-

Fed announced $15 billion per month tapering

-

Real economic growth slowed

-

Bottlenecks are expected to last into next year but ease throughout

-

Too early to talk about rate hikes

-

US indices hit record highs, USD weakens

The Federal Reserve announced a decision to taper asset purchases by $15 billion per month. A $10 billion reduction will be made to Treasury purchases and $5 billion to MBS purchases. Interest rates were left unchanged as expected.

Fed Chairman Powell tried to explain today's policy decision during a press conference. Powell said that the focus of today's meeting was on tapering and not raising rates. He stressed that it is not the time yet for rate hikes but they cannot be ruled out should conditions improve. Fed Chairman said that real economic growth has weakened recently with supply bottlenecks playing a big role. He also noted a lower participation rate that masks softness in the job market. A $15 billion per month reduction pace will be maintained if the economy develops in-line with expectations. If not, adjustments to the pace will be made. Current pace assumes end of asset purchases by middle of the next year.

During a Q&A session Powell said that maximum employment could be reached next year. There is no evidence of a wage-price spiral but it's an issue that the Fed will watch closely. Powell also repeated that the Fed can be patient when it comes to rate hike decisions. Powell said that he cannot provide more details on changes in QE taper pace but assured that he does not want to surprise markets with its decisions. Powell also seems to have back down from his "inflation is transitory" calls. While he still expects inflation to wane over time, he also believes that it will stay elevated for some time. Overall, inflation wasn't a topic that was often discussed during the conference. Powell hinted strongly that full employment takes precedence over inflation mandate.

Market reaction

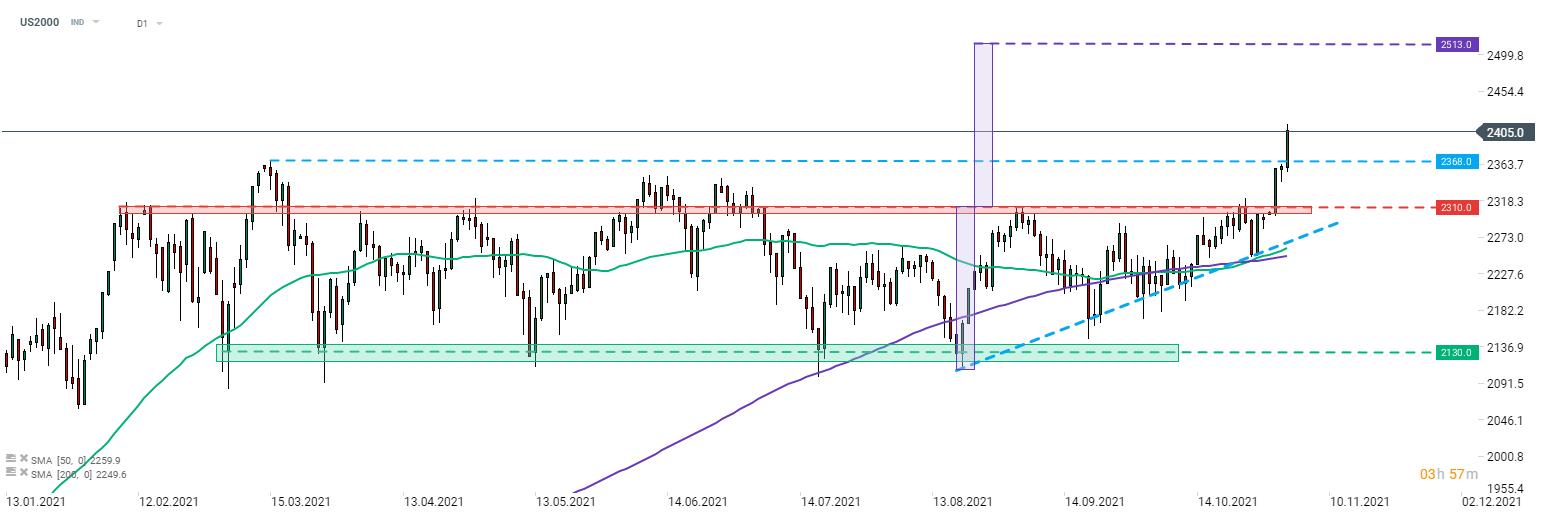

Equity indices extended upward move during Jerome Powell's presser. US500 climbed above 4,640 pts, US100 jumped above 16,000 pts, US2000 cleared 2,400 pts mark, while US30 approached 36,000 pts area. All 4 US indices traded at fresh record highs.

