The main news of the day, eagerly awaited by the markets, were the key macroeconomic data releases from the United States, which provide important insights into the state of the economy in the last quarter of 2025. In November, producer prices rose by 0.2% month-on-month and 3.0% year-on-year, slightly above market expectations. This reading confirms that underlying price pressures remain and are not easing as quickly as one might expect, suggesting that companies are still facing challenges from rising production costs.

On the other hand, retail sales data came in positively, showing a 0.6% increase compared to October. Consumers remain active and willing to spend, even after excluding the most volatile categories, such as automobiles, fuel, and food services. This is a clear signal that domestic demand continues to drive the U.S. economy and support its growth in the fourth quarter.

This combination of persistent upstream inflation and dynamic consumption suggests that the economy remains on a path of stable growth but also requires caution in monetary policy. For the Federal Reserve, higher-than-expected inflation readings are a strong argument against rushing to cut interest rates. On the contrary, it is likely that the current, relatively high rates could remain unchanged for an extended period, which markets are already beginning to price in.

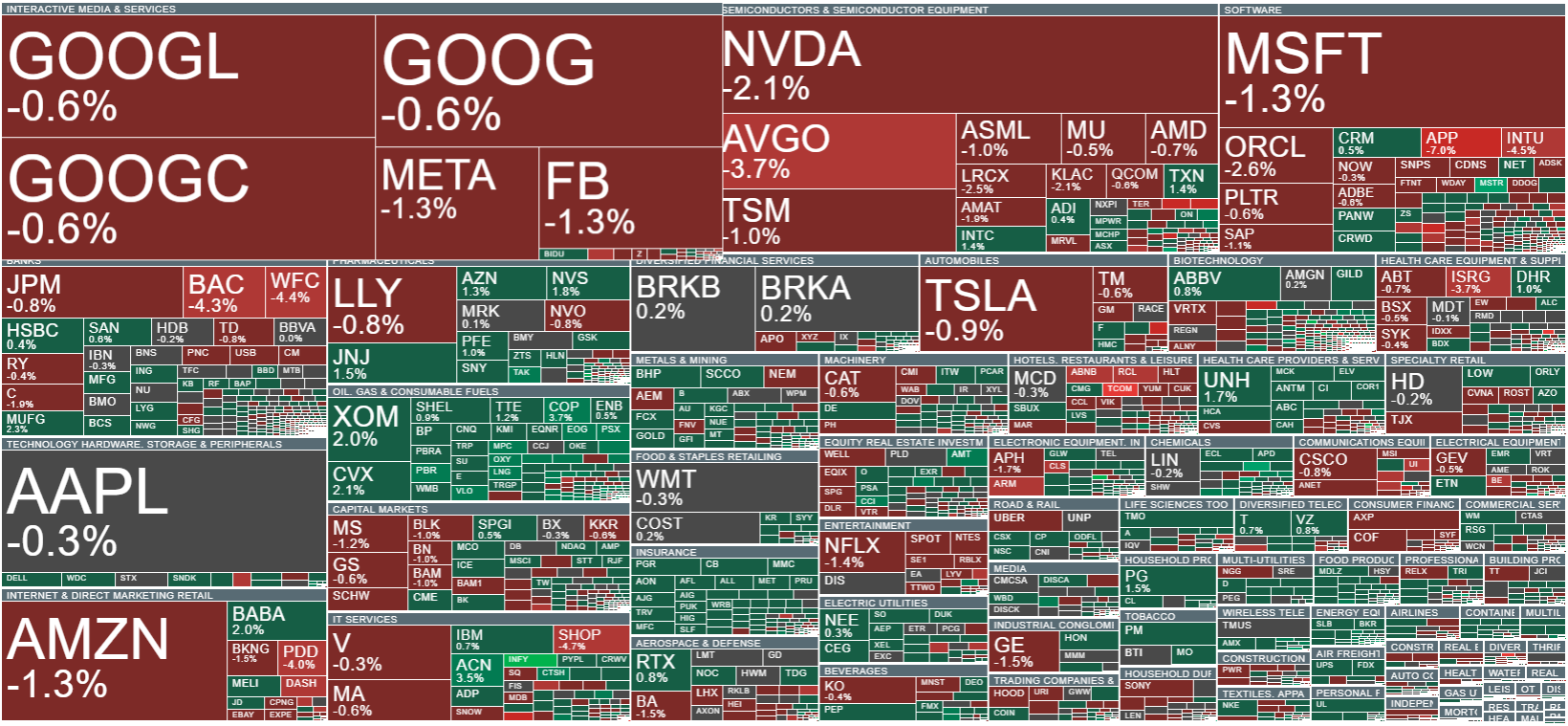

In response to this news, U.S. stock indices are showing notable weakness today. The Dow Jones is down about 0.2%, the S&P 500 has declined by 0.6%, and the Nasdaq is falling around 0.9%. This reaction reflects market concerns that persistent inflationary pressures could require further restrictive monetary policy, which in turn could slow corporate profit growth and increase financing costs. The Nasdaq, which is heavily weighted with technology companies, is particularly sensitive to higher interest rates, which raise the cost of capital and limit these firms' future growth potential.

