-

Tesla's Q3 results are expected to be strong, driven by record deliveries (497,099 vehicles), but analysts note this was likely inflated by the expiring $7,500 US tax credit.

-

The company faces near-term headwinds, including margin pressure from price cuts and the loss of CAFE regulatory credit revenue, which previously accounted for 30% of net profit.

-

Tesla's sky-high valuation (P/E over 200) is justified by market belief in its non-automotive ventures—specifically the potential for Robotaxi (1$ trillion value) and the Optimus humanoid robot (Musk forecasts over $$$10 trillion in long-term revenue).

-

Tesla's Q3 results are expected to be strong, driven by record deliveries (497,099 vehicles), but analysts note this was likely inflated by the expiring $7,500 US tax credit.

-

The company faces near-term headwinds, including margin pressure from price cuts and the loss of CAFE regulatory credit revenue, which previously accounted for 30% of net profit.

-

Tesla's sky-high valuation (P/E over 200) is justified by market belief in its non-automotive ventures—specifically the potential for Robotaxi (1$ trillion value) and the Optimus humanoid robot (Musk forecasts over $$$10 trillion in long-term revenue).

Tesla will publish its third-quarter 2025 financial results on Wednesday after the close of the US trading session. It will be the first company from the so-called "Magnificent 7" group to report. The market is bracing for strong financials following record deliveries, but questions about the company's future, and particularly its core business, remain open.

Market Expectations for Q3 2025:

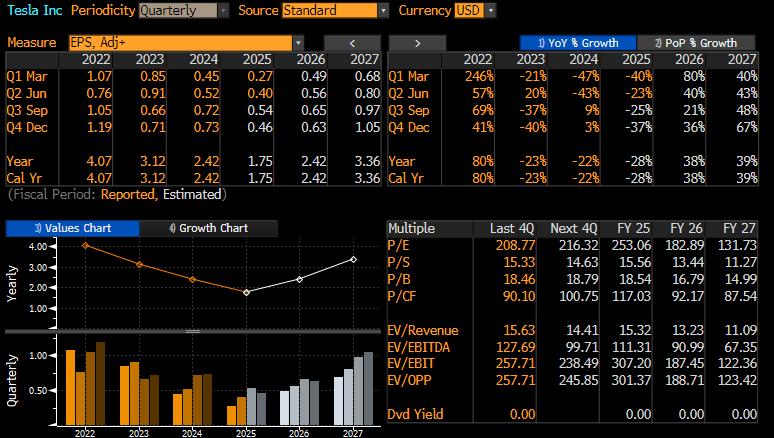

- Adjusted EPS: 54-55 cents (down 25% YoY)

- Revenue: $26.36-$26.4 billion (up 17% QoQ, 5.5% YoY)

- Gross Margin: 17.2%

- Automotive Gross Margin (excluding regulatory credits): 15.6-16.5%

- Operating Income: $1.65 billion

- Free Cash Flow: $1.25 billion

- Capital Expenditure: $2.84 billion

Annual Forecasts:

- Production: 1.72 million vehicles

- Deliveries: 1.61-1.63 million vehicles (down approx. 10% YoY)

- Capital Expenditure: $10 billion

Record deliveries of 497,099 vehicles in Q3 were significantly above analyst expectations of 443-456 thousand units. This represents an increase of 7.4% year-on-year and 29% quarter-on-quarter. However, experts underscore that this result is largely an effect of accelerated demand ahead of the expiration of the $7,500 electric vehicle tax credit on September 30, 2025. Q3 itself will likely be the best quarter in terms of profit generation, while significant shifts in earnings are only expected in 2026 and 2027, which is when the company is slated to return to the golden years of 2022-2023.

