- Wall Street is set to open higher on the last day of the week

- Mixed sentiment after contrary signals from labor market data

- MongoDB shares rally after Q1 results

Wall Street is set to open higher on Friday following the approval of a debt-limit deal. Futures for the US500 are traded at 4,268 points with +0.7% change, US100 0.2% to 14,520 points.

The agreement to raise the government's debt limit and implement spending cuts removed the threat of default that had unsettled markets the previous week. While the debt deal provided relief, investors are now focusing on whether the economy will enter a recession before inflation subsides enough to convince the Federal Reserve to pause its rate hikes. Recent data showing fewer unemployment benefit applications and stronger-than-expected job growth has added to the uncertainty. The hope is that the Fed may delay or reduce further rate hikes if upward pressure on prices eases.

In May, the US labor market presented mixed signals as nonfarm payrolls increased and unemployment rate rose, leading to speculation about a pause in interest-rate hikes by the Federal Reserve. Payrolls showed a broad-based advance, particularly in professional and business services, government, and healthcare sectors. The rise in payrolls caused Treasury yields to jump. However, the surge in the unemployment rate and the number of jobless individuals raised concerns about the longevity of labor demand. The report may support the Fed's decision to pause rate hikes temporarily, allowing them to assess the effects of previous hikes. Fed officials are expected to closely examine the upcoming consumer price index data before their June meeting.

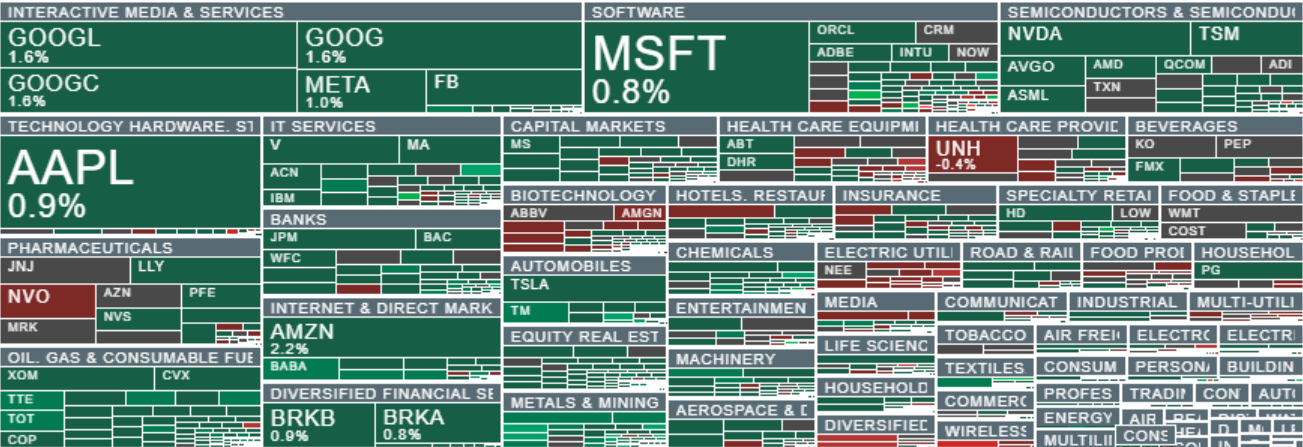

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by META (META.US), Alphabet (GOOGL.US) and Microsoft (MSFT.US). Source: xStation5

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by META (META.US), Alphabet (GOOGL.US) and Microsoft (MSFT.US). Source: xStation5

The US500 index is currently trading at 4268 points gaining 0.7% today. The price has broken above the bear market channel, indicated by the blue lines, which suggests a positive development. Additionally, the presence of two large green candles indicates a strong upward movement. The next significant resistance level to watch is at 4300 points. On the downside, if the bullish momentum weakens, there is a support line at 4200 points. Traders should closely monitor the price action around these levels to gauge the strength of the ongoing trend.

Company News:

- Asana (ASAN.US) shares are up 1.8% after the software company reported first-quarter revenue that was slightly better than expected. Morgan Stanley also touted the company’s billings, margins, and “strong positioning to deliver compelling AI capabilities” as positives.

- MongoDB (MDB.US) shares are soaring 34% with analysts positive on the database software company after it reported first-quarter results that beat expectations and raised its full-year forecast. Citi says the outlook “could signal a faster recovery in the consumption trends of the business, potentially driven by GenAI tailwinds.”

- Samsara Inc. (IOT.US) shares are up 19% after the software company boosted its total revenue guidance for the full year. It also reported first-quarter revenue that was higher than analyst expectations.

- PagerDuty (PD.US) shares fall 12% after the company saw a worsening of the spending environment in 1Q. That resulted in a cut to the fiscal 2024 outlook, but guidance looks achievable, according to Morgan Stanley.

- Dell Technologies (DELL.US) published sales outlook indicating that a recovery may take a bit longer than expected as it continues to struggle to sell PCs, particularly to consumers.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.