- Wall Street opens higher

- Dollar loses slightly

- Bond yields lose for third consecutive session

Weak NFP data reignited investor hopes for faster interest rate cuts. While total employment came in above expectations at 206k market attention shifted to strong downward revisions for last month's data, a rise in the unemployment rate and lower private sector growth. Following the release of the data, we saw a sharp jump in index futures and a fall in the value of the dollar. However, moments later, the initial movements were erased. Investors are pricing in the chances of a cut in September and less than a cut in December this year. Following the release of the reports, the chances of interest rate cuts in the US have increased.

Today's market rises are mainly driven by the largest companies, as can be seen very well in the graphic presented above. Source: xStation 5

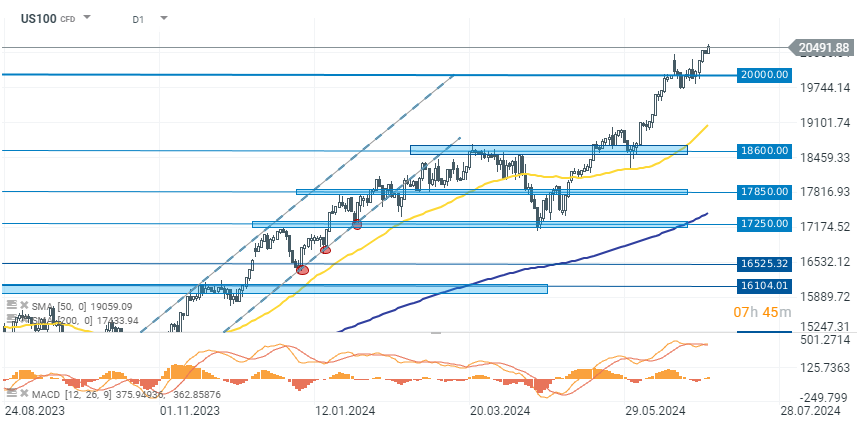

US100

The technology companies index (US100) is back on the rise after a brief consolidation at the 20000 point level. The US100 is today gaining 0.70% above 20500 points. The increases are mainly driven by the largest companies, including Amazon, Google and Meta Platforms.

Source: xStation 5

Company news

Macy (M.US) gains over 9% after an investor group, including Arkhouse Management and Brigade Capital Management, raised their takeover bid to $24.80 per share, valuing the company at approximately $6.9 billion. This new offer follows earlier rejections of $24 per share in March and $21 per share in December.

Crypto-related stocks are experiencing panic sellof as Bitcoin's price continued to drop for the fourth day in a row, decreasing nearly 6% to $54,300 ahead of a $9 billion payout to users of the defunct Mt. Gox exchange. The decline in Bitcoin is also affecting other cryptocurrencies like Ethereum, which fell about 10%, and related stocks such as Riot Platforms (RIOT.US), MicroStrategy (MSTR.US), CleanSpark (CLSK.US), Coinbase (COIN.US) and Marathon Digital (MARA.US).

Cleanspark stock price, source: xStation 5

Cleanspark stock price, source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.