The stock exchanges in the USA started the day on a slightly positive note – they are also recording slight gains today. Investors remain cautious, focusing on upcoming key inflation data and Oracle's results. US500 is up 0.2% at the opening, and US100 is up 0.1%.

After yesterday's close, Nasdaq set a new record. The indices continue their upward trend, driven by strong demand for technology and AI companies. Global market growth is sustained by rising expectations of Fed rate cuts – supported by weaker employment data, which lowered bond yields, and the dollar weakened to its lowest level in about seven weeks. Meanwhile, gold reached new highs.

In light of the upcoming CPI and PPI readings, investors will closely monitor clues regarding the Fed's next decisions – particularly whether weak data will confirm the scenario of rate cuts later this year. The market is also awaiting a revision of employment data, which is expected to be record-breaking, downward.

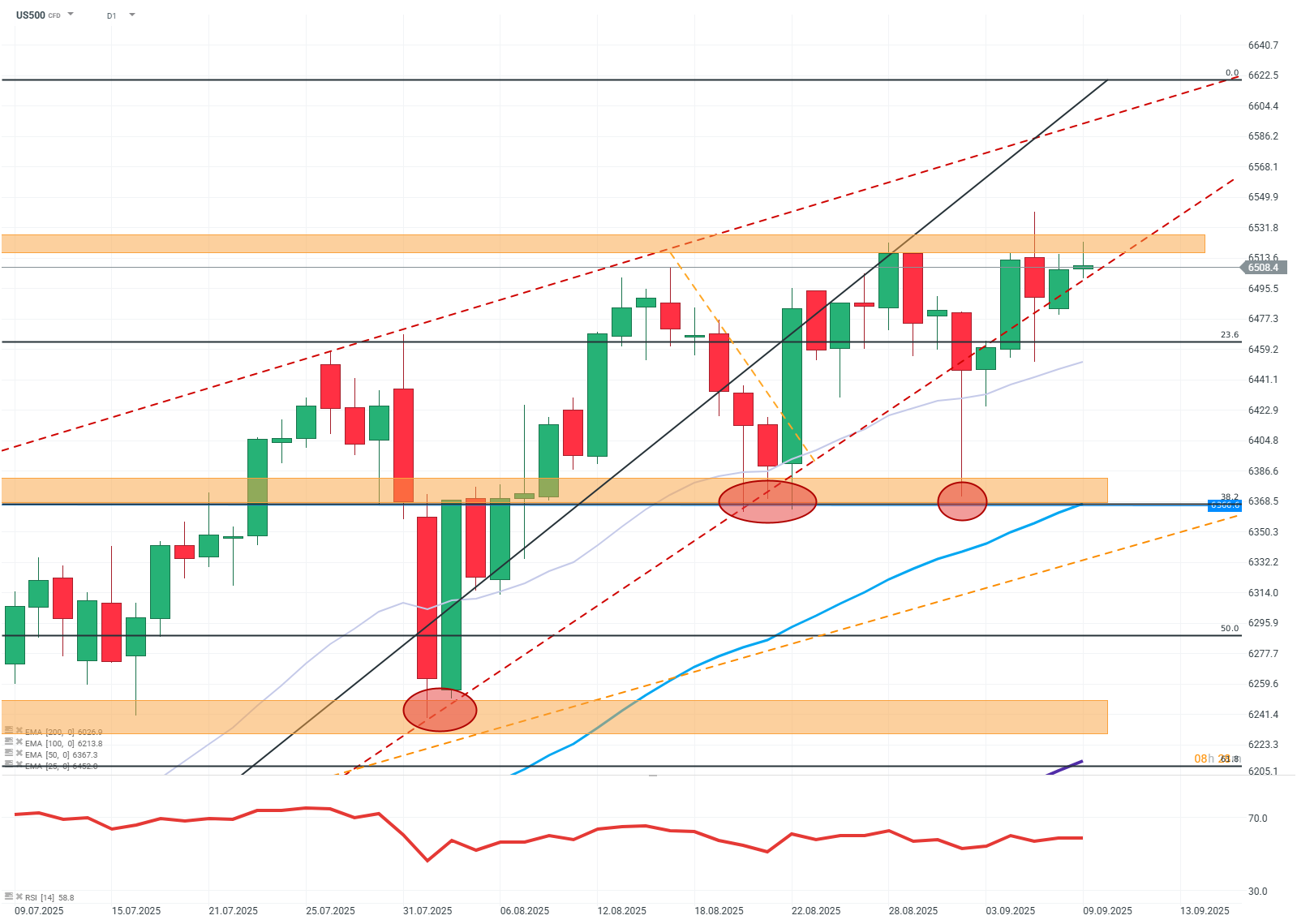

US500 (D1)

Source: Xstation

Buyers continue to demonstrate strength on the chart. The recent correction was quickly and fully recovered to resume the upward trend without major issues. The price returned above the lower boundary of the upward trend channel and is currently approaching the vicinity of the last ATH, which is currently the only obvious resistance for the price. In the event of a slowdown in growth and/or declines, it is highly likely to transition into a consolidation where the boundaries are between the last ATH and strong support around 6300 dollars.

Company News:

Robinhood (HOOD.US), Applovin (APP.US) — The company behind the Robinhood investment app and Applovin, which produces business applications, both rise by over 8%. This is due to the fact that both companies will join the S&P 500 index. This is not only a prestigious distinction but also brings tangible benefits in the form of capital allocation by investors and institutions focused on investing in the world's largest stock index.

Oracle (ORCL.US) — The cloud services giant publishes its results after today's session ends. The market is prepared for a slight decline in revenue and EPS.

Verizon (VZ.US), AT&T (T.US) — Telecommunications companies are losing significantly, averaging over 4%. This is due to the sale of Echostar SpaceX. This purchase significantly increases the competitiveness of SpaceX products, including Starlink. Everything indicates that traditional internet providers will lose another portion of market share.

Atlassian (TEAM.US) — The business software provider is up over 6% at the opening. The company announced that it will withdraw from the data center business and move its clients to the cloud.

Unitedhealth Group (UNH.US) — The leader in the health insurance market in the USA gains over 3% after receiving positive evaluations of its plans and recommendations from investment banks.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.