- ISM ticks up in April

- JP Morgan Gains following FRB takeover

- Arista Networks to publish report after earnings

Following a very strong end to the April trading US stocks opened flat on Monday with Europe mostly off due to the Labour Day and full focus on the events ahead this week and especially the Fed decision. The ISM manufacturing release did little to change the market situation. The index was up from 46.3 to 47.1 on the back of somewhat stronger orders, production and employment. At the same time prices subindex also rose and moved back above the 50 points threshold. That could be another reminder that disinflation could look easy now with huge base effects but could be tricker down the road and force the Fed to keep rates elevated for longer.

The ISM followed our regional composite slightly higher in April but both remain in the slowdown territory. Source: XTB, Macrobond

The ISM followed our regional composite slightly higher in April but both remain in the slowdown territory. Source: XTB, Macrobond

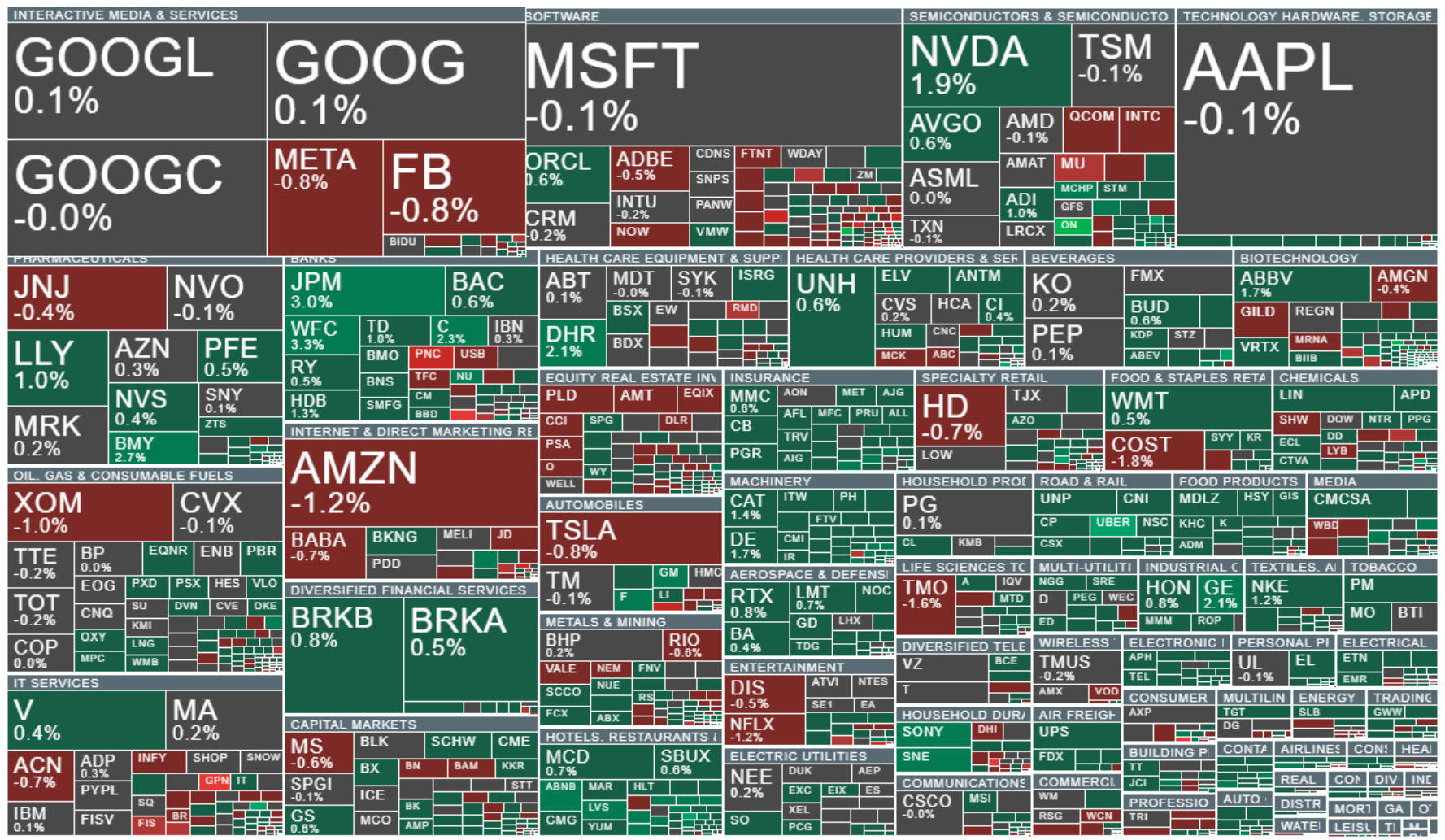

Banking sector is in the spotlight after the forced takeover of First Republic Bank (FRC.US) by JP Morgan. The details of the deal seem to be positive for the largest US bank (at least on paper) and thus the stock is one of the winners during Monday’s trade.

Banking stocks are mostly up led by the JP Morgan. Source: XTB

Banking stocks are mostly up led by the JP Morgan. Source: XTB

JP Morgan has opened with the bullish gap and is testing a resistance.

JP Morgan has opened with the bullish gap and is testing a resistance.

The earnings season remains in full swing after mostly promising reports last week (mainly from Meta and Microsoft). While all eyes will be on Apple this Thursday investors should also watch somewhat smaller companies that deliver solid growth. One such company is certainly Arista Networks – a cloud network company that has a strong history of earnings beat and unsurprisingly – an amazingly bullish chart. The company will release its quarterly report after the bell.

Arista Networks (ANET.US) has been in a flag formation lately but has managed to defend 50 day sma. Long term price action has been incredibly bullish.

Arista Networks (ANET.US) has been in a flag formation lately but has managed to defend 50 day sma. Long term price action has been incredibly bullish.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.