Although retail sales indicate healthy consumer demand, the prevailing concern about prolonged high interest rates is influencing caution and market decisions. In the longer term, upcoming consumer inflation reports will be key.

Source: xStation5

Futures for the US500 (S&P 500) are retreating compared to yesterday’s close, mainly in reaction to a higher-than-expected PPI, indicating persistent inflationary pressures and limiting market expectations for rapid Fed rate cuts. Core PPI data above consensus triggered concerns about the continuation of current monetary policy. The RSI indicator is falling to around 50, signaling neutral momentum and the possibility of further correction after December’s record levels.

Source: xStation5

Corporate News

Wells Fargo (WFC.US) reported Q4 2025 results that disappointed the market, as revenue and EPS were below expectations, leading to a decline in its stock price. Nevertheless, the bank posted net profit growth and presents optimistic prospects for 2026, assuming stable spending, increased interest income, and growth in lending and financial markets segments. The removal of regulatory constraints enables further expansion and investment, raising hopes for improved results in the coming year.

Key Q4 2025 Wells Fargo financials:

- Revenue: $21.29 billion

- EPS: $1.62

- Balance sheet: over $2 trillion

- YoY net profit growth driven by interest income

- Strong growth in new credit cards and auto loans

Citigroup (C.US) reported Q4 2025 results that positively surprised the market. Despite weaker performance in the markets division, the bank showed solid growth in investment banking and wealth management segments. The bank forecasts growth in net interest income in 2026 and maintenance of an efficient cost structure.

Key Q4 2025 Citigroup financials:

- Adjusted EPS: $1.81 vs. expected $1.62

- Revenue: $19.9 billion vs. consensus $20.5 billion, up from $19.5 billion YoY

- Net interest income (NII): $15.7 billion, +5% QoQ, +14% YoY

- Total operating expenses: $13.8 billion vs. $14.3 billion in the previous quarter

- Loan loss reserve: $2.22 billion, down from $2.45 billion

- Loans: $752 billion, deposits: $1.40 trillion

- Segment revenue:

- Services: $5.94 billion, +11% QoQ, +15% YoY

- Markets: $4.54 billion, -18% QoQ, -1% YoY

- Banking: $2.21 billion, +4% QoQ, +78% YoY

- U.S. Consumer Banking: $5.29 billion, +3% YoY

- Wealth Management: $2.13 billion, +7% YoY

- Services: $5.94 billion, +11% QoQ, +15% YoY

The bank highlighted that 2025 ended with record revenues and positive operating leverage across all five business segments, with investments driving solid revenue growth.

Bank of America (BAC.US) reported Q4 2025 results that exceeded market expectations. Growth in both interest and non-interest income reflected the resilience of consumers and businesses. The Global Banking and Global Wealth & Investment Management segments posted year-over-year and quarter-over-quarter revenue growth. The bank forecasts 5–7% growth in net interest income and positive operating leverage in 2026.

Key Q4 2025 Bank of America financials:

- EPS: $0.98 vs. expected $0.95

- Net interest income (FTE): $15.9 billion, up from $14.5 billion YoY

- Non-interest income: $12.6 billion, up from $12.1 billion YoY

- Loan loss reserve: $1.31 billion, down from $1.45 billion YoY

- Operating expenses: $17.4 billion vs. $16.8 billion in Q4 2024

- Deposits: $2.01 trillion

- Revenue: $28.40 billion vs. forecast $27.55 billion

- Net income: $7.6 billion

- Segment revenue:

- Consumer Banking: $11.2 billion, up from $10.6 billion YoY

- Global Wealth & Investment Management: $6.62 billion, up from $6.0 billion YoY

- Global Banking: $6.24 billion, up from $6.10 billion YoY

- Global Markets: $5.32 billion, up from $4.86 billion YoY

- Consumer Banking: $11.2 billion, up from $10.6 billion YoY

The bank reported solid credit quality, positive operating leverage, and revenue growth in key segments, which, combined with resilient consumer and business demand, builds optimism for the coming year.

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Market wrap: European and US stocks try to rebound rebound 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.