Sentiments on Wall Street are very calm ahead of the US stock market open, ahead of the Fed decision which we will (as well as the economic projections) learn at 7 PM GMT; Fed chair Powell will speak at 8 PM GMT. Futures on S&P 500 (US500) gain only 0.1% while US100 is slightly down. Nvidia shares are rising slightly boosted by the news about potential large orders from ByteDance and Alibaba, after the US president Trump approved AI H200 chip export to China. On the macro side, US employment costs came in slightly lower than expected.

- Employment Costs Index - Q3 2025: Cost Index QoQ: 0,8% (Expected 0,9%; Previous 0,9%)

- Employment Wages QoQ: 0,8% (Previous: 1%)

Costs of employment grew less than expected in third quarter. Decrease of dynamic from 0,9% to 0,8%. It maintains a long trend of steadily decreasing dynamic of cost of labor growth in US, which started in mid 2022. This data is yet another indicator that the labor market in US might already be tighter than most think, although not severely so. Labor market pressure will support FOMC members striving for faster/deeper rate cuts, although data reading surprise was minimal; therefore, market reaction remains alike.

- US average home prices to rise 1.5% in 2025, 1.4% in 2026 vs 2.1% and 1.3% seen in September - Poll.

Source: xStation5

Company news

- Braze, a customer engagement platform operator, surged more than 15% in premarket trading after delivering a stronger-than-expected third-quarter update. The customer engagement software provider posted $191 million in revenue, beating the $184 million consensus estimate tracked by LSEG. Adjusted earnings landed at $0.06 per share, matching expectations, but the clear top-line momentum drove the rally.

- AeroVironment shares came under pressure, falling over 4%, after the drone manufacturer reported a significant earnings shortfall. The company posted $0.44 per share in fiscal second-quarter profit, well below the $0.78 expected by analysts. The miss overshadowed otherwise steady operational commentary.

- GameStop slipped about 6% after releasing third-quarter results that highlighted ongoing revenue softness. The retailer reported $0.24 in adjusted EPS on $821 million in revenue, falling short of at least one analyst expectation of $900 million+. The figures underscore the company’s continued struggle to stabilize its core business despite cost-cutting measures.

- Blue Owl Capital gained roughly 3% after Raymond James upgraded the stock to Strong Buy from Market Perform. Analyst Wilma Burdis noted that redemption risks appear “manageable,” adding that the firm is positioned to meet withdrawal requests—removing a key overhang that has weighed on sentiment.

- Cracker Barrel saw its shares drop roughly 9% in after-hours trading following a weaker-than-anticipated first-quarter revenue print. The company generated $797.2 million, slightly below the $800.3 million expected by analysts surveyed by FactSet. Despite the revenue miss, Cracker Barrel reported a narrower adjusted loss than feared.

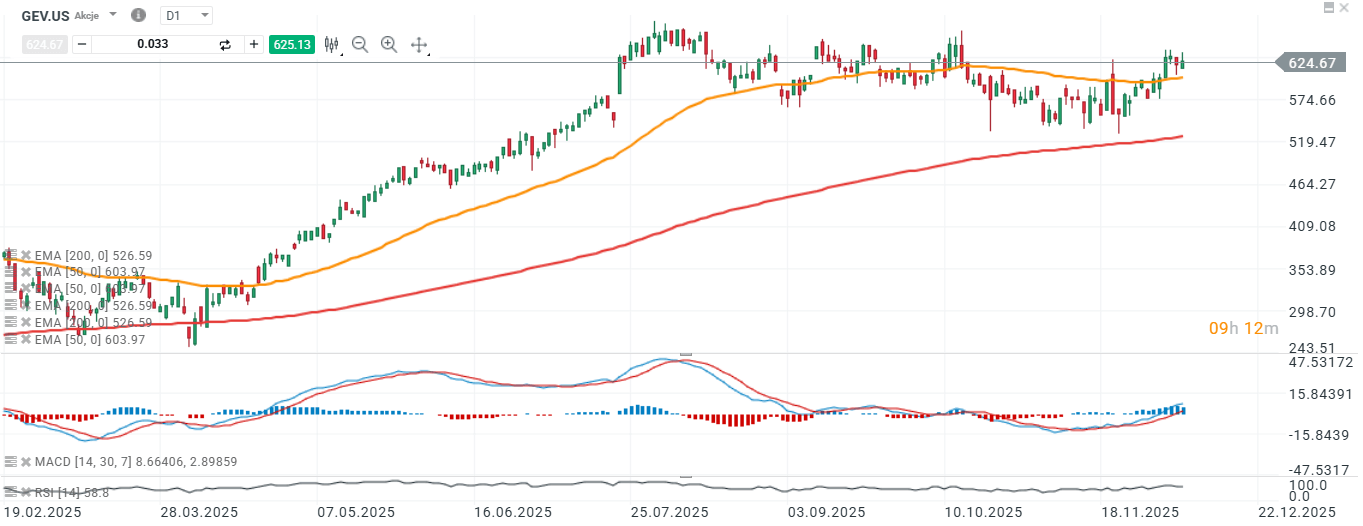

- GE Vernova surged as the energy giant saw jumped 8% after it said 2025 revenue was trending toward the higher end of its guidance. The company also doubled its quarterly dividend to 50 cents per share from 25 cents per share.

