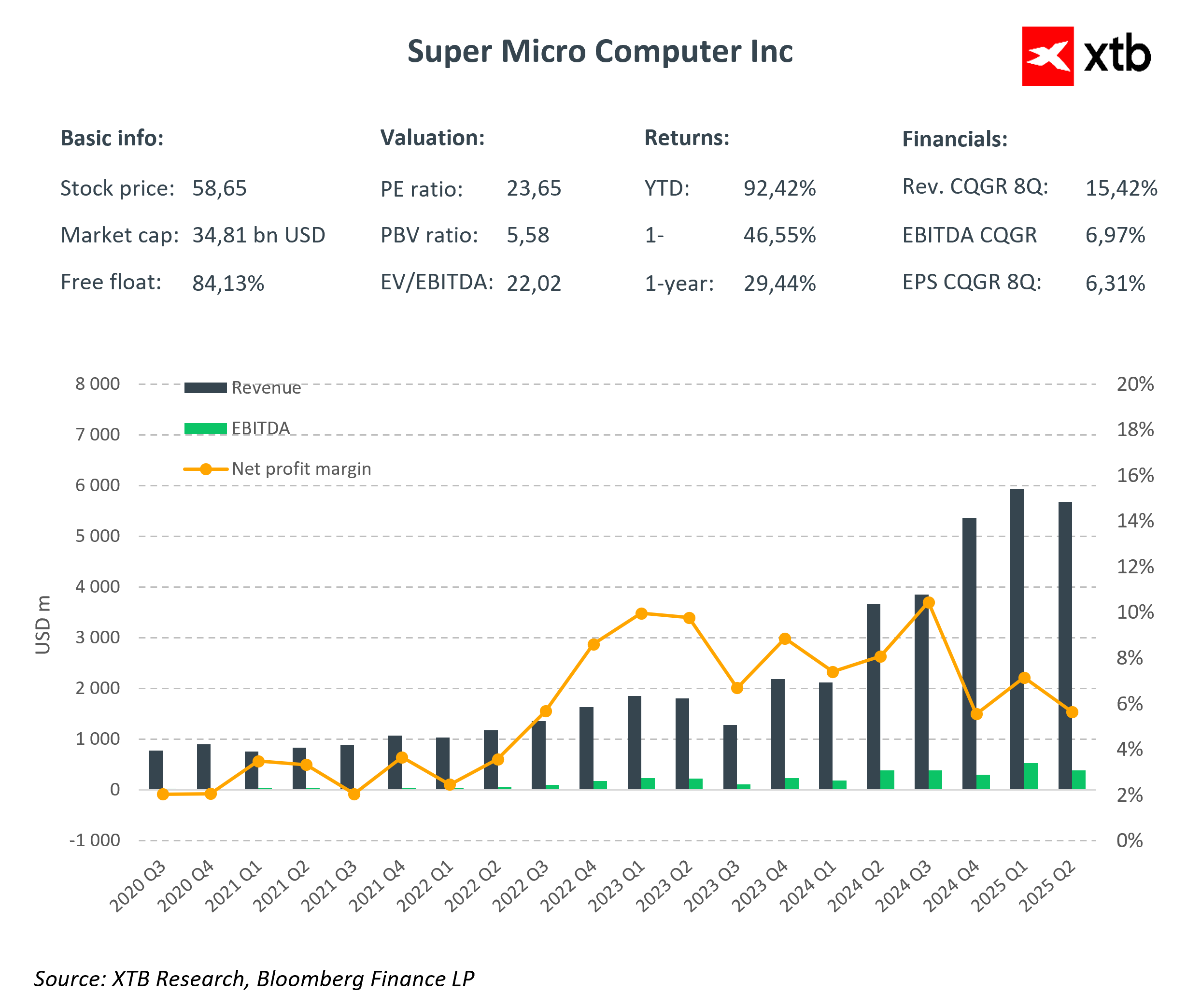

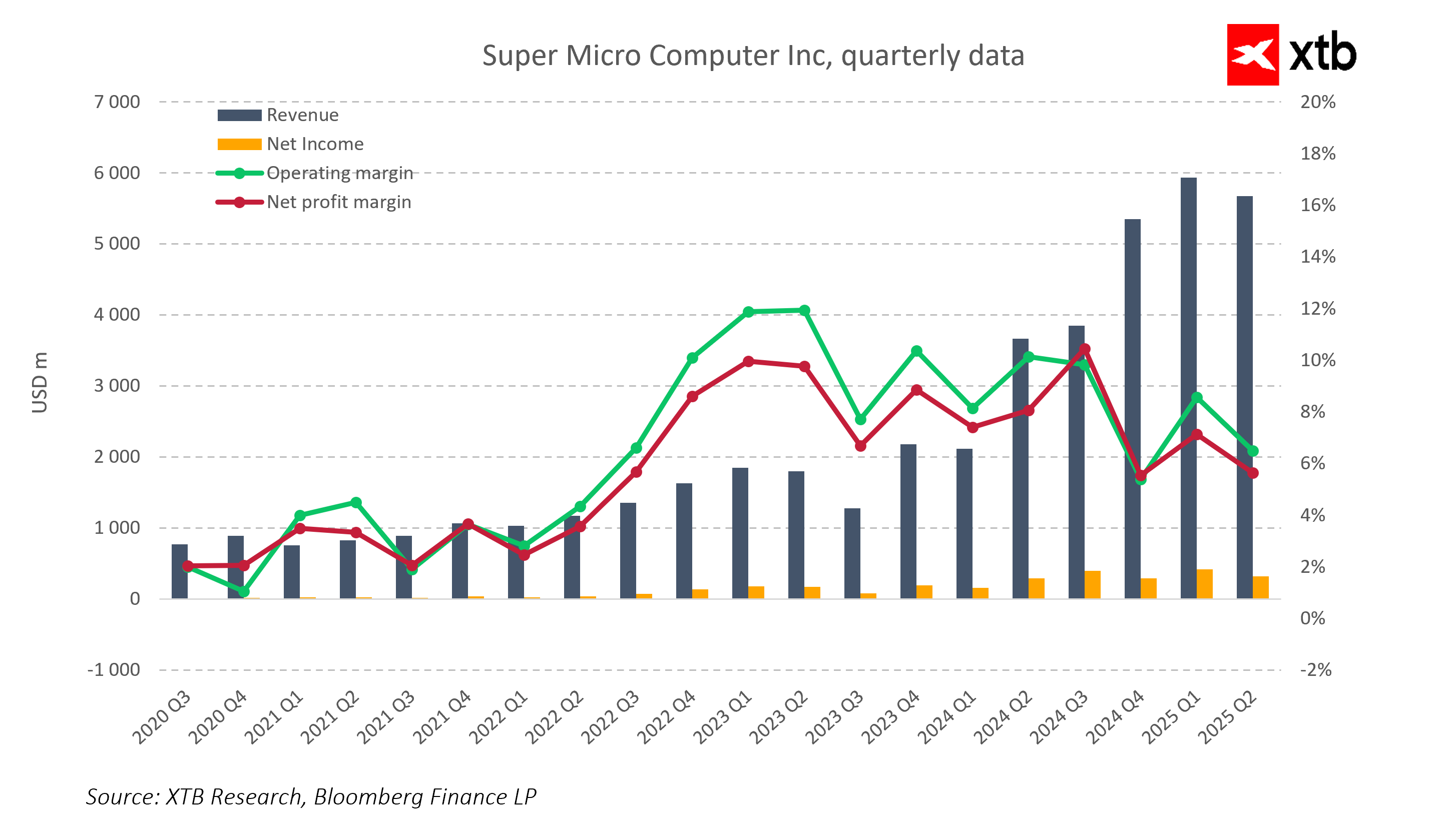

Financial data clearly shows that the company is growing rapidly, particularly evident in its quarterly revenue surge since mid-2023. SMCI’s success aligns with broader macro trends reshaping the global IT and AI infrastructure landscape. The explosion of AI applications, particularly large language models, is fueling intense demand for high-performance data centers and GPU-based servers. Industry giants like Microsoft, Amazon, Meta, and Google are investing billions in expanding computing capacity. Thanks to its flexible production model and ability to customize hardware for client needs, SMCI is emerging as one of the main beneficiaries of this transformation.

SMCI is not only increasing revenue but also improving profitability and net income — as seen in its quarterly financial results. Since 2023, the company has shown strong sales growth alongside rising operational and financial efficiency. Margins, once volatile, have stabilized in the 6–10% range, showing that the company can grow without losing control over costs.

