- Company delivered acceptable earnings

- Worse guidance has sunk the stock's price

- Texas Instrument benefits from Chip's act but suffers on tariffs

- Trade tensions might benefit company in the long term

- Despite tense financial situation, company returns cash back to investors

- Company delivered acceptable earnings

- Worse guidance has sunk the stock's price

- Texas Instrument benefits from Chip's act but suffers on tariffs

- Trade tensions might benefit company in the long term

- Despite tense financial situation, company returns cash back to investors

Texas Instruments is an icon of analog semiconductors. It designs and manufactures power, signal, and microcontroller systems that are used in automotive, industrial, consumer electronics, and medical equipment. The company is also building its own manufacturing chain on 300-millimeter wafers in the United States, which aims to make it independent from external suppliers and strengthen control over costs.

At first glance, the third-quarter report published by the company today looks decent.

- Revenues reached $4.74 billion, exceeding consensus

- Sales increased by 7% quarter-on-quarter and by as much as 14% year-on-year.

- Earnings per share amounted to $1.48, which was one cent lower than market expectations.

Despite this, shares are falling by about 8% before the market opens. The reason is clear and was immediately apparent after the publication. The company provided a weaker forecast for the fourth quarter, which was significantly below the previous consensus, and the market interpreted this as a signal of slower recovery in the entire analog sector.

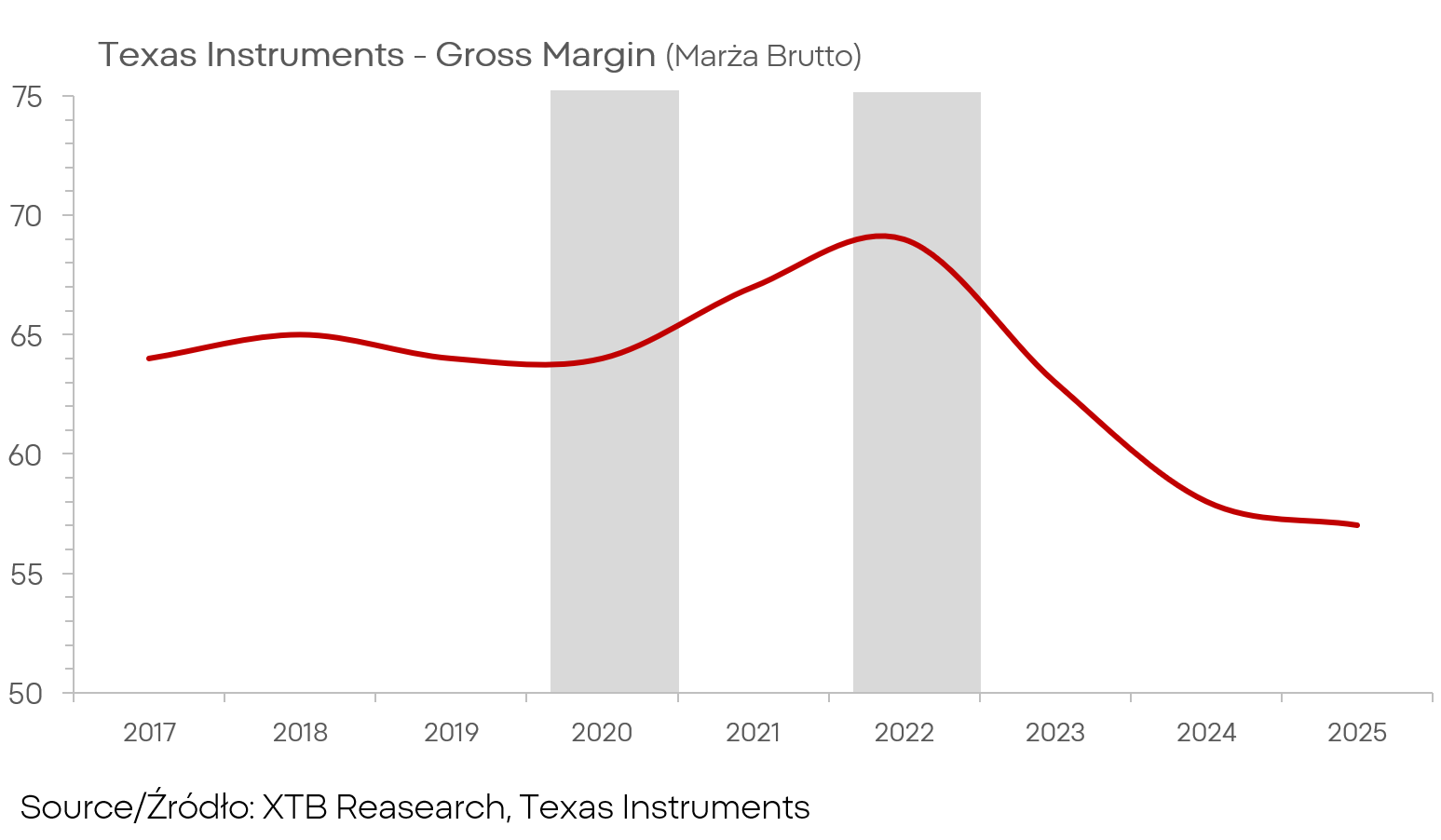

However, the list of problems does not end there. The company operates under increasing pressure from tariffs and uncertainty regarding new duties, and it also faces tougher competition from manufacturers in China. The expansion of capacity in older-generation semiconductors there is causing price pressure, and the cyclical rebound in demand in automotive and industry is slower than many expected. As a result, the market fears that orders in the coming months may not meet expectations. Additionally, total debt amounts to about fourteen billion dollars, and margins, although recently rebounding, remain lower than in 2022.

