Wednesday’s session on Wall Street is unfolding in an atmosphere of cautious optimism. Investors are still reacting to reports about a possible end to the ongoing U.S. government shutdown, which has already left a clear mark on the market and macroeconomic data. Hopes for a political agreement in Washington are one of the main drivers behind the improved sentiment today, as ending the administrative paralysis would allow for the resumption of key economic reports and restore greater transparency in assessing the state of the U.S. economy.

At the same time, the market is closely watching signals from the Federal Reserve. Recent weaker labor market data, including a disappointing ADP report, have strengthened expectations that the Fed may decide to cut interest rates as soon as December. Such a scenario would be seen as a clear sign of support for the economy following a period of monetary tightening. However, there are visible disagreements within the Fed itself regarding the future course of action, with some members advocating caution, fearing that too rapid easing could rekindle inflationary pressures.

From a macroeconomic perspective, the U.S. economy continues to show surprising resilience despite the ongoing political deadlock. Economic growth remains moderate, though signs of slowing are already evident in certain sectors, particularly in manufacturing and foreign trade. Additionally, uncertainty around global supply chains and weaker data from China represent risk factors that could dampen investors’ risk appetite.

Currently, the market is balancing between hope for a political resolution to the budget crisis and expectations regarding the Fed’s decisions. This combination fosters moderate optimism but also highlights how fragile the current equilibrium is. If the shutdown indeed ends and the Fed adopts a more dovish stance in December, the U.S. stock market could close the year with significantly improved sentiment. For now, however, investors remain cautious, aware that any new statement from Washington or the Fed could quickly reverse market moods.

US500 (H1 interval)

Contracts on the US500 are currently gaining, although a slight correction is visible after the recent peak. The market remains above key exponential moving averages (EMA 25, 50, and 100), which technically indicates bullish dominance and continuation of the upward trend. The RSI indicator is in a neutral but slightly optimistic zone, suggesting there is still room for further gains. However, markets remain moderately cautious as they await the resolution of the ongoing U.S. government shutdown, which continues to affect sentiment and uncertainty. Support around the moving averages remains strong, but upcoming macroeconomic data and political developments will be crucial for the index’s next moves.

Source: xStation5

Company News:

-

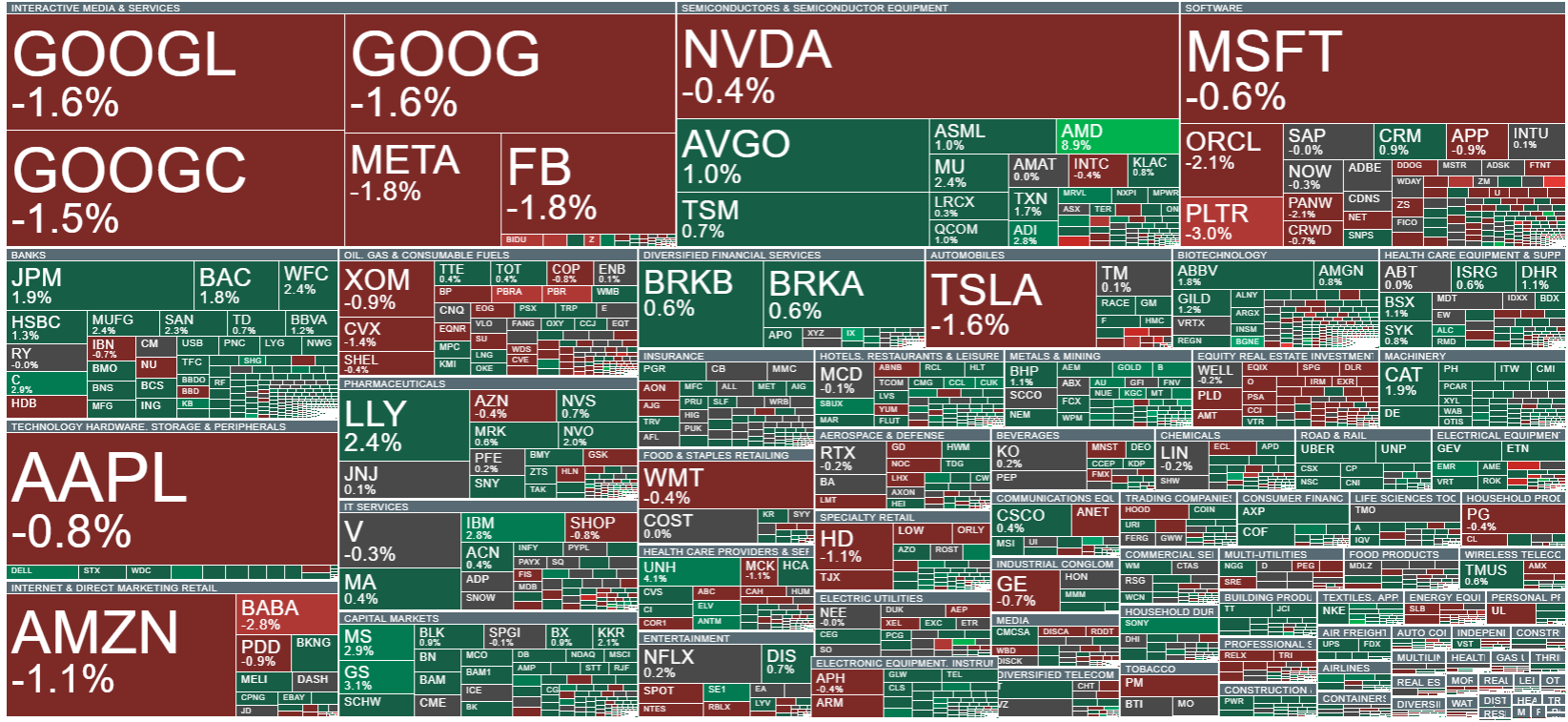

AMD (AMD.US) shares are rising by over 8% at the start of today’s session, reacting to optimistic forecasts for the AI data center market, which CEO Lisa Su estimates could reach $1 trillion by 2030. The company expects rapid revenue growth from data centers to tens of billions of dollars by 2027, supported by new GPU chips and Helios systems. Investors also respond positively to AMD’s strong Q3 2025 results, with revenues up 36% to $9.25 billion and EPS of $1.20, surpassing analyst expectations. The stock has gained over 90% year-to-date, while AMD is also expanding into aerospace, defense, and telecommunications sectors, supporting its long-term growth potential.

-

IBM (IBM.US) is gaining about 2.5% during today’s trading session. The company’s shares rise on the back of positive news about advancements in quantum technology, including the launch of the new Quantum Nighthawk processor, which can handle circuits 30% more complex.

-

Circle Internet Group (CRCL.US) shares are falling over 7% today after the company reported a decline in its third-quarter reserve return rate. Although the firm beat analyst expectations in Q3 and forecasts its full-year revenue margin after distribution costs to be at the upper end of previous guidance, investors remain cautious. Circle Internet, specializing in stablecoin technology, also signals that operating expenses may rise compared to earlier forecasts, explaining the share price decline.

-

OKLO (OKLO.US) shares are up about 11% during today’s session, driven by reports of increased cash and equivalents in Q3 and a new strategic focus on obtaining approval from the U.S. Department of Energy. Investor optimism reflects growing confidence in the company’s prospects in the nuclear technology sector and the potential of next-generation reactors. The rise is notable, especially considering prior price volatility and market dynamics.

-

Bill Holdings (BILL.US) shares rise over 12% today, fueled by news that the company is exploring various strategic options, including a potential sale.

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.