Both revenue and net income are in a strong upward trend. In some periods, annual revenue growth exceeded 100%. These results are not a fluke — SMCI has steadily built a scalable business model that allows it to respond flexibly to the needs of highly demanding clients. The company is not just riding the AI boom — it’s converting it into a lasting market advantage through innovative technology, high performance, and rapid delivery capabilities.

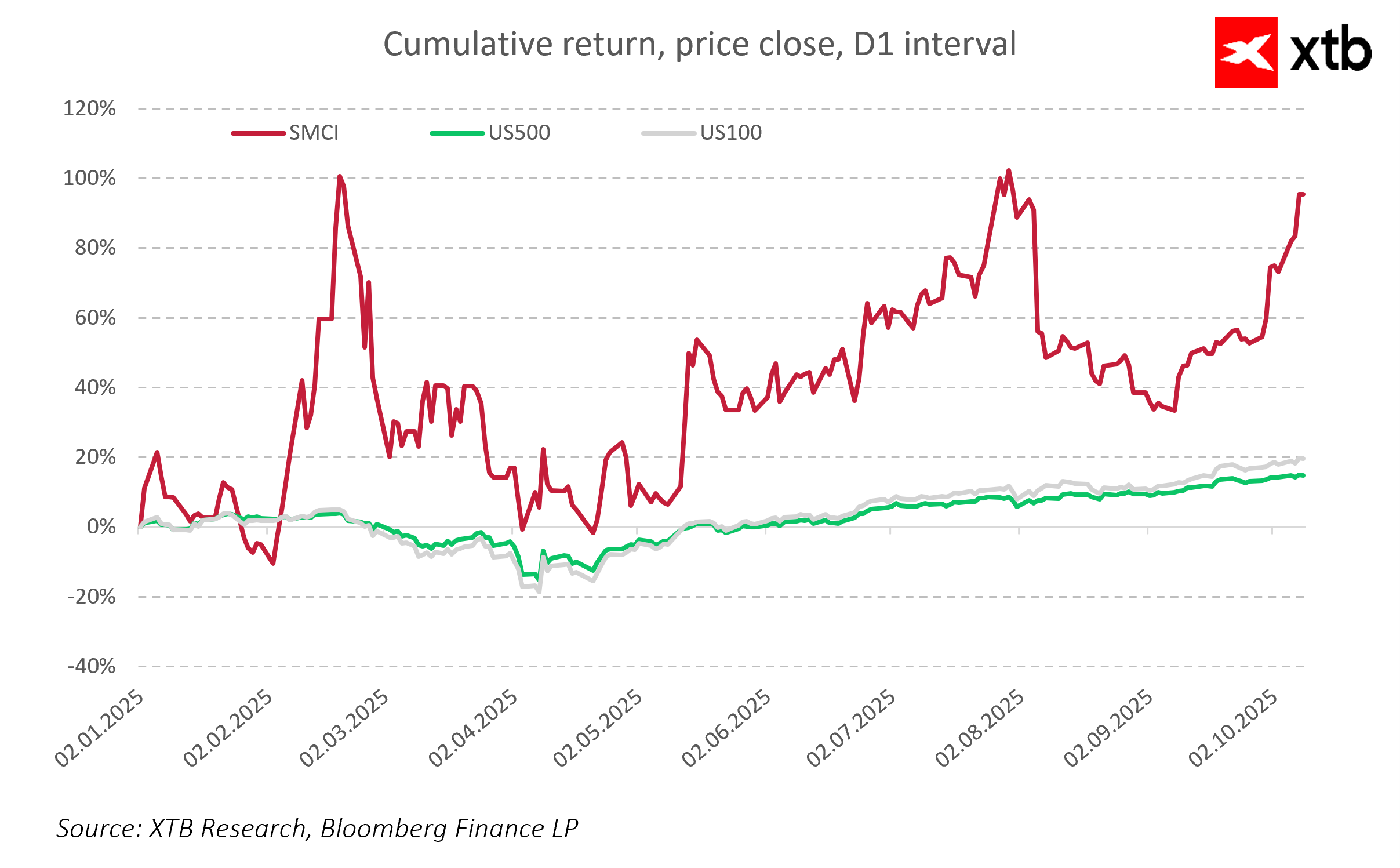

Compared to the broader market, SMCI also stands out in terms of stock performance. A cumulative return chart since the start of 2025 shows SMCI has significantly outperformed the S&P 500 (US500) and Nasdaq 100 (US100). However, its share price shows significantly higher volatility — indicating greater investment risk but also potentially higher returns.

