Shares of L3Harris Technologies LXH.US (a manufacturer of advanced defence systems) rose by an impressive 13% at the start of today's session on Wall Street after announcing plans to float its missile business in the second half of 2026. This move reflects growing investor interest in the defence sector, driven by global geopolitical tensions and increased US defence spending. Of particular importance is the strategic partnership with the US Department of Defence, which guarantees stable orders and a long-term revenue stream for the spun-off company. The market has clearly recognised the potential of the missile segment's IPO – the transaction will not only be a way to optimise L3Harris' corporate structure, but above all will allow for the immediate raising of capital for the dynamically developing area of defence technologies. The increase in the value of the parent company's shares reflects investors' belief that the missile segment has significantly higher growth potential than the company's other divisions, and that its prospects are secured by contracts with the federal government.

But that's not all, as the company's shares are also responding to a £1 billion government investment in Missile Solutions L3Harris. The investment is set to be a game-changer in US defence strategy and is potentially an even stronger catalyst for share growth than the prospect of an IPO alone. The Department of Defence, guided by its new "Go Direct-to-Supplier" strategy, is moving to direct financing of key suppliers, guaranteeing them stable, long-term orders for Tomahawk, PAC-3, THAAD and Standard Missile missiles. The structure of the transaction – a convertible preferred share that will automatically convert to common shares during the IPO in the second half of 2026 – means that the government is not only subsidising production expansion, but also participating in the potential profits from the public debut. This model combines guaranteed demand from the Pentagon with the potential for revenue from future market valuation, virtually eliminating all business risk for the new company. The investment also signals the Trump administration's determination to rapidly strengthen the defence industry's production capacity, especially in the face of geopolitical tensions, creating a scenario of significant growth momentum for the defence sector in the coming years.

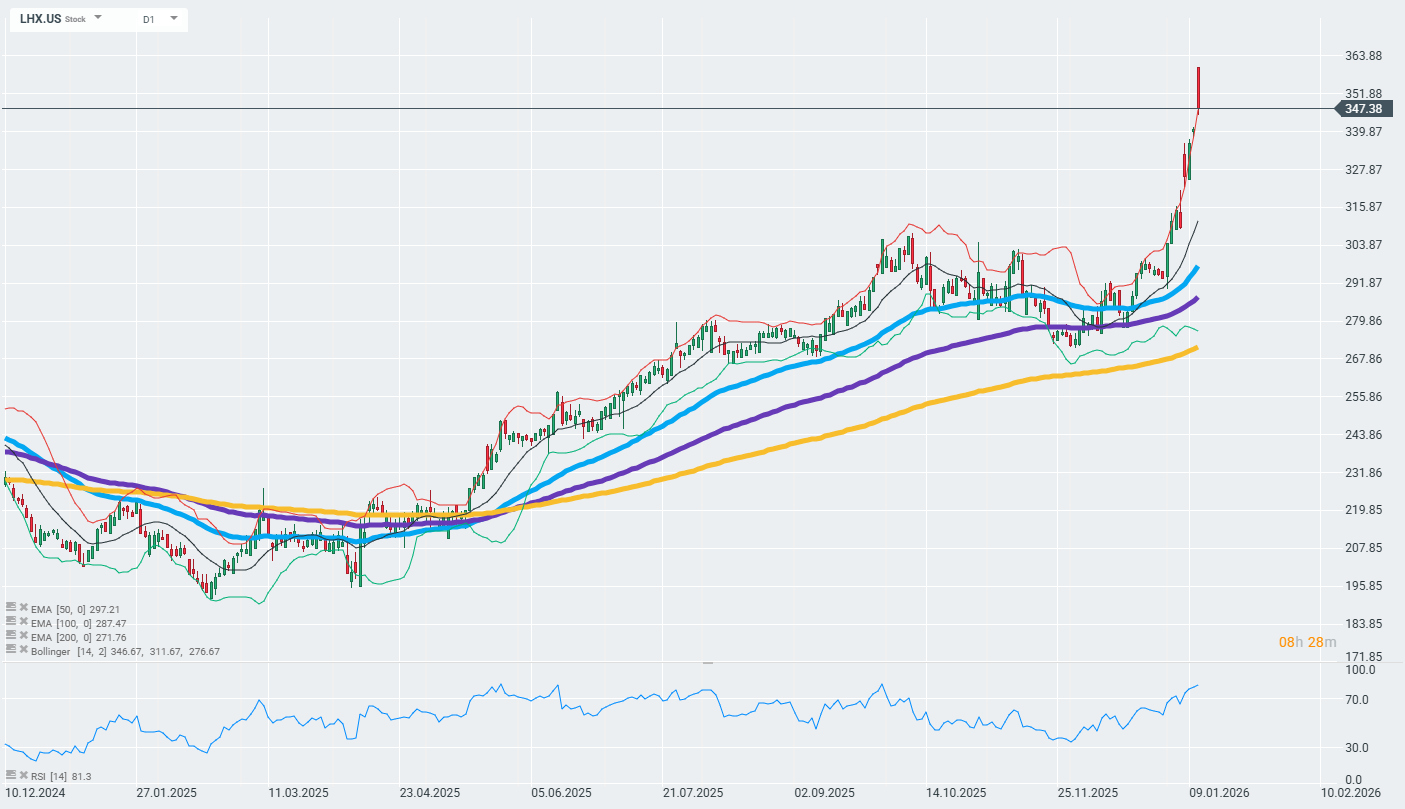

The company's shares started trading with a huge upward gap, which, however, is now reduced to almost a minimum, which may indicate that the above information had already been priced in by the market earlier. However, these movements do not change the fact that the shares are in an upward trend (looking at exponential moving averages), but with considerable short-term growth momentum, which may be limited. The RSI for the 14-day average is currently breaking through the 83-point level.

Source: xStation

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.