Source: xStation5

Source: xStation5

Fed Preview

The Fed is widely expected to deliver a 25 bp rate cut, its third consecutive move; Expect dovish messaging, but a hawkish-leaning dot plot that could limit the initial rally. Balance sheet hints (Treasury bill buying) are quietly supportive for liquidity and risk assets. The real market driver won’t be the cut itself, but how dovish Powell sounds and how divided the committee appears. Weak Beige Book and ADP payrolls data give Powell room to justify easing. At the press conference, expect him to:

-

Emphasize softening labor conditions

-

Point to limited inflation pressure

-

Acknowledge that some officials still oppose further cuts

This blend — dovish message but acknowledging hawks — is key for risk sentiment.

A Split FOMC: Visible & ‘Silent’ Dissents

-

One expected open dissent (Kansas City’s Schmid, favoring no cut).

-

Up to five policymakers may quietly signal they didn’t want to cut via the dot plot.

This “hawkish minority vs. dovish Powell coalition” dynamic will shape the market interpretation of the path ahead.

Updated Dot Plot: Not as Dovish as Markets Want?

The Fed is likely to stick to:

-

75 bps of cuts in 2025

-

Only one 25 bp cut in 2026

-

Another 25 bp cut in 2027

Markets currently price far more easing. Any gap between Fed dots and market pricing is a volatility trigger, particularly for:

-

US rates (2Y, 5Y)

-

USD crosses

-

Duration-sensitive equities (tech, growth)

5. Inflation Outlook Improves & Labor Market Softens: A Dovish Input

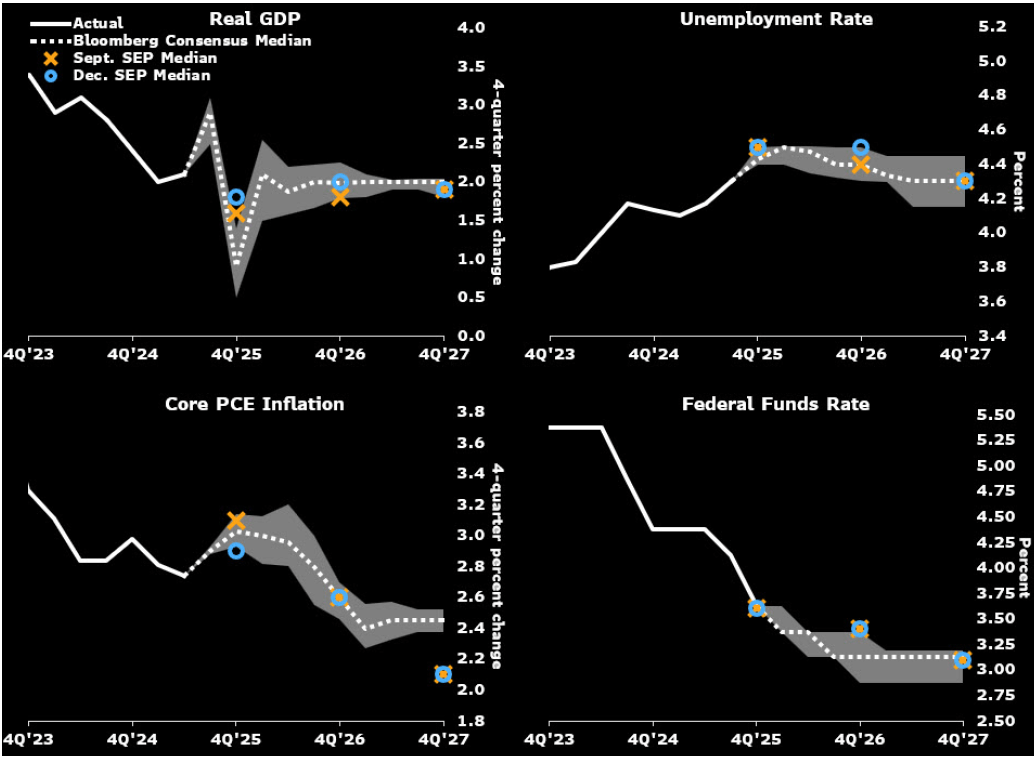

Core PCE for 2025 likely revised down to 2.9% (from 3.1%). Lower inflation + rising unemployment expectations = a more defensible easing path.

Unemployment projections for 2026 move slightly higher, and the statement will highlight:

-

Jobless rate drifting above trend

-

Clear softening in labor indicators

This shift toward employment-risk management reinforces the dovish narrative.

Balance Sheet Policy: Quiet But Important

Starting January 2026, the Fed is likely to:

-

Begin Treasury bill purchases (~$10–15B/month)

-

Aim to keep reserves “ample” as they are now verging on “scarce”

This is essentially a slow pivot away from QT, supportive for:

-

Liquidity conditions

-

Money markets

-

Risk assets more broadly

This is a sleeper bullish factor for equities and credit.

FOMC Statement: Minimal Changes (But with a Softer Inflation Line)

Key phrasing likely changes to:

-

Inflation “remains somewhat elevated”, dropping the earlier “has moved up”

-

Acknowledgment of a softening labor market

-

Continued emphasis that downside risks to employment have grown — the core justification for easing

Markets should read this as incrementally more dovish.

Powell’s Consensus-Building Will Matter for Market Reaction

Even though Powell may be in the minority of those wanting to cut again next year, weak incoming data strengthens his hand.nIf Powell manages to project unity despite hawkish pockets inside the Fed, markets will interpret:

- Lower-for-longer rates are still on the table

- If the division feels too sharp: Short-end yields may spike, USD may rebound

-

The 25 bp cut is priced in — the tone drives the reaction.

Projected stronger growth and falling inflation may still support sentiments on Wall Street.

Source: Bloomberg Finance L.P

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.