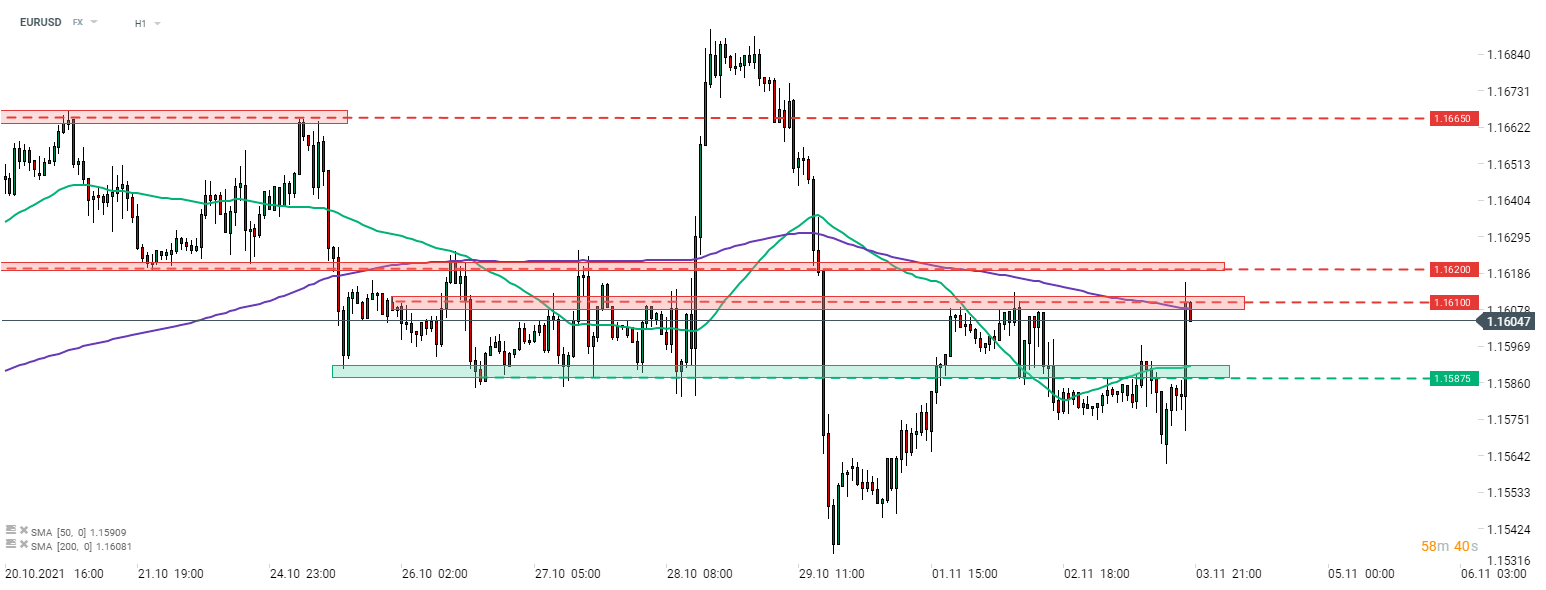

US dollar saw limited reaction to the first 15 minutes of the press conference but began to weaken later on. EURUSD moved above 1.1610, USDJPY dropped below 113.90 and USDCAD tested 1.2390.

US2000 reached fresh all-time highs today and extended the upward move during Powell's presser. The index topped 2,400 pts for the first time in history. A textbook range of the upside breakout from recent triangle pattern points to an upward move above 2,500 pts. Source: xStation5

US2000 reached fresh all-time highs today and extended the upward move during Powell's presser. The index topped 2,400 pts for the first time in history. A textbook range of the upside breakout from recent triangle pattern points to an upward move above 2,500 pts. Source: xStation5

EURUSD jumped above 1.1610 during Powell's press conference, the highest level in almost a week. However, the upward move was halted there for now. Source: xStation5

EURUSD jumped above 1.1610 during Powell's press conference, the highest level in almost a week. However, the upward move was halted there for now. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.