Despite ongoing correction on Wall Street, FactSet Research data signals still strong earnings season across the US public companies. Here is the highlight actual as of November 7 (after Big Tech ex-Nvidia earnings reports).

-

Strong Q3 reporting season: With 91% of S&P 500 companies already out with results, 82% beat earnings expectations, while 77% topped revenue forecasts — a broadly positive quarter.

-

Earnings growth gaining momentum: S&P 500 profits are on track to grow 13.1% year over year in Q3. If confirmed, this would mark the fourth straight quarter of double-digit earnings growth, showing solid corporate momentum.

-

Upward revisions across sectors: At the start of the quarter (September 30), earnings growth was estimated at 7.9%. Companies have significantly outperformed since then, lifting the blended growth rate, with 10 sectors now reporting higher earnings thanks to positive EPS surprises.

-

Guidance remains mixed: Looking ahead to Q4, 42 companies have issued negative EPS guidance, while 31 companies provided positive guidance, suggesting a cautious but not pessimistic outlook.

-

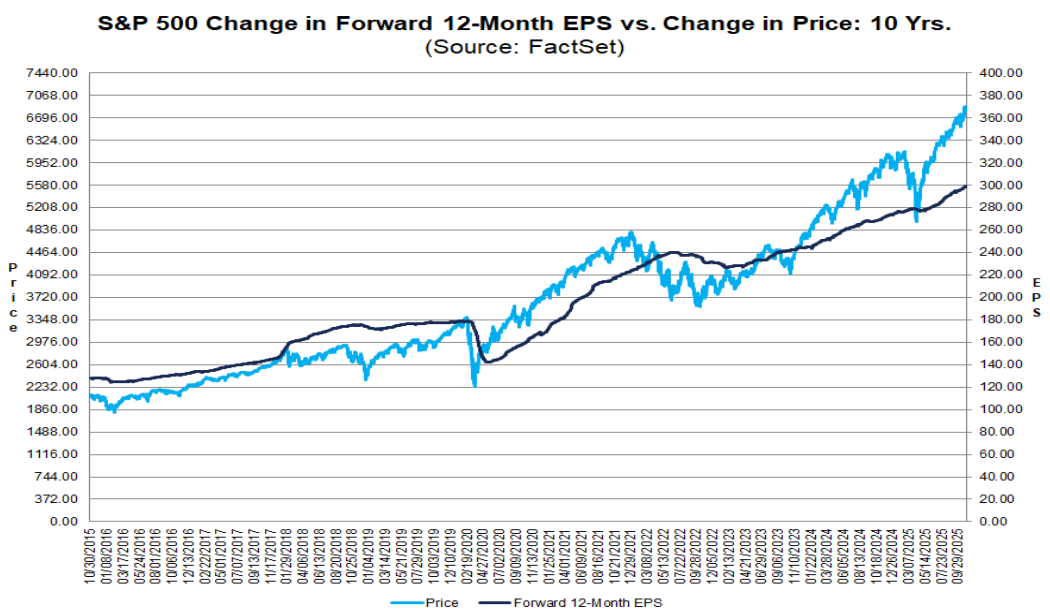

Valuations above long-term norms: The S&P 500 trades at a forward P/E of 22.7, which is above the 5-year average (20.0) and above the 10-year average (18.6) — signaling elevated valuations relative to historical levels.

Source: FactSet

82% of Companies Beat EPS Expectations & 77% Beat Expected Revenue

-

Q3 earnings season is delivering strong results, comfortably beating analyst expectations. A larger-than-usual share of S&P 500 companies is surprising to the upside, and the index is now showing higher earnings than both last week’s levels and the end-of-quarter estimates.

-

With 91% of S&P 500 companies having already reported, 82% beat EPS expectations — well above the 5-year average (78%) and 10-year average (75%). If this number holds, it would match the best beat rate since Q3 2021.

