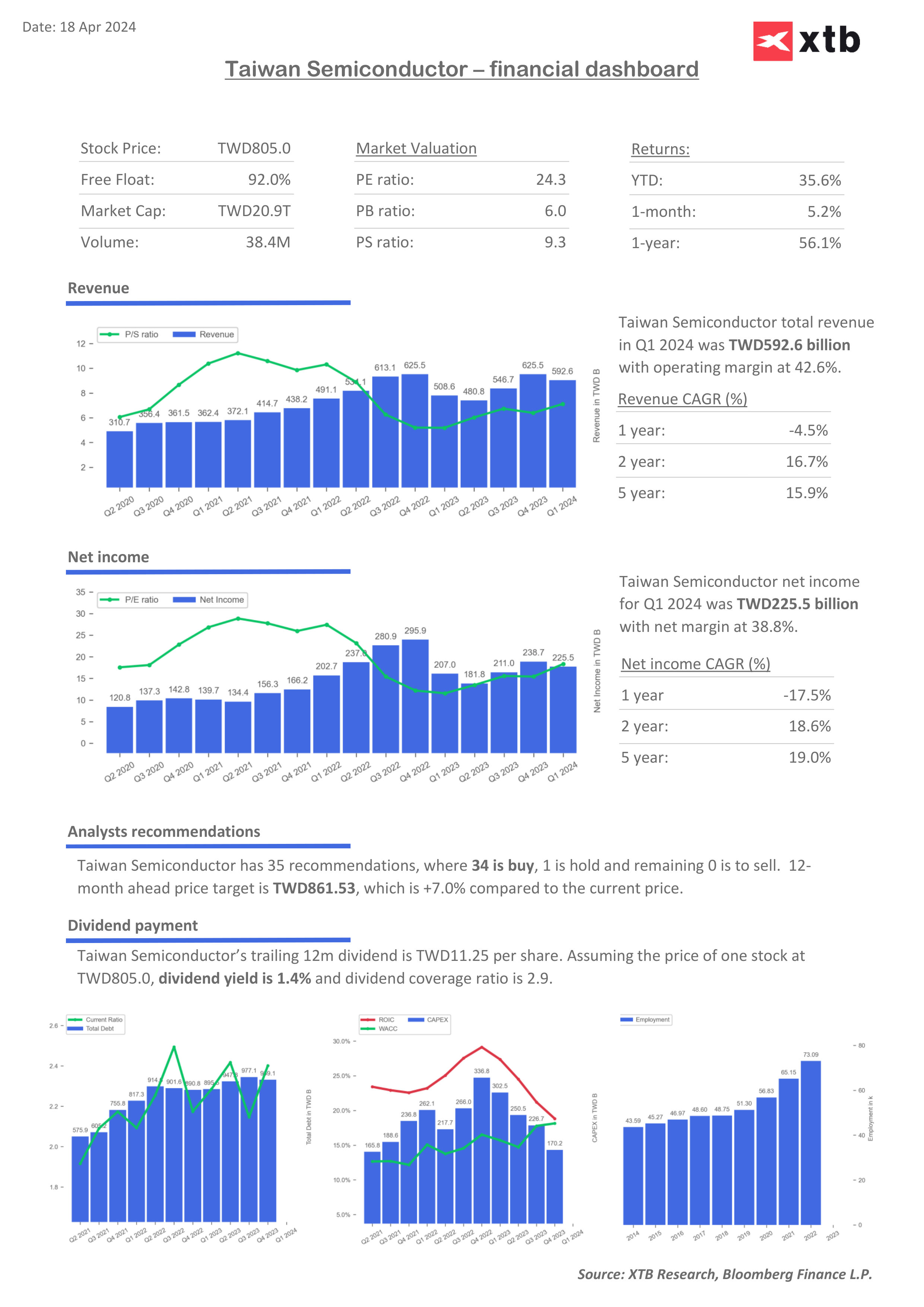

Taiwan Semiconductor Manufacturing Co. (TSM.US) announced strong financial results for the first quarter of 2024, with consolidated revenue reaching NT$592.64 billion, an increase of 16.5% year-over-year, although there was a 5.3% decrease from the fourth quarter of 2023. Net income for the quarter rose by 8.9% year-over-year to NT$225.49 billion, beating average analyst estimates. The company experienced growth primarily due to robust demand for AI chips, spurred by applications such as large language models and ongoing needs in the high-performance computing (HPC) sector.