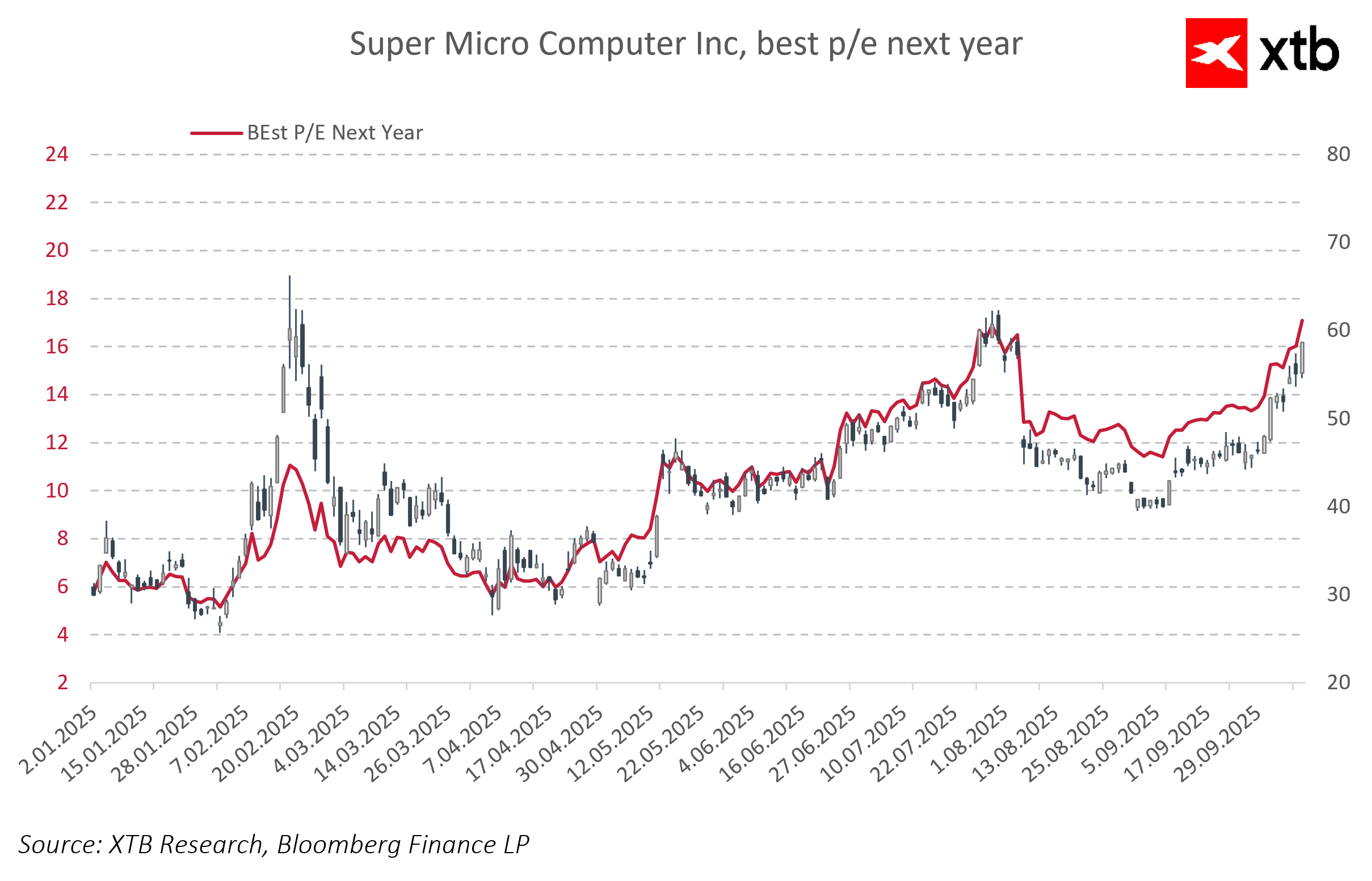

A declining forward P/E ratio is interpreted by the market as a sign of growing expectations for the company’s future results. Investors are assuming rapid profit growth in coming quarters, making the current valuation more attractive relative to future earnings. For many, this also signals that SMCI is no longer seen merely as a hardware supplier, but increasingly as a strategic player in the AI infrastructure and data center ecosystem. A falling forward P/E may reflect rising confidence that the company can not only maintain its current growth trajectory but also develop a durable competitive edge.

