Nike (NKE.US) stock slumped 7% during today's session after the apparel giant reduced its revenue forecasts due to supply chain issues which are hurting its business more than it previously anticipated. This was mainly due to the ongoing supply disruptions from Vietnam, which is a key manufacturing hub for Nike products. Nike produces about three-quarters of its shoes in Southeast Asia, 51% of which is made in Vietnam and 24% in Indonesia. However, recent pandemic restrictions have forced the company to close its factories several times. In Vietnam, for instance, it has lost 10 weeks of production since July.

"We are not immune to the global supply chain headwinds that are challenging the [manufacturing] and movement of product around the world," Chief Financial Officer Matthew Friend said on an earnings call. "Over the last 90 days, two things have happened in the industry that we didn't anticipate. First, already long transit times worsened; and second, local governments mandated shutdowns in Vietnam and Indonesia," Friend told analysts Thursday.

Company also warned of possible supply shortages lasting into the holiday season. The sneaker giant now expects revenue for this fiscal year to grow by single digits, compared to its previous guidance of double-digit growth in the previous year.

Results for the quarter ended August were mixed. Company reported earnings of $1.16 per share, which is a 22.1% increase from the same period last year and above analysts' expectations of $1.11 per share. Revenues increased 16% to $12.2 billion, slightly below market projections of $12.465 billion.

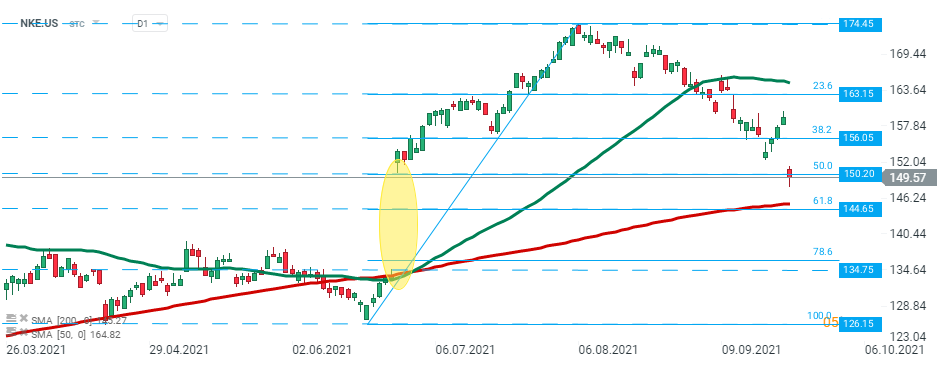

Nike (NKE.US) stock launched today’s session sharply lower and broke below the support at $ 150.20 which coincides with 50% Fibonacci retracement of the last upward wave and upper limit of the bullish gap from end of June. If current sentiment prevails then the downward correction may be extended to the support at $144.65 which is marked with 61.8% retracement and 200 SMA (red line), or even to $134.75 handle where lower limit of the aforementioned price gap is located. On the other hand, if sellers manage to regain control, then another upward impulse towards resistance at $156.05 may be launched. Source: xStation5

Gaming companies with huge discounts 🚨 Will Project Genie end the traditional era of gaming ❓

Lockheed Martin earnings: The peak of global tensions and valuations

Market wrap: European indices outperform US stocks ahead of the opening bell on Wall Street 📉

Apple’s Record Quarter: iPhone, Services, and ‘Invisible’ AI. Is a Return to the Throne Imminent?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.