- Flat opening on US stock exchanges

- 10-year Treasury yields slightly down

- The US Dollar Index (USDIDX) loses 0.40%

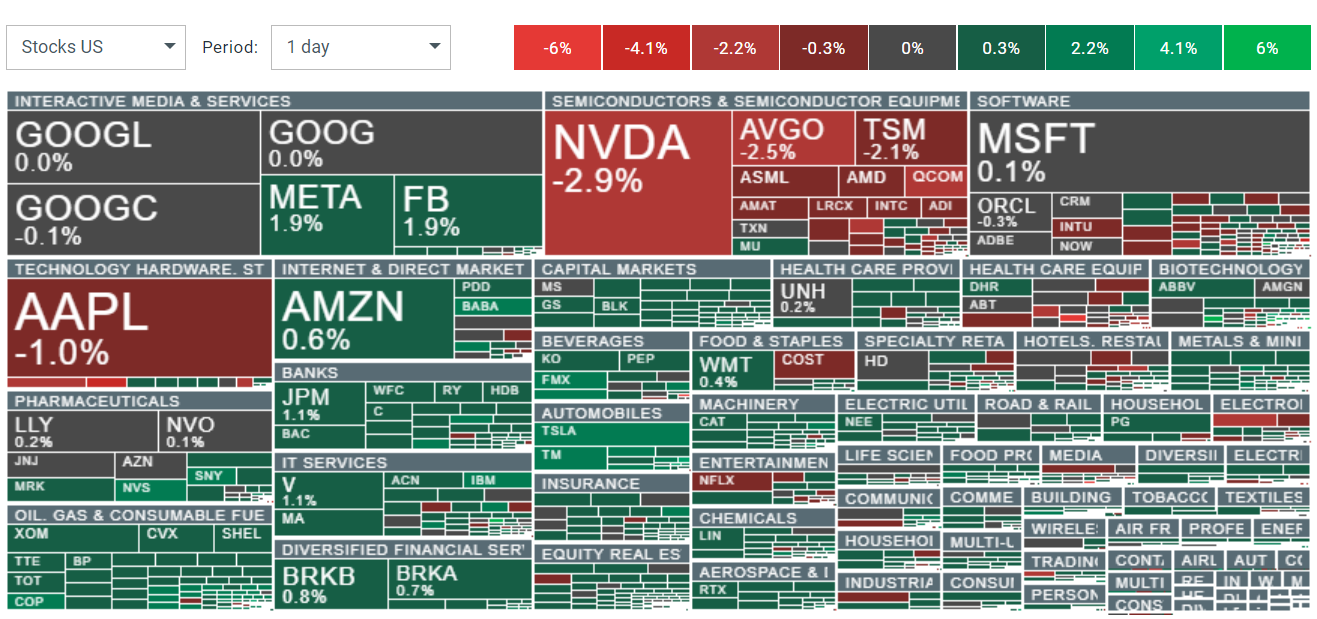

- Semiconductor sector continues to decline

The start of the new week is not the best for investors in the American stock market. Gains in major indexes on the Old Continent do not translate into better moods in the USA. Once again, for the second day in a row, companies related to the semiconductor sector are having a weaker session. At the time of publication, the US500 is up 0.40%, while the US100 is down 0.20%.

Nvidia loses an additional 3.10%, with the share price falling to $123.50. Meanwhile, Broadcom and TSM are both down by 2.60%. On the other side, among the sectors gaining the most, we can highlight Oil & Gas, and Interactive Media & Services.