Forecast

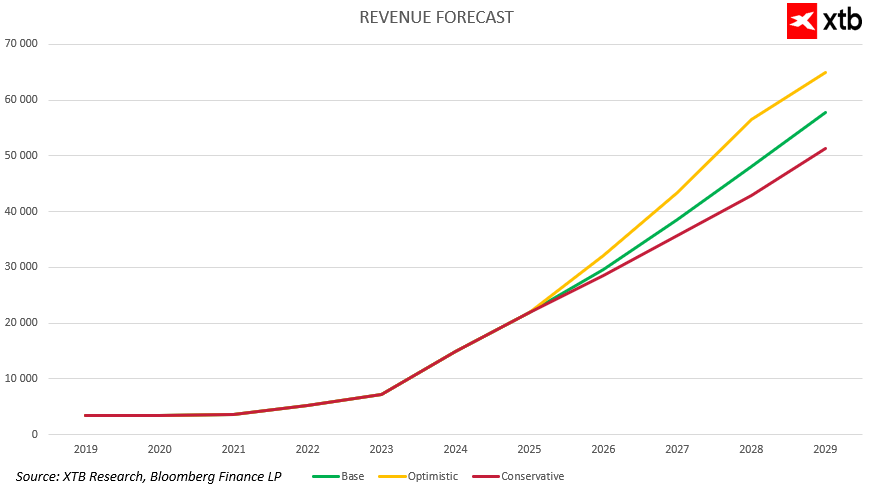

Following record revenue growth in 2023 and 2024, the key question facing the market is: can Super Micro Computer sustain this strong momentum in the coming years? The company operates in a highly promising sector, but the AI and data center boom won’t last forever. Growth will naturally slow over time. The analysis presents three realistic development scenarios: base, optimistic, and conservative, considering both continued AI momentum and potential challenges such as market saturation, margin pressure, and investment cycles.

-

Base scenario assumes very high growth will continue until around 2027, driven by strong demand for AI infrastructure, global hyperscaler investment, and the expansion of large language models. Revenue surpasses $38 billion by 2027, then slows naturally as the market matures and competition increases. Even then, the company continues to scale, reaching nearly $58 billion in revenue by 2029. This is a balanced scenario between continued momentum and market cyclicality.

-

Optimistic scenario sees SMCI not only maintaining but accelerating its growth through continued market and technological expansion. Data center investments remain strong, the company wins new customers, and strengthens its partnerships. Revenue could reach $65 billion by 2029, with stable growth throughout the forecast period.

-

Conservative scenario assumes the biggest growth impulse occurred in 2023–2025. AI investments slow down, competition intensifies, and some clients shift to cheaper or more integrated solutions. Still, SMCI’s revenues continue to grow, albeit more moderately, reaching over $51 billion by 2029. This would still represent a resilient business model even in a tougher environment.

Valuation

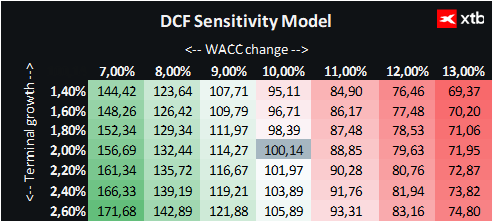

We present a Discounted Cash Flow (DCF) valuation. This is for informational purposes only and does not constitute investment advice or an exact valuation.

The valuation is based on the baseline revenue and earnings forecast scenario. A constant WACC (Weighted Average Cost of Capital) of 10% was used throughout the forecast period. The terminal value was estimated assuming a conservative 2% long-term growth rate. Other financial parameters were averaged based on performance over the past five years.

Based on this, the estimated fair value per share of Super Micro Computer is approximately $100, which is about 71% above the current market price of $58.65. This difference may suggest an attractive investment opportunity, especially for those who believe in the company’s continued rapid growth.

Chart of the day: JP225 jumps on unexpected upward GDP revision 🇯🇵 📈 Japan is back in the game❓

Economic Calendar: Quiet Tuesday Highlights Geopolitics and Weekly Oil Stocks (10.03.2026)

EURUSD gains 0.2% on unexpectedly bigger trade surplus in Germany 🇩🇪 📈

Morning wrap (10.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.