- US and Nvidia leverage strategy unfolded by China

- Large H200 orders

- Intel buys an AI start-up

- Romba vacuum creators bankrupt

- Gold miners benefit from higher prices

- US and Nvidia leverage strategy unfolded by China

- Large H200 orders

- Intel buys an AI start-up

- Romba vacuum creators bankrupt

- Gold miners benefit from higher prices

The first session of the week on Wall Street opens with a moderately positive sentiment. All contracts on the main indices of the American stock exchange are recording increases around 0.4%.

Nvidia and China are once again in the spotlight. During Friday's negotiations, the Chinese delegation reportedly indicated to the USA that Nvidia chips are not the bargaining chip that the USA thinks they are. According to Bloomberg Tech sources, the Chinese prefer to continue investing in their own products rather than relying on ready-made solutions that the USA will use against them at the slightest opportunity.

Macroeconomic data:

- The NY Empire Index showed a decline of -3.9, noticeably below expectations of 9.6.

- Later in the day, investors can expect speeches from FOMC members - Williams and Miran.

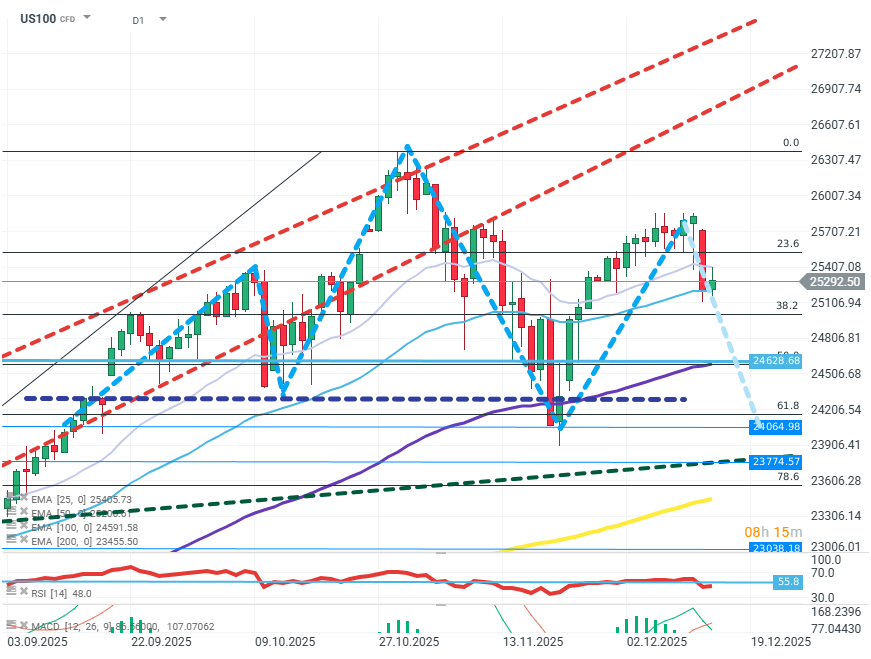

US100 (D1)

Source: xStation5

The valuation on the technology index chart continues the realization of the RGR formation. Today's session is yet another attempt to negate the formation. The key level for buyers is 26000 and FIBO 23.6. These levels must be exceeded to negate the formation. At the same time, sellers must bring the price at least around the neckline level of approximately 24200 to have hope for the realization of the formation.

Company news:

- Adobe (ADB.US) - An investment firm issues a series of negative recommendations for IT service companies, including Adobe, which is losing about 1% today.

- Immmunome (IMNM.US) - The biotechnology company published positive results of clinical trials for one of its potential products. The valuation is rising by over 20%.

- IRobot (IRBT.US) - The robot manufacturer, including the iconic "Roomba," announces bankruptcy. Valuations are falling by about 70%.

- Anglogold (AU.US) - Gold miners continue to see valuation increases on the wave of demand for precious metals. The company is growing by over 2%.

- Texas Instruments (TXN.US) - The company specializing in the production of specialized semiconductors and analog electronics is losing about 2%. The decline is caused by a negative recommendation from an investment bank, indicating low attractiveness of the company in the context of demand generated by AI.

- Nvidia (NVDA.US) - The producer of AI software and components is recovering some of the valuations lost due to the failure of Friday's negotiations. A number of Chinese companies have placed large orders for export versions of H20 chips, i.e., H200. Nvidia's valuation is rising by about 1%, although the transaction is still awaiting acceptance from the Chinese side.

- Intel (INTC.US) - The processor manufacturer purchased the AI startup SambaNova System for 1.6 billion dollars. The stock price is rising by about 1%.

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.