-

Wall Street open slightly higher after Jobless Claims data

-

Lower PPI than expected and weaker dollar extends bullish momentum

-

Crispr Therapeutics (CRSP.US) rises over 8% after positive recomendation and bright 2023 perspective

Wall Street opens higher after publication of PPI and Jobless Claims data earlier today. Jobless Claims data came higher than expected by analysts at 239k during the last week compared to 230k forecasted and 228k last week. Job Openings data falling significantly and now unemployment claims come in worse than expected. Despite that US500 extends bullish momentum and is trading in consolidation range between 4100 and 4172 points.

Positive market sentiment is also enhanced by lower than expected PPI data at 3.0% y/y compared to 2.7% y/y forecasted and 4.9% y/y previously. Despite a significant drop in overall PPI, core PPI is more sticky and came at 3.4% y/y.

US100 opens 0.75% higher at the beginning of the session but bears can fight back. The bulls failed to break above the resistance line near 13360 points (red line). Nevertheless, current positive sentiment on the market can push prices higher and US100 testing the resistance level once again. Source: xStation5

US100 opens 0.75% higher at the beginning of the session but bears can fight back. The bulls failed to break above the resistance line near 13360 points (red line). Nevertheless, current positive sentiment on the market can push prices higher and US100 testing the resistance level once again. Source: xStation5

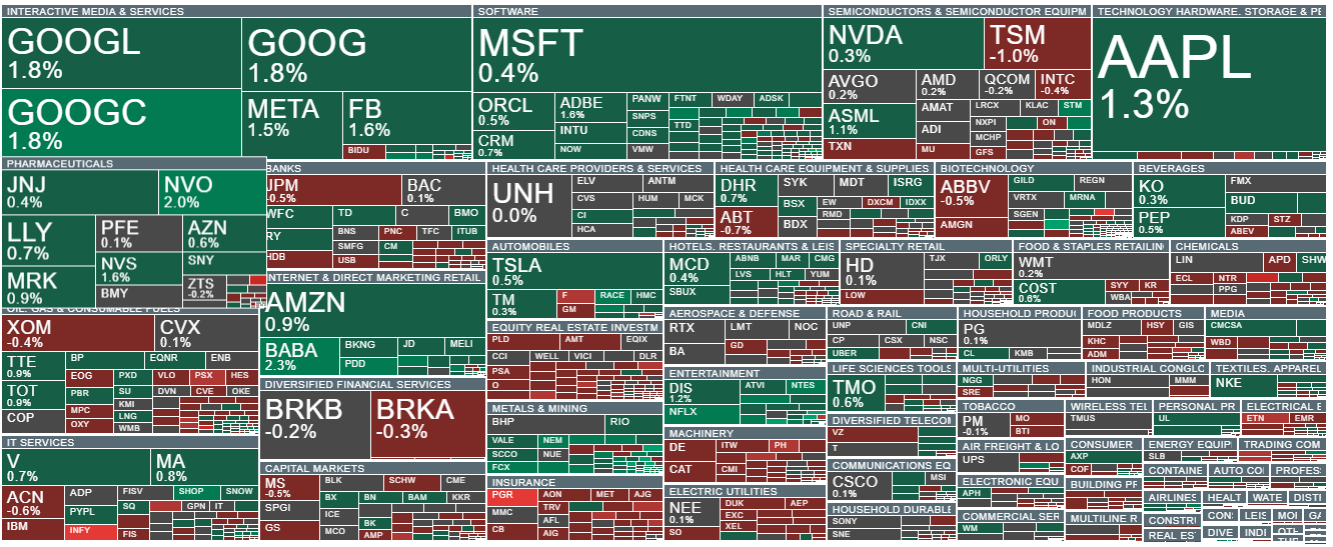

Stocks from the S&P 500 index categorized by sector and industry. Source: xStation5

Company News

- Delta Air Lines (DAL.US) gains 3% after the company forecast adjusted earnings per share for the second quarter that beat the average analyst estimate.

- Crispr Therapeutics AG (CRSP.US) rises over 8% after Cantor Fitzgerald initiated coverage with a recommendation of overweight, with analyst saying that it stands out as an interesting gene editing play for 2023.

- Magnite Inc. (MGNI.US) shares are up 8% after B Riley Securities started coverage on the online advertising services company with a buy rating and $15 price target. The share prcie is currenty trading at $9.4.

- Fastenal (FAST.US) shares are down 3.3% after reporting March daily sales growth of 6.8% that is “weaker than previous months.” Even though, Its first-quarter EPS beat analysts expectation. Share price currently trding at $50.8.

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.