Thursday started in euphoric moods on indices but ended with a panic sell-off, triggered by US tech stocks. While there was no obvious single reason, it all started with Tesla. The company first announced share sale and then we learned that a major shareholder reduced his stake – a sign that valuation could be simply too high.

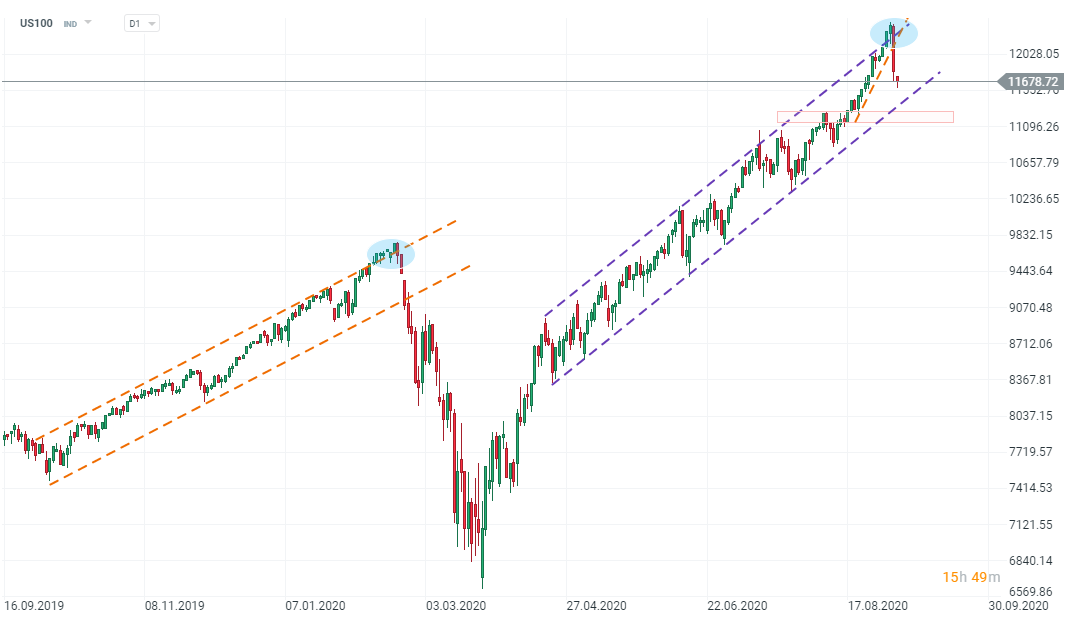

Valuation concerns are present for the whole tech sector and little wonder US100 was the biggest sell-off victim among indices. What’s next? The index is still very high and within a very steep upwards channel. A lower limit of this channel runs around 11450 points while a previous local high is around 11265 – these are support level to watch.

However, when the index made an attempt to break higher from a similar channel in February it eventually ended in a massive sell-off. This situation looks similar but obviously back in February pandemic was the main reason.

However, when the index made an attempt to break higher from a similar channel in February it eventually ended in a massive sell-off. This situation looks similar but obviously back in February pandemic was the main reason.

Traders will receive one more crucial piece of information today – the NFP report from the US (1:30pm BST). We will comment the release in the “News” section for you.

Daily summary: Wall Street, precious metals and EURUSD surge📈Bitcoin under pressure

US Open: Rebound attempt on Wall Street 📈Meta Platforms surges 3.5%

VIX sell-off deepens amid rebound on Wall Street 📉

Economic calendar: Key U.S. data to shift focus from geopolitics (22.01.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.