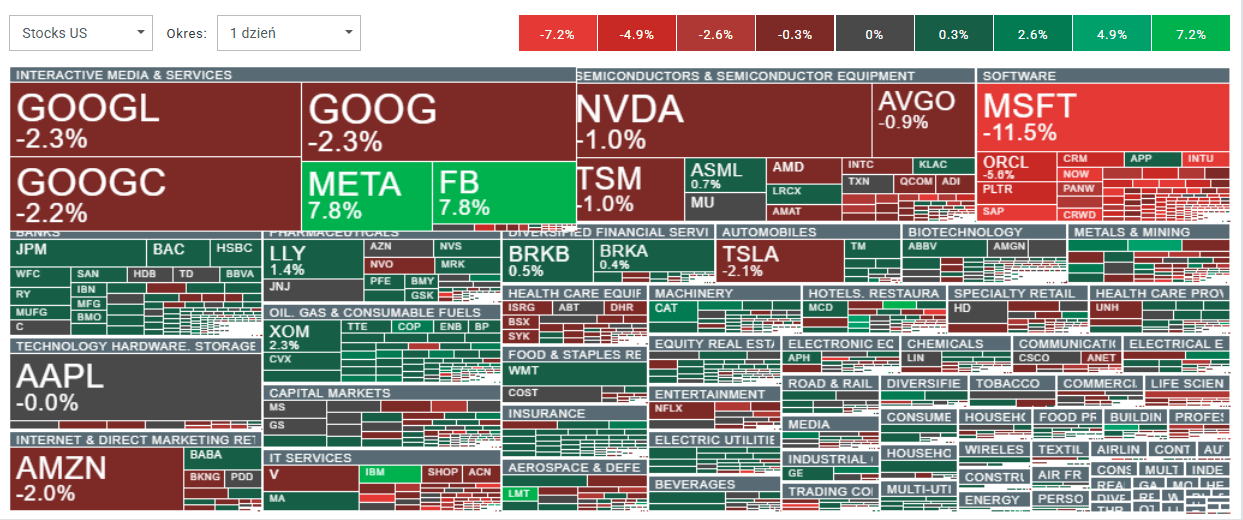

U.S. index futures opened the session in a sharply risk-off mood. A drop of more than 10% in Microsoft (MSFT.US) following its earnings is weighing heavily on sentiment and dragging major benchmarks lower — especially the US100, which is down close to 2%.

- Declines in the U.S. equity market are also weighing on cryptocurrencies. Bitcoin has fallen to around $86,000, while Strategy shares are down more than 6%.

- Analysts at Switzerland’s UBS raised their price target for Meta Platforms to $872 per share, up from $830 previously. Meanwhile, JPMorgan lowered its price target for Tesla to $145 per share, from $150 previously.

- Large losses are also visible across the software sector, where Microsoft’s sell-off is putting pressure on names such as Oracle, Palantir, Intuit, Salesforce, and ServiceNow. Big Tech is broadly weaker as well, with the exception of Meta Platforms: Amazon, Alphabet, and Tesla are down nearly 2%, while Nvidia is off about 1%. Apple (AAPL.US) is scheduled to report after today’s U.S. close; its shares are trading flat ahead of the release.

- On the macro side, U.S. factory orders rose 2.7% m/m, beating expectations of 1.3% and rebounding from -1.3% previously. December 2025 wholesale sales also increased by 1.3%, versus expectations for just a 0.1% rebound after -0.4% previously.

US100 (H1 interval)

Source: xStation5

The only notable gainers today are essentially Meta Platforms (META.US), IBM (IBM.US), and Lockheed Martin (LMT.US).

Source: xStation5

Microsoft plunges on AI CAPEX?

Microsoft shares slid 11% on 29 January 2026, wiping out several billion dollars of market value as investors fixated on two things: sky-high AI capex and signs of cooling cloud momentum.

-

The headline numbers were actually strong:

-

Revenue: $81.3B, up 17% YoY (ahead of expectations)

-

Adjusted EPS: $4.14 vs $3.93 expected

-

-

The cloud engine is still growing, but the market is picky about the “rate of change”:

-

Microsoft Cloud revenue: $51.5B, up 26% YoY

-

Azure growth: +39% (called out as a key driver)

-

-

The real shocker was the spending:

-

Capex jumped 66% to $37.5B

-

Roughly two-thirds of that went into AI GPUs and infrastructure

-

Result: operating margins compressed versus last year

-

Satya Nadella’s message was essentially: we’re early in the AI cycle, and Microsoft’s AI business is already big enough to rival some of its legacy franchises — and the company plans to keep pushing across the full AI stack. So this wasn’t a “bad quarter,” it was a valuation / patience test, so the numbers beat, but the bill for AI build-out is arriving now. Microsoft didn’t pretend the AI story is finished but it made a believable case that today’s spending has a clear path to payback. The bolatility can persist as long as capex stays elevated and margins are pressured. It's not only about the Microsoft but about the broader, software stocks sector. However, the long-term perspective is: if AI features become deeply embedded across Azure and Microsoft’s enterprise software, these investments can translate into durable growth and eventually rebuild investor confidence.

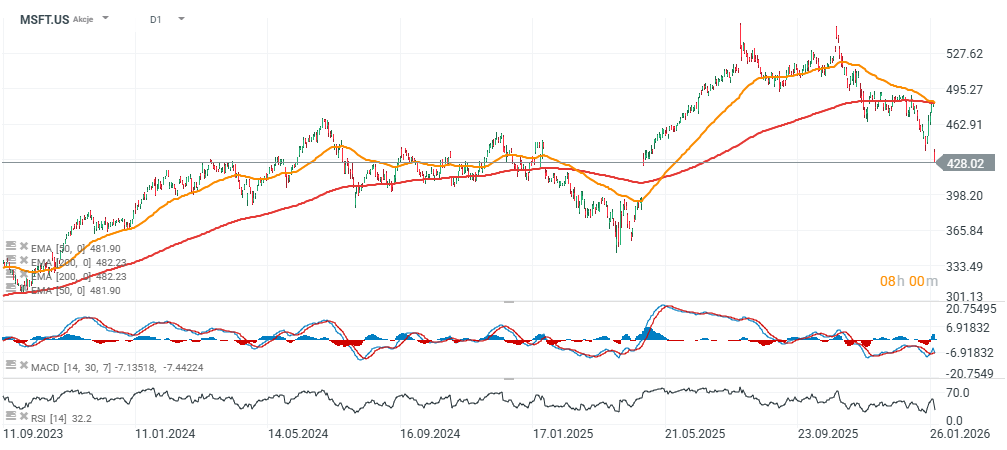

MSFT.US (D1)

Microsoft shares - the third-largest U.S.-listed company by market capitalization are down more than 10%. The current discount versus the EMA200 (red line) is now close to 15%.

Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.