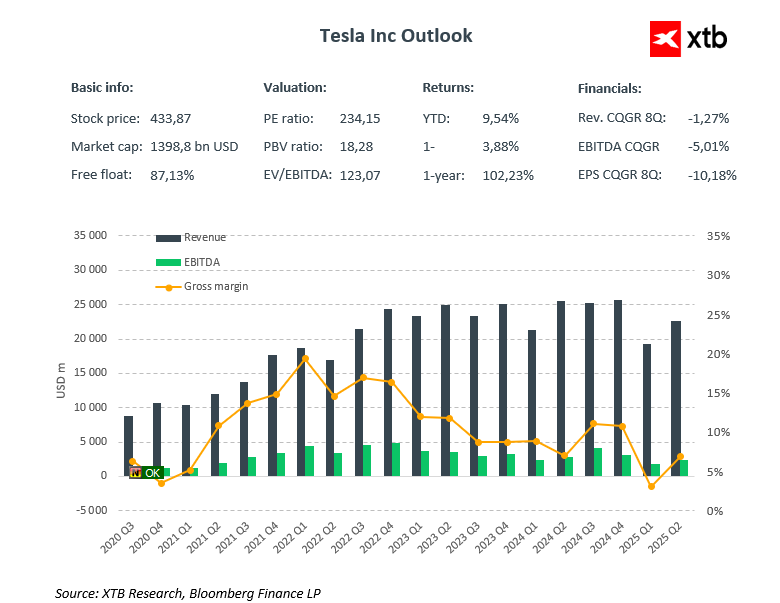

The Company's Profit Outlook. It is worth noting the high dynamics of profit decline this year. Price-to-earnings ratios are at an astronomical level, theoretically pointing to a strong overvaluation for a company primarily engaged in car manufacturing. Even treating the company as a high-tech play, these valuations remain extremely elevated. Source: Bloomberg Finance LP

Revenue should jump to all time high and margin should be a little bit higher. Source: Bloomberg Finance LP, XTB

Key Short-Term Risks:

- CAFE Regulatory (Emission) Credits: From October 1, 2025, the sale of regulatory credits is expected to drop practically to zero after President Trump waived penalties for manufacturers for non-compliance with Corporate Average Fuel Economy (CAFE) standards. This implies the loss of a source of pure profit, which in recent years accounted for around 30% of Tesla's net income.

- Margin Pressure: The introduction of cheaper versions of the Model Y (below $40,000) and 40% reductions in UK leasing prices in the middle of Q3 point to an aggressive volume-over-profitability strategy. The automotive gross margin has fallen from a peak of 25% in 2022 to the mid-teens.

- Q4 Demand: Analysts anticipate a weaker Q4 following the expiration of the tax credit effect. Bloomberg Intelligence points to a drop in US deliveries in subsequent quarters. Europe also remains weak due to an aging product offering and competition from China.

As analysts issuing recommendations for the stock indicate, Tesla is entering a phase of assessment: is it a maturing car company that must fight to prevent a significant market share drop, or should it be viewed as a producer of self-driving cars, primarily robotaxis, and a company dynamically operating in the field of AI?

Is Tesla Still Just a Car Company?

The answer is: definitively not. And it is this very transformation that may justify the stock's valuation premium. The price-to-earnings ratio, both current and forward, remains clearly above 200, a level significantly higher than the average or median for the entire technology sector. Tesla is currently perceived, however, as a visionary of potential new services in the future.

Robotaxi: A Trillion Dollars Within Reach?

Tesla launched its Robotaxi service in Austin, Texas, in July 2025, using approximately 10-20 Model Y vehicles with safety drivers supervising. Since then, the company has obtained testing permits in Arizona, Nevada, Illinois, and Colorado, and Dan Ives of Wedbush Securities forecasts expansion to 25 US cities by 2026. The Cybercab – a vehicle designed specifically for autonomous driving, without manual control capability, with a target price of around $30,000 – is scheduled to enter production in 2026. Musk predicts "millions" of autonomous Teslas in the second half of next year.

Robotaxi Market Valuation: Wedbush Securities estimates that the autonomous unit alone could add $1 trillion to Tesla's valuation, potentially raising its market capitalization to $2 trillion by the end of 2026. Ark Invest projects that the robotaxi market could reach $10 trillion by 2030. With a mere 10% market share, Tesla would achieve a $1 trillion valuation from this segment alone. Wedbush's analysis assumes the deployment of 3.75 million robotaxis, each driving 65,000 miles annually at $0.40 per mile, generating $100 billion in revenue. With a 30% operating margin, this would yield $30 billion in operating profit, and even a conservative 20x EV/EBIT multiple implies a valuation of $600 billion. Tesla's key advantage over Waymo is the full vertical integration model. While Waymo requires $750 million for mapping and $11 billion for vehicles to scale to 50 US cities, Tesla lowers the cost per mile with its in-house FSD chip, charging network, and insurance. The Dojo training chip is expected to be 5x cheaper than Waymo's TPU-based cloud solution.

