- USA finally ends its government shutdown, but markets fail to grow regardless

- Wall Street extend recent decline

- Google probed by EU regulators again

- Cisco positively surprises investors on earnings

- Gold rebound supports miners

- Quantum computing slips further

- USA finally ends its government shutdown, but markets fail to grow regardless

- Wall Street extend recent decline

- Google probed by EU regulators again

- Cisco positively surprises investors on earnings

- Gold rebound supports miners

- Quantum computing slips further

Americans can celebrate the reopening of the government, the end of the decision-making paralysis, and the resumption of funding for essential programs. However, the markets do not seem to be in a celebratory mood. The session on Wall Street opens with noticeable declines. US100 contracts are falling by about 1%. S&P500 and Russell are doing slightly better, with their contracts depreciating by 0.5% at the start of trading.

The weakness of the American market in today's session is also evidenced by the significant decline of the dollar, which is losing against most major currencies. The Dollar Index itself is down over 0.2%, reaching its lowest value in 3 weeks.

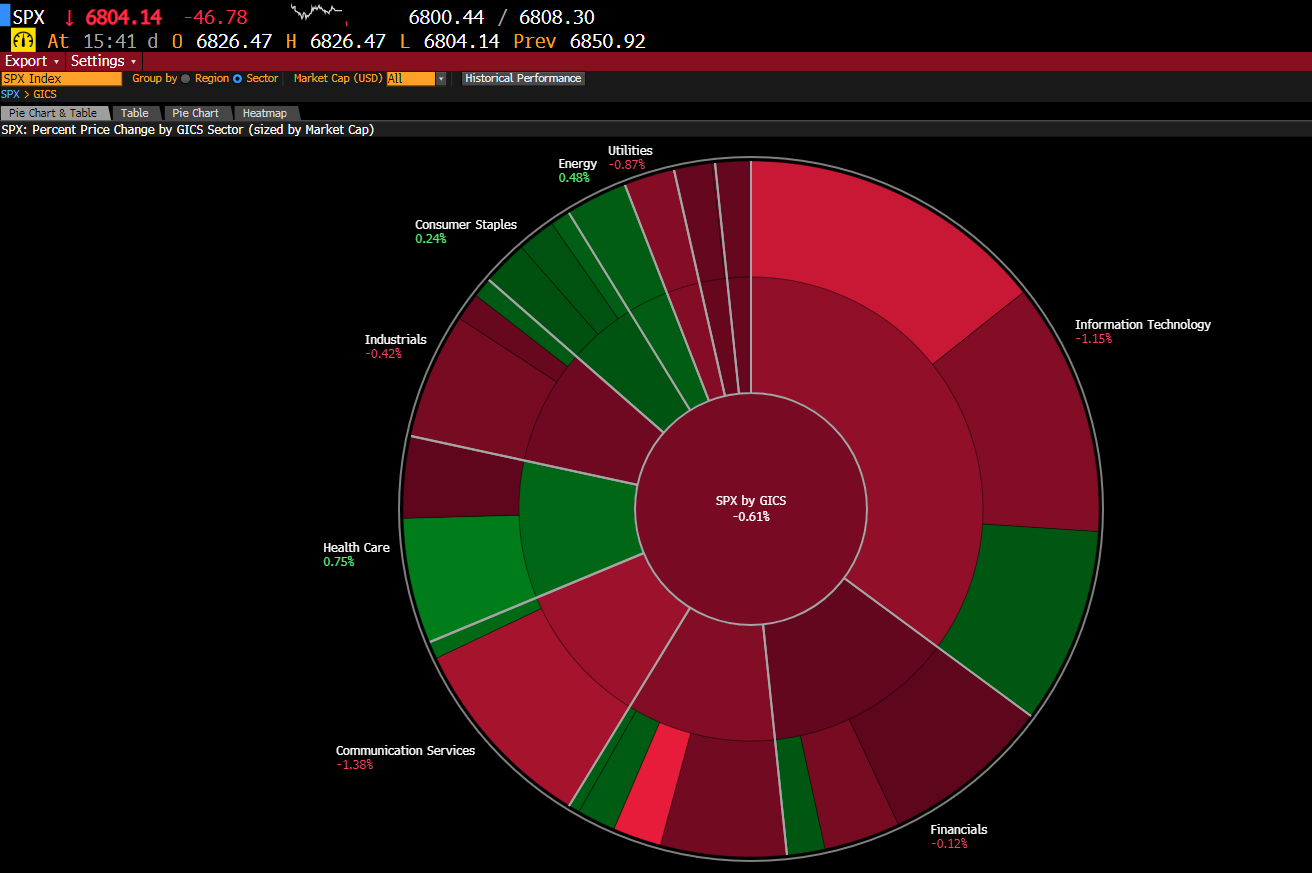

Source: Bloomberg Finance LP

The leaders of the declines at the beginning of the session in the USA are technology companies and retailers. The industrial sector is experiencing shallower declines. The healthcare sector is doing the best, standing out with gains.

