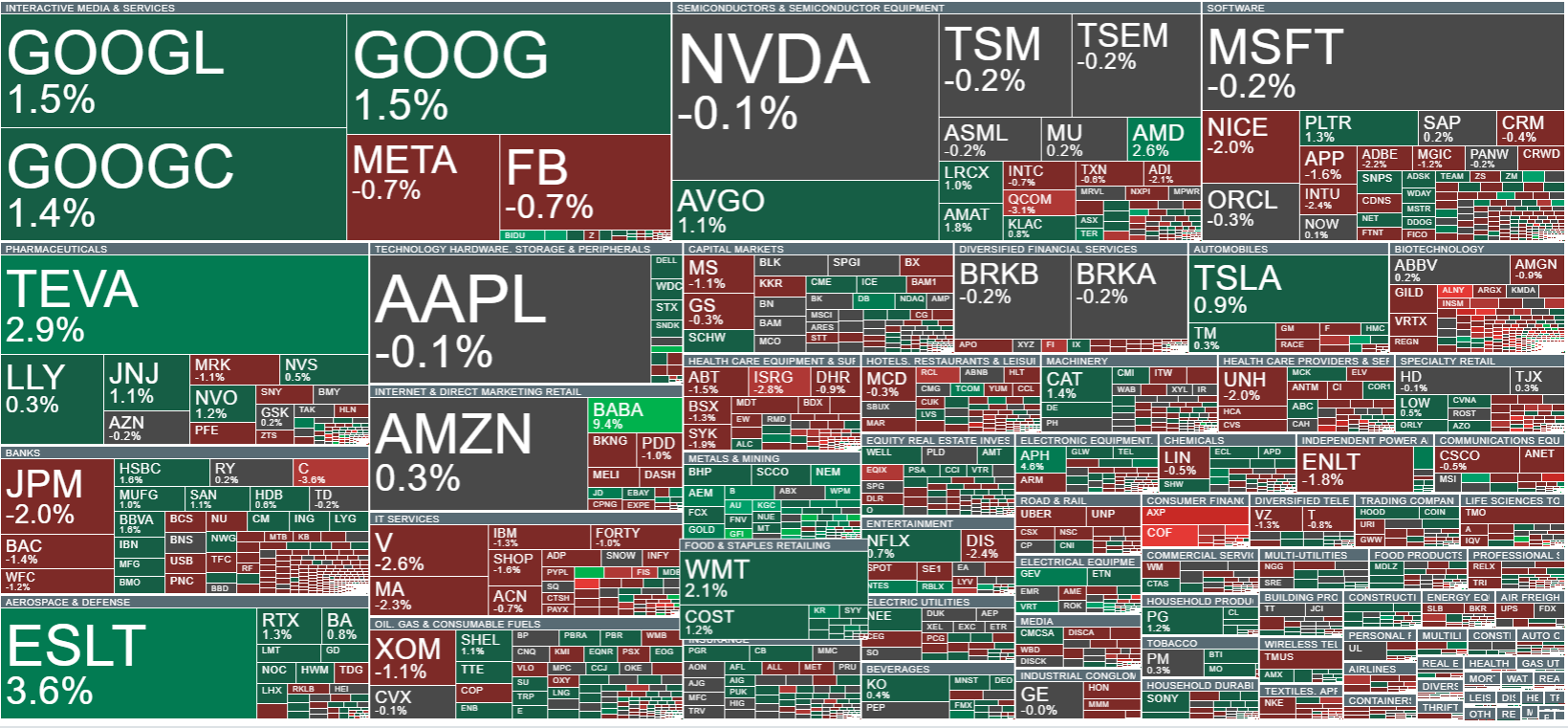

At the opening of the Wall Street session, the Dow Jones Industrial Average is down 0.5%, the S&P 500 has lost 0.2%, and the Nasdaq Composite is down 0.1%, reflecting growing investor uncertainty amid escalating political tensions surrounding the Federal Reserve. Over the past weekend, U.S. federal prosecutors launched a criminal investigation into Fed Chair Jerome Powell concerning the bank’s headquarters renovation project and his Senate testimony. The Department of Justice has issued grand jury subpoenas and suggested the possibility of charges, an unprecedented event in the modern history of the Fed. Powell has denied the allegations, calling them a politically motivated attack aimed at pressuring the central bank to lower interest rates faster, as requested by President Donald Trump’s administration.

The declines in equities are driven by investors’ concerns over the Fed’s independence and the potential increase in risk and volatility in monetary policy. Political pressure on the central bank could influence interest rate decisions, borrowing costs, and the overall stability of the U.S. economy, heightening uncertainty in both the short and long term.

Source: xStation5

US500 (S&P 500) futures are falling today amid rising tensions between President Trump and the Federal Reserve. Markets fear an escalation of the conflict and uncertainty regarding the Fed’s future decisions, which could impact interest rates, credit costs, and the stability of the U.S. economy.

Source: xStation5

Company News:

- Beam Therapeutics (BEAM.US) shares are up around 20% after announcing progress in developing precision genetic medicines and presenting the company’s strategic plans for 2026. The company highlighted recent achievements in liver-targeted genetic diseases and hematology, outlined strategic priorities for the year, and extended its projected funding runway through 2029. Expansion of the liver-targeted genetic disease portfolio is also underway, with a new program to be announced in the first half of 2026.

- Birkenstock (BIRK.US) shares are up more than 2% following preliminary fiscal Q1 2026 revenue of €402 million, reflecting a 11.1% year-over-year increase on a reported basis and 17.8% growth in constant currency. The company will release full results on February 12.

- UnitedHealth Group (UNH.US) shares are down nearly 2% after a Senate committee found the company had employed “aggressive tactics” to boost federal payments in the Medicare Advantage program. The company denies some of the allegations

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.