Optimus: The Robot That Could Be Worth More Than All the Cars

In January 2025, Elon Musk announced that Tesla could achieve over $10 trillion in long-term revenue from the Optimus humanoid robot. This requires the deployment of 100 million robots generating $100,000 in annual revenue per unit.

Optimus Production Schedule: 2025: Approximately 10,000 units (originally planned, but later reduced) for internal use in Tesla factories 2026: Production of Version 2 (V2) in mid-year with deliveries to external customers by year-end, capacity of 10,000 units per month 2026+: Third production line for 100,000 units per month

Musk estimates the long-term demand for general-purpose humanoid robots to be over 20 billion units. At a Tesla fan conference in San Mateo in July 2025, Musk stated: "Hypothetically, if Tesla were producing a billion of these a year... maybe at around $30,000, I'm just guessing here, that would be $30 trillion in revenue."

Analysts at Deutsche Bank note that Musk's focus on robotaxis and Optimus "will allow Tesla to capitalize on its leadership position in embodied artificial intelligence." Dan Ives of Wedbush maintains that autonomy and humanoid robotics could drive Tesla to a $3 trillion market capitalization by the end of 2026.

Energy Storage: Tesla's Quiet “Gold”

While all investors are focused on cars or robots, Tesla's energy storage business is quietly achieving triple-digit growth. In 2024, revenue from energy generation and storage increased by 67% YoY to over $10 billion. Deployments amounted to 31.4 GWh, a 114% YoY increase.

Key Data for the Energy Segment: Q4 2024: Deployments 11 GWh (+244% YoY), Revenue over $3 billion (+113% YoY) Q1 2025: Deployments 10.4 GWh (+154% YoY), Revenue $2.7 billion Q2 2025: Deployments 9.6 GWh (+48% YoY), Gross Margin above 30%

Gross margins in the energy segment exceed 30%, significantly higher than the automotive margins. Tesla is currently the world's largest battery storage integrator, with a 15% share of the global market and 39% in North America.

Full Self-Driving: A Game-Changing Monthly Subscription

FSD remains one of Tesla's largest growth opportunities. The company sells FSD as a one-time payment of up to $15,000 or a subscription for $99 per month. Tesla CFO, Vaibhav Taneja, noted that those subscribing to premium FSD are essentially enjoying a "personal chauffeur" for approximately $3.33 a day. However, according to August 2025 research, FSD deterred more US consumers than it attracted. Among respondents actively seeking to purchase a fully electric vehicle, only 20% expressed a greater inclination to buy a Tesla because of FSD, while 33% felt less inclined.

Valuation: Extremely Expensive, but Fully Justified?

With a price-to-earnings ratio above 200, Tesla is trading at a premium of over 1000% compared to the sector average, which does not approach the 20 level. Historically, it traded at approximately a 350% premium to comparable companies in the technology and automotive sectors.

The current market capitalization is about $1.4 trillion, meaning the market potentially attributes as much as $900 billion in value to projects like robotaxi and Optimus, with $500 billion for the automotive sector itself. Nevertheless, the current average target price among Wall Street analysts is slightly above $350, with today's stock price below $440 per share. The company has 29 buy recommendations, 17 hold, and 17 sell. The company has experienced several headwinds this year, which is why its shares have gained only 9% year-to-date. On the other hand, from a 12-month perspective, this is an increase of over 100%, a value significantly higher than the S&P 500 index.

Summary

The company is set to present strong Q3 results, albeit driven by aggressive car sales. The company notoriously boasts valuations of around 200 for the price-to-earnings ratio, which, however, is justified by the company's ambitious plans for self-driving cars and robotics. The company's shares have been trading sideways since mid-September and are approximately 10% below historical peaks. The implied stock change after the results is about 6-7%, which could potentially give us the highest price since last December. Simultaneously, the price could potentially fall to its lowest level since mid-September.

The price is tumbling ahead of the earnings after the bell. Source: xStation5

🚀 AMD Confirms AI Thesis with Strong Results and Confident Guidance

US OPEN: Powell, MAG7 and Trump mix market's sentiment

Apple Preview: Will Asia spoil the earnings?

Economic calendar - ECB Decision and the Next Wave of Tech Giants' Earnings

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.