-

The magnitude of earnings surprises is also healthy: on aggregate, profits are coming in 7% above expectations, matching the 10-year average (and just slightly below the 5-year trend of 8.4%).

-

The S&P 500 is now on track for 13.1% year-over-year earnings growth in Q3, marking the fourth consecutive quarter of double-digit profit expansion. This figure has climbed steadily from 7.9% at the end of Q3 and 10.7% just one week ago, boosted by stronger-than-expected results.

-

Over the past week, companies in the Industrials, Financials, and Health Care sectors delivered the most meaningful earnings surprises, pushing the overall earnings growth rate higher.

-

Since September 30, the biggest positive contributions to earnings growth have come from Financials, Information Technology, and Consumer Discretionary companies. Weak results from Communication Services partially offset those gains.

-

Revenue performance is also robust: companies are beating top-line estimates at rates well above historical norms, with many reporting meaningful year-over-year growth.

Strong Earnings Trend Set To Persist?

-

If the S&P 500 ultimately delivers 13.1% earnings growth for Q3, it would mark the fourth straight quarter of double-digit year-over-year profit growth and the ninth consecutive quarter of positive earnings growth overall — a sign of sustained corporate strength.

-

Eight of eleven sectors are showing year-over-year earnings growth, with the strongest contributions coming from Information Technology, Financials, Utilities, Materials, and Industrials.

Meanwhile, three sectors are posting declines, led by Communication Services. -

On the revenue side, 77% of S&P 500 companies have beaten expectations. It's well above both the 5-year (70%) and 10-year (66%) averages. Aggregate revenues are coming in 2.1% above estimates, matching the 5-year norm and exceeding the 10-year average of 1.4%.

-

Over the past week, stronger-than-expected revenue results across several industries — most notably Financials and Consumer Staples — lifted the index’s overall revenue growth rate.

-

Since the end of Q3 (September 30), the biggest contributors to rising revenue growth have been companies in Health Care, Financials, and Consumer Discretionary, reflecting broad-based momentum across cyclical and defensive groups.

Revenue Growth Is Rising

-

The S&P 500’s blended revenue growth rate for Q3 has risen to 8.3%, up from 7.9% last week and 6.3% at the end of Q3. If 8.3% holds, it would be the strongest revenue growth since Q3 2022 (11%) and mark the 20th straight quarter of year-over-year revenue expansion.

-

All eleven sectors are posting revenue growth compared to a year earlier — with Information Technology, Health Care, and Communication Services leading the charge, showing broad strength across the index.

-

Looking ahead, analysts expect earnings growth of 7.5% in Q4 2025, 11.8% in Q1 2026, and 12.7% in Q2 2026. For full-year 2025, consensus calls for 11.6% earnings growth.

-

The S&P 500 currently trades at a forward P/E of 22.7, above both the 5-year (20.0) and 10-year (18.6) averages, though just slightly below the 22.8 level recorded at the end of Q3.

EPS Beats Remain Strong

-

With 91% of the index having reported Q3 numbers, 82% delivered EPS above expectations, 3% met estimates, and 15% missed.

-

The 82% beat rate is above the 1-year (77%), 5-year (78%), and 10-year (75%) averages.

-

If this figure stands, it would match the highest beat rate since Q3 2021.

-

Sector leaders in EPS beats include:

-

Health Care – 93%

-

Consumer Staples – 93%

-

Information Technology – 92%

-

Financials – 89%

The weakest sector is Communication Services – 62%.

-

Earnings Surprise Magnitude

-

On average, companies are reporting earnings 7.0% above estimates — in line with the 10-year average, though slightly below the 1-year and 5-year averages.

-

The Industrials sector shows the biggest upside surprise, with earnings coming in 15.6% above expectations. Notable contributors include:

-

Southwest Airlines ($0.11 vs. –$0.04)

-

Uber Technologies ($3.11 vs. $0.69)

-

UPS ($1.74 vs. $1.29)

-

US500 (D1 chart)

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.