- Wall Street indices open higher

- US2000 tests 2,100 pts resistance zone

- GameStop surges 70% as interest in meme-stocks revives

- Stericycle rallies at double-digit pace after agreeing to be acquired by Waste Management

Wall Street indices launched today's trading higher - S&P 500 gains 0.3%, Dow Jones trades flat, while Nasdaq and Russell 2000 jump around 0.8% each. Meme-stocks are in the center of attention again after media reported that RoaringKitty, trader associated with 2021 mania, build a large position on GameStop. GameStop launched today's trading with an over-70% bullish price gap.

Economic calendar for the US session today is light, but there is one important release scheduled - ISM manufacturing index for May at 3:00 pm BST.

Source: xStation5

Source: xStation5

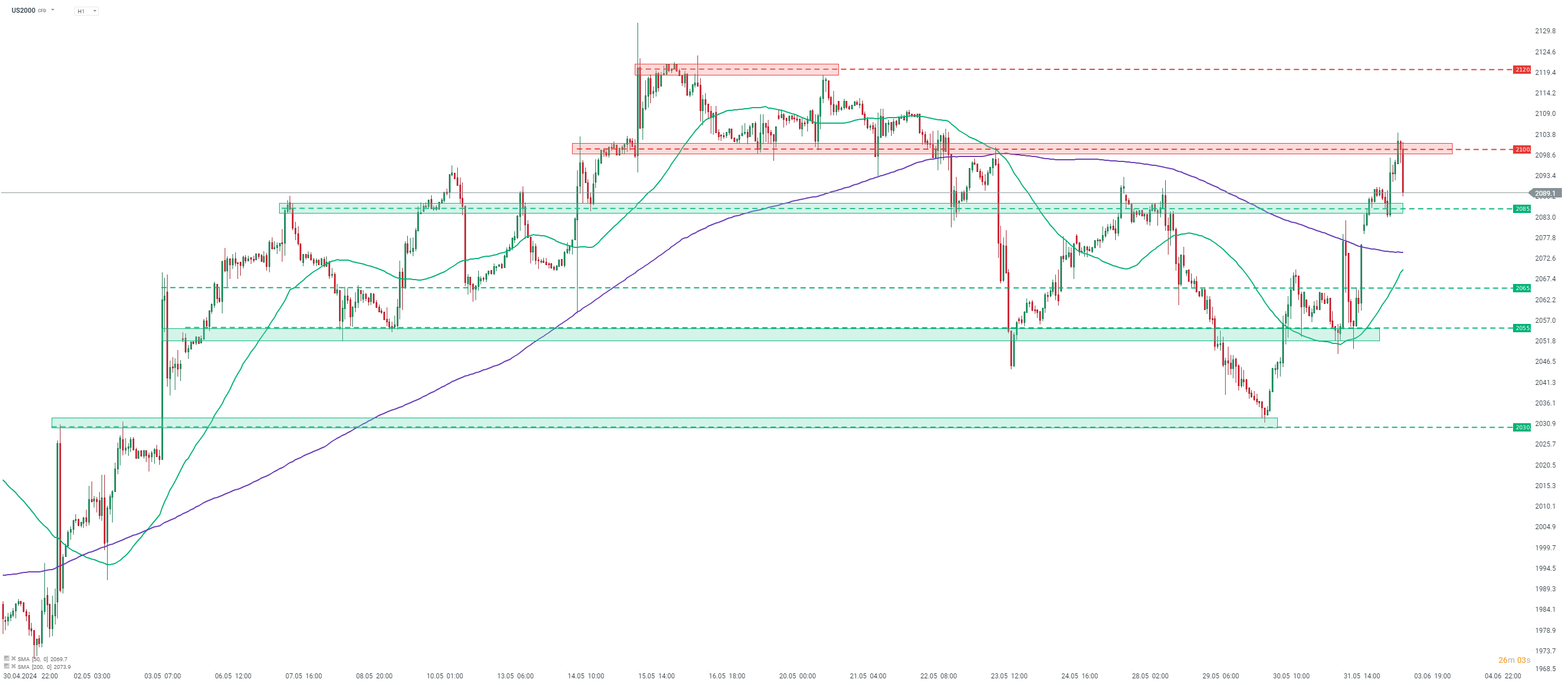

Russell 2000 is the best performing major Wall Street index today, as it is supported by renewed interest in meme-stocks. Taking a look at Russell 2000 futures (US2000) chart at H1 interval, we can see that the index climbed to the 2,100 pts resistance area and trades at the highest level since May 22, 2024. Clearing this area would pave the way for a test of 2,120 pts zone, marked with mid-May local highs. On the other hand, in case of a failure to maintain bullish momentum and a pullback from 2,100 pts area, the first near-term support zone to watch can be found in the 2,085 pts area and the next one can be found in the 2,065 pts area. So far, it looks like the latter option is in play with US2000 pulling back sharply after launch of US cash trading.

Company News

GameStop (GME.US) and other meme-stocks are on the rise again. GameStop (GME.US) is among top performers, launching today's cash session with an around-70% bullish price gap. The move higher was triggered by media reports signalling that RoaringKitty, a trader associated with Reddit meme-stocks mania, has amassed an over $180 million position in GameStop shares and call options. Other meme stocks - AMC Entertainment (AMC.US), Beyond Meat (BYND.US), BlackBerry (BB.US) - are also trading higher but not as much as GameStop.

Stericycle (SRCL.US), medica-waste disposal company, agreed to be acquired Waste Management (WM.US), North America's largest waste recycling company. Waste Management will pay $62 per each share of Stericycle, marking an around 20% over company's closing price on Friday. Transaction gives Stericycle enterprise value of $7.2 billion and is expected to close in the fourth quarter of 2024, following regulatory approval and approval from Stericycle's shareholders. Stericycle launched today's trading with a big bullish price gap and is gaining at a double-digit pace, while Waste Management trades slightly lower.

Nvidia (NVDA.US) and Advanced Micro Devices (AMD.US) trade higher today after executives of both companies made AI-related announcements over the weekend at an event in Taiwan. Jensen Huang, CEO of Nvidia, said that his company will premier Blackwell Ultra chip in 2025 and next-gen Rubin AI platform in 2026. AMD announced that it is speeding up introduction of new AI processors.

Analysts' actions

- Best Buy (BBY.US) upgraded to 'buy' at Citi. Price target set at $100.00

- Dell Technologies (DELL.US) downgraded to 'hold' at Citic Securities. Price target set at $151.00

- Broadcom (AVGO.US) rated 'buy' at Melius Research. Price target set at $1,850.00

- Target (TGT.US) rated 'underperform' at BNPP Exane. Price target set at $116.00

- Cava Group (CAVA.US) downgraded to 'neutral' at JPMorgan. Price target set at $77.00

GameStop (GME.US) launched today's trading with an over-70% bullish price gap. Source: xStation5

GameStop (GME.US) launched today's trading with an over-70% bullish price gap. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.