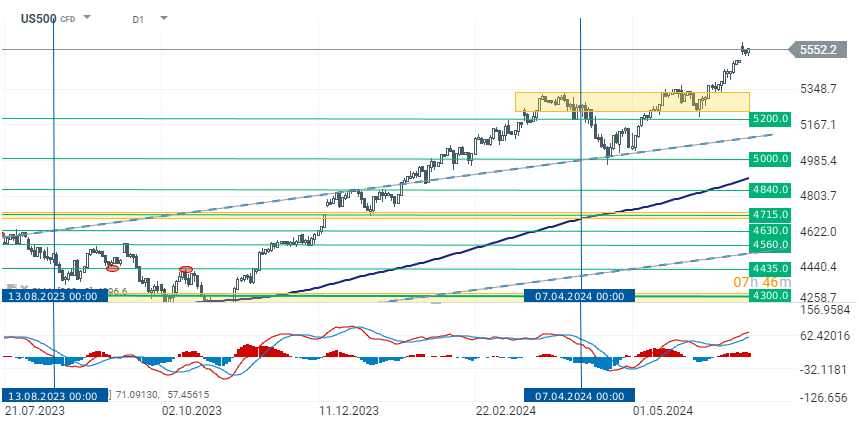

US500

The main index of companies in the USA, US500, gains 0.40% at the opening of the cash session. The quotes are consolidating around historical highs at the level of 5550 points for the third session in a row. The nearest support level in case of a deeper correction remains the 5330 points zone, which is the upper limit of the previous consolidation channel.

Source: xStation 5

Company News

Alnylam Pharmaceuticals (ALNY.US) gains 28% following successful late-stage trial results for vutrisiran, a treatment for ATTR amyloidosis with cardiomyopathy. The trial met its primary and secondary endpoints, achieving significant reductions in composite all-cause mortality and recurrent cardiovascular events, as well as notable mortality reduction in pre-specified secondary endpoints.

Altimmune (ALT.US) shares soared 26% after phase 2 trial results of pemvidutide demonstrated notable efficacy in obesity treatment, with participants losing an average of 15.6% body weight at 48 weeks. This obesity candidate not only showed significant weight loss but also better preservation of lean muscle mass compared to other treatments, highlighting its unique position in obesity management.

Affirm Holdings (AFRM.US) rose by 7.30% after Goldman Sachs began coverage with a Buy rating and set a price target of $42. Goldman Sachs commended Affirm for its groundbreaking credit solutions, excellent underwriting processes, and robust risk management strategies.

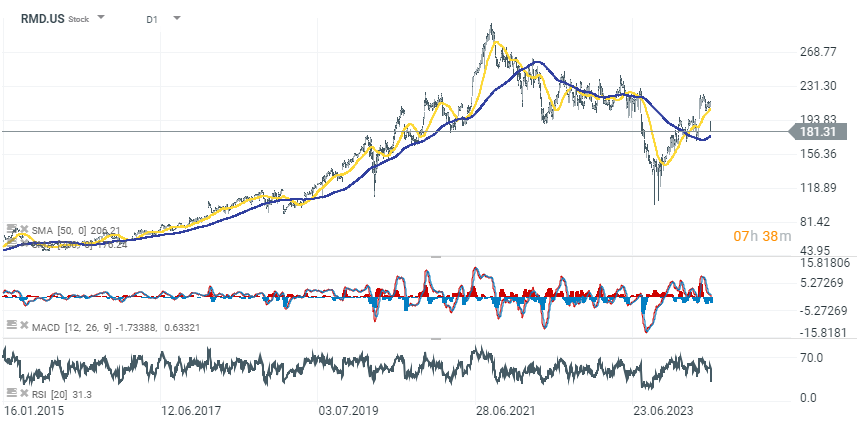

ResMed (RMD.US) saw its stock fall more than 13% following an announcement by Eli Lilly regarding an FDA decision to expand the use of its weight loss therapy, tirzepatide, to treat obstructive sleep apnea (OSA). This decision follows the successful results of the Phase 3 SURMOUNT-OSA program, potentially setting tirzepatide up as a direct competitor to ResMed’s CPAP machines for OSA treatment.

Crypto-related stocks, including Riot Platforms (RIOT.US), MicroStrategy (MSTR.US), CleanSpark (CLSK.US), and Marathon Digital (MARA.US), experienced notable losses as the prices of Bitcoin and other significant cryptocurrencies fell. This decline was influenced by reduced interest in the recently introduced spot Bitcoin ETFs and ongoing uncertainty about future interest rate decisions by the Federal Reserve, which affected the broader cryptocurrency sector stocks.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.