- Wall Street indices launch trading little change

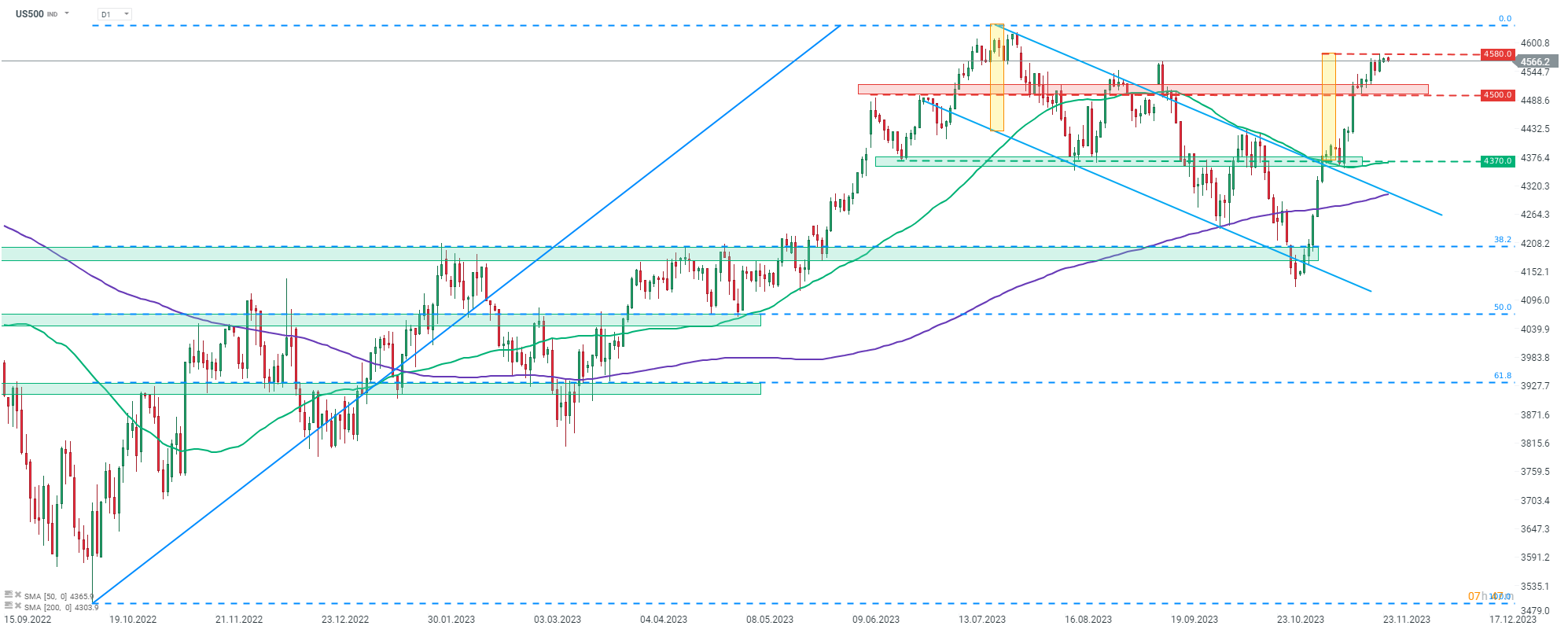

- US500 reaches textbook range of a breakout from channel

- iRobot surges on Reuters report

Wall Street indices launched today's trading little changed - Dow Jones gained 0.1% at the opening, S&P 500 traded flat while Nasdaq and Russell 2000 were down 0.1-0.2%. However, small-cap Russell 2000 managed to recover from the drop later on and is now trading 0.6% higher on the day. Meanwhile, the other three Wall Street indices are trading more or less where they were at cash session launch.

Source: xStation5

Source: xStation5

S&P 500 futures (US500) are trading little changed on the day. Taking a look at US500 chart at D1 interval, we can see that the ongoing upward move slowed after price reached 4,580 pts area, marked with the textbook range of the upside breakout from the bearish channel. Given how quick and steep recent gains were, a correction cannot be ruled out. In case we see index start pulling back, the first near-term support zone to watch can be found in the 4,500 pts area.

Company News

Nvidia (NVDA.US) is trading slightly lower today. Drop comes after media reported that the company is facing delays in launch of its custom AI chip for Chinese customers. Reuters reported that the most powerful of three chips Nvidia is designing for a Chinese customer may have its launch delayed until first quarter of 2024.

Fisker (FSR.US) launched today's trading with a bullish price gap. Company filed a delayed Q3 2023 earnings report. Company said that some of the expenses in its preliminary quarter report were incorrectly recorded, and it has resulted in a net loss that was $4 million higher than in preliminary results. Fisker said that there is no substantial doubt about company's ability to operate as a going concern.

Shares of iRobot (IRBT.US), US household appliance company, are surging today. Reuters reported that Amazon (AMZN.US) is set to win unconditional antitrust approval for the iRobot acquisition from the European Union.

iRobot (IRBT.US) is surging after Reuters reported that EU is likely to greenlight company's acquisition by Amazon. A near-term resistance zone can be found in the $39.50 area. Source: xStation5

iRobot (IRBT.US) is surging after Reuters reported that EU is likely to greenlight company's acquisition by Amazon. A near-term resistance zone can be found in the $39.50 area. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.