Summary:

-

US Advance GDP beats forecasts; prior revised lower

-

ADP employment change in line with estimates

-

US500 edges towards ATH ahead of FOMC decision

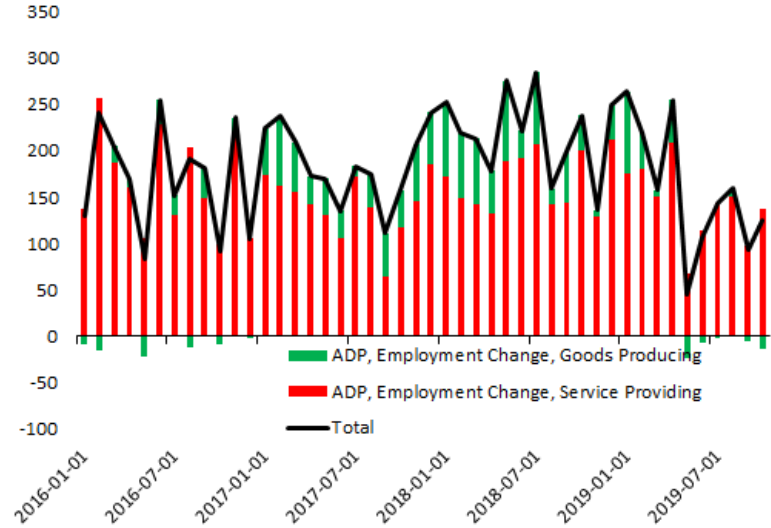

It’s a busy North American session this afternoon with several key economic releases. Kicking things off the ADP employment change for October came in bang inline with the consensus forecast at 125k but there was a notable downward revision to the prior which now reads 93k after 135k originally. One key story to watch for the US labour market is the impact of the GM workers strike where 50,000 employees stopped working for 6 weeks in the middle of September. This isn’t captured in the latest ADP release but will have a negative impact on Friday’s more widely viewed NFP.

The current ADP reading is amongst the weakest in several years and saw a decline in goods producing roles - something of a trend of late with 5 of the past 6 months seeing a decline in this area. Source: xStation

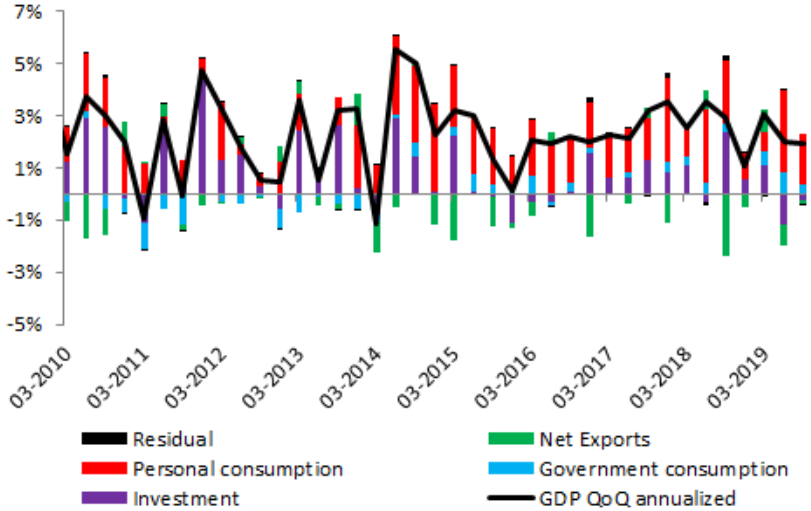

A more keenly viewed data point than the ADP is the first look at 3rd quarter growth in the US. The Q3 advance GDP reading came in at +1.9% Q/Q in annualised terms, comfortably above the 1.6% forecast. There was a small downward revision to the final Q2 read which will now stand at 2.0%, 10 basis points lower than last stated, but on the whole this is a positive release.

Looking at the breakdown personal consumption remains surprisingly strong (+2.9% vs +2.6% expected). Source: XTB Macrobond

Both of these releases will be taken into account when the FOMC announce the outcome of their latest policy meeting later this evening at 6PM GMT. Our preview of the event can be viewed here.

A mini head-and-shoulders may be forming in the Nasdaq with the head coming in at the all-time high of 8125. The region from 8035-8045 could be seen as the neckline although how this market reacts to the FOMC decision will likely outweigh any technical setups. Source: xStation

A mini head-and-shoulders may be forming in the Nasdaq with the head coming in at the all-time high of 8125. The region from 8035-8045 could be seen as the neckline although how this market reacts to the FOMC decision will likely outweigh any technical setups. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.