- Net income NT$225.5 billion, +9% y/y, estimate NT$214.91 billion

- Gross margin 53.1% vs. 53% q/q, estimate 53%

- Operating profit NT$249.02 billion, +7.7% y/y, estimate NT$240.87 billion

- Total Revenue NT$592.64 billion, +17% y/y, estimate NT$583.46 billion

Revenue Stream

- Quarterly Comparison: Despite the annual growth, there was a 5.3% decrease in revenue compared to Q4 2023.

- Geographic Revenue Distribution: North America was the largest contributor, accounting for 69% of total net revenue; China, Asia Pacific, Japan, and EMEA contributed 9%, 12%, 6%, and 4% respectively.

Revenue by Technology Segment

- Advanced Technologies: Technologies defined as 7-nanometer and below accounted for 65% of total wafer revenue.

- Specific Technologies: 3-nanometer technology contributed 9%, 5-nanometer 37%, and 7-nanometer 19% of total wafer revenue.

Revenue by Platform Segment:

- High-Performance Computing (HPC) and Smartphones: These segments represented 46% and 38% of net revenue, respectively.

- Other Segments: IoT, Automotive, DCE, and Others each represented 6%, 6%, 2%, and 2% of revenue respectively.

TSMC's management highlighted that the company is recognized as the world’s largest producer of advanced processors. The company services major tech giants, including Nvidia and Apple, reflecting its pivotal role in the global semiconductor industry. TSMC is at the forefront of semiconductor technology, producing 3-nanometer chips and planning to start mass production of even smaller 2-nanometer chips by 2025. This shift towards more advanced, smaller nanometer technologies is expected to drive TSMC's long-term growth, enhancing the power and efficiency of the chips they produce.

TSMC dominates the global foundry market, accounting for 61% of the total revenue in the fourth quarter, with its closest competitor, Samsung Foundry, holding 14%. The demand for AI chips, especially for applications in large language models like ChatGPT, has significantly contributed to a 56% surge in TSMC’s shares over the past year.

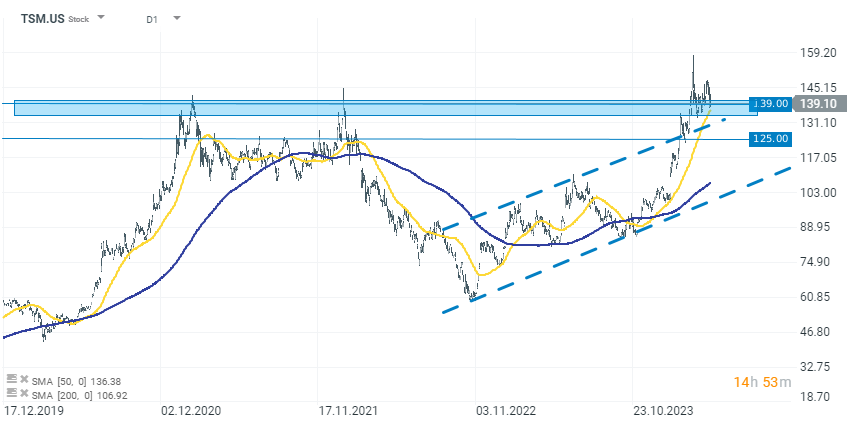

TSM (D1 interval)

At the last session, the company's stock price closed around the resistance level of 139-140 dollars per share. Good results and promising forecasts for the second quarter of this year may support the stock price. On the other hand, expectations for the entire fiscal year are not as optimistic, which could act as a downward pressure.

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.