This is due to higher costs, weaker capacity utilization, and price pressure. Such a combination naturally worsens the perception of the company in the eyes of the market in an environment of heightened uncertainty.

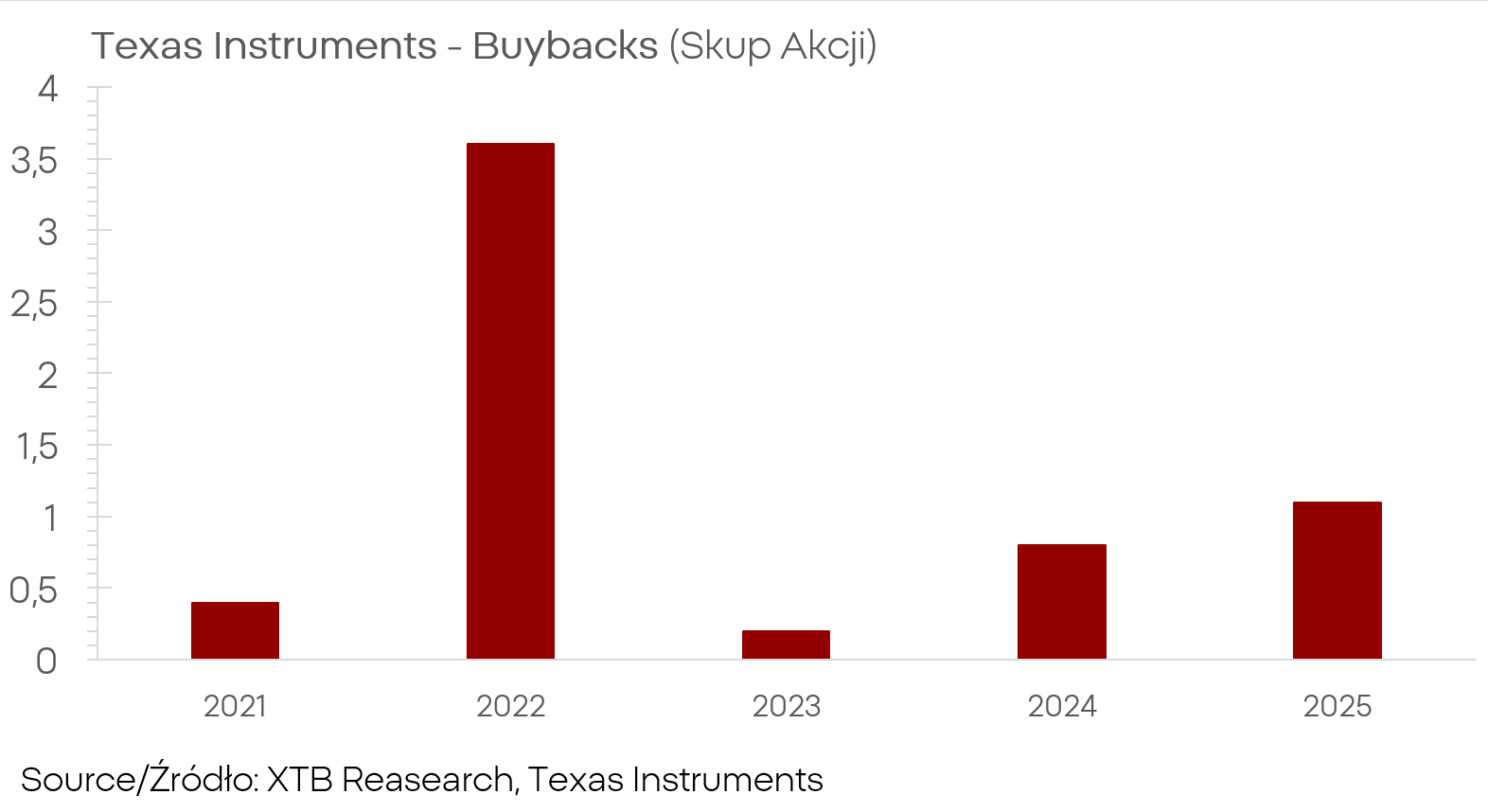

Two numbers stand out in the report. Free cash flow over twelve months increased by sixty-five percent, and spending on share buybacks went up by about two hundred fifty-three percent. However, it should be noted that in the case of share buybacks, this is mainly due to a low base and still far from the levels of 2022. In the case of free cash flow, the picture is better because lower CAPEX clearly contributes to improvement. Thanks to subsidies from the CHIPS Act program, the company was able to maintain the pace of investments at a significantly lower cash cost. Additionally, the company benefited from better inventory and receivables management, which lowered the inventory cycle ratio.

Not everything is lost, though.

The management continues the restructuring and optimization program and expands domestic production capacities, all while maintaining a generous dividend and share purchase policy. In the long term, current trade tensions may paradoxically become an advantage if American customers start preferring local suppliers, and investments from recent years begin to reflect in the results in the form of higher productivity and free cash flow.

This scenario is not guaranteed but remains a real option that investors should consider.

The situation of Texas Instruments is complex and does not inspire optimism for the next quarter, but the company is taking actions to address key weaknesses.

If transparency in tariff policy improves and competition stabilizes in mature markets, and ongoing investments start to increase efficiency, then over the next few years, the current weakness may prove to be a transitional period that builds the foundation for more solid growth.

For now, however, the market rightly discounts weaker indications for the fourth quarter and greater environmental uncertainty.

TXN.US (D1)

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.