The upcoming week on the financial markets promises to be extremely eventful. Investors around the world are preparing for a series of events that could determine the direction of the stock markets in the coming months. At the center of attention will be the tech giants from the Magnificent 7, whose quarterly results could decide the fate of the tech rally fueled by the artificial intelligence boom.

At the same time, all eyes are on the Federal Reserve meeting. Jerome Powell and his team will make a decision on interest rates, with a press conference on Thursday evening that could set the tone for the entire week. While the market expects rates to remain stable, any comments from Powell regarding inflation or future rate cuts could shake bond yields, the dollar, and equity markets.

Adding to the mix is a political element. President Donald Trump may announce his preferred candidate to succeed Powell this week, further intensifying the atmosphere. Names such as Rick Rieder and Kevin Warsh are reportedly in the running. Any hints in this regard could increase uncertainty, fueling debate about the Fed’s independence and the future direction of monetary policy.

This week brings together two key worlds: the earnings of the largest tech companies and decisions with the highest impact on monetary policy. Positive surprises from tech giants combined with a hawkish Fed signal could strengthen market optimism, while any disappointments or political uncertainty could trigger sharp volatility. For investors, the coming days will be a real test of nerves, and the unfolding events could set the tone for the start of the year.

Source: xStation5

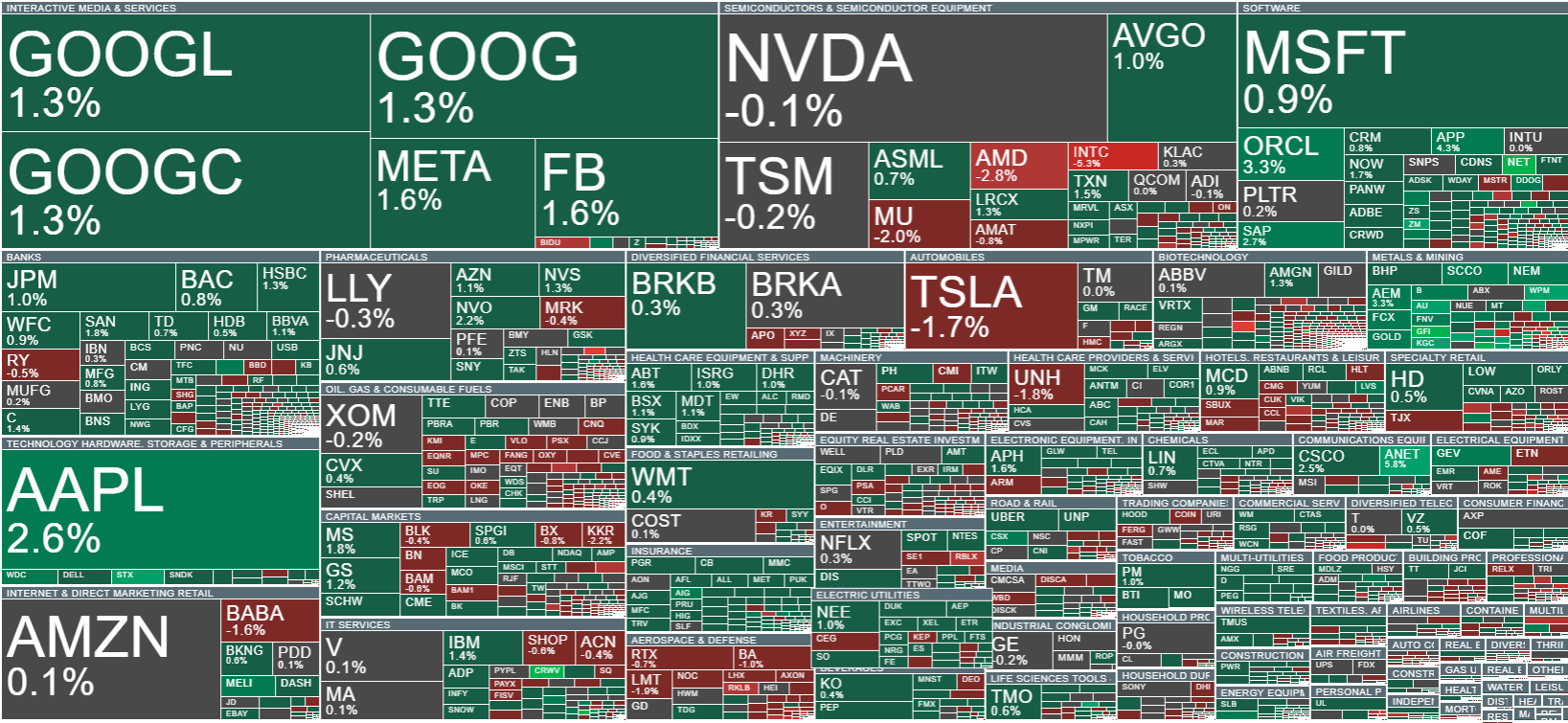

US500 (S&P 500) futures are rising during today’s session, driven mainly by optimism ahead of the quarterly reports from the Magnificent 7. The exponential moving averages are forming a classic bullish pattern, further supporting positive market sentiment.

Source: xStation5

Company News:

-

CoreWeave (CRWV.US) announced that Nvidia will invest $2 billion to accelerate the development of AI infrastructure. With Nvidia’s support, CoreWeave plans to build over 5 GW of computing capacity in its data centers by 2030.

-

USA Rare Earth (USAR.US) confirmed that the U.S. government will take an equity stake in the company, providing approximately $1.6 billion in funding under the critical rare earth metals support program. In exchange, the government will receive shares and stock options, giving it a significant stake in the company. Following the announcement, USA Rare Earth shares surged.

-

Revolution Medicines (RVMD.US) shares fell by about 20% after reports that Merck (MRK) is no longer in acquisition talks with the company.

-

AppLovin (APP.US) shares rose 5% after receiving a “Buy” recommendation, reflecting investor optimism about the company’s prospects in the mobile app and advertising sector.

Morning Wrap - Oil price is still elevated (07.03.2026)

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.