Macroeconomic Data:

In the data publication segment — EIA will present changes in oil and gasoline inventories today. Alberto Musalem from the FED St. Louis and FOMC member Beth M. Hammack will also speak on monetary policy.

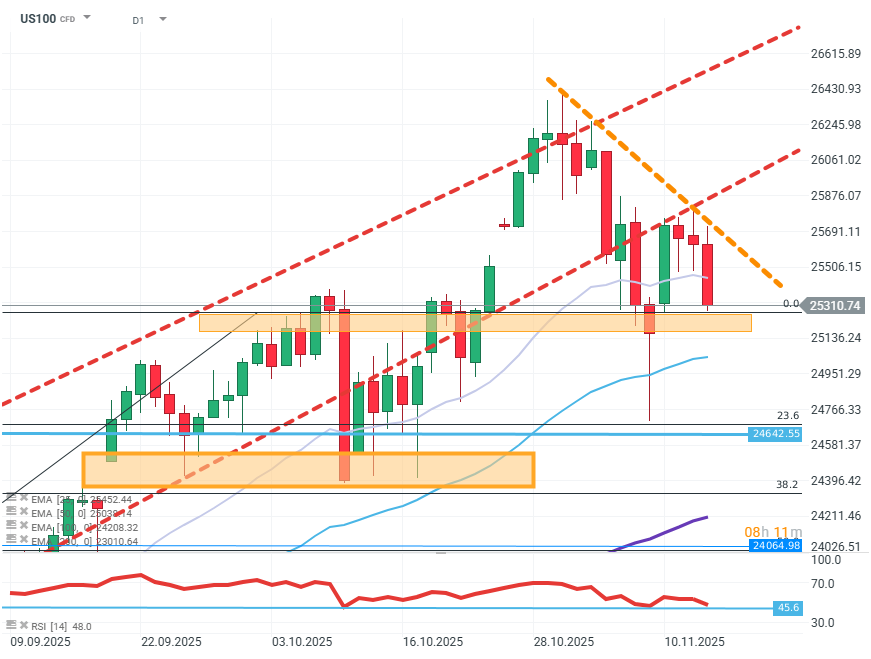

US100 (D1)

Source: xStation5

The price on the chart is making another decline, stopping at the support level of 25,300 dollars. Buyers failed to maintain the previous upward trend. The next target for the demand side will be to defend the current level with a perspective on consolidation and growth. However, if sellers manage to break the resistance at 25,300, the price may face a deeper correction towards 24,640.

Company News:

- CISCO (CSCO.US) - The network solutions provider is rising after an earnings conference, where it not only beat market expectations regarding revenue but also significantly raised its future EPS forecasts. The valuation is rising by almost 7% before the market opens.

- Alphabet (GOOGL.US) - The tech giant is under scrutiny by EU regulators, who suspect it of unfair practices towards customers. The company's stock is down 1.5%.

- Dollar Tree (DLTR.US) - The retail chain is losing about 3% after receiving a negative recommendation from an investment bank, concerned about the lack of further growth space for the company.

- Nike (NKE.US) - The clothing manufacturer is up over 2% after receiving a positive recommendation from an investment firm. According to Wells Fargo analysts, the company is preparing for significant valuation increases. This thesis may be supported by the upcoming shopping season and speculation regarding the so-called Trump tariff dividend.

- FireFly (FLY.US) - The space company plans to resume the use of the "Alpha Rocket," and the market is reacting very positively, with the company's valuation rising by over 20%.

- Anglogold (AU.US) - Gold mining companies are gaining from a new wave of precious metal valuation increases. One of the segment leaders is up nearly 3% before the market opens.

- Alibaba (BABA.US) - The Chinese company associated with e-commerce, listed on the American stock exchange, is up nearly 5% after announcing the premiere of its AI model, which is set to compete with ChatGPT.

- Rigetti Computing (RGTI.US) - Companies involved in quantum technology are still losing as investors retreat from this segment. The company's stock is down over 3%.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.