The US100 is poised to recover recent losses, fueled by Nvidia's 2.6% premarket surge following CEO Jensen Huang's ambitious AI technology announcements at CES 2024. The chipmaker's latest innovations in gaming, robotics, and personal computing are reinforcing its dominant position in the AI ecosystem.

Key Market Moves:

-

Nvidia trading at $153.4 premarket, extending 2024 momentum

-

US100 futures erases premarket decline

-

Heavy trading volume expected as investors digest CES announcements

-

Market sentiment boosted by Microsoft's $80B AI infrastructure commitment

Groundbreaking AI Developments

Nvidia unveiled several major initiatives at CES, including Project Digits, a $3,000 personal AI supercomputer powered by the new GB10 Grace Blackwell Superchip. The desktop system, launching in May, promises to democratize AI development by bringing data center-grade computing power to individual developers and researchers.

Strategic Partnerships Expand

The company announced significant partnerships in the automotive sector, with Toyota adopting Nvidia's DRIVE AGX Orin chips and DriveOS operating system for its next-generation vehicles. Additional collaborations with Continental and Aurora aim to bring autonomous trucks to roads by 2027, targeting what Huang describes as "the first multi-trillion-dollar robotics industry."

Analyst Reception

Wall Street firms remain overwhelmingly bullish on Nvidia's prospects:

-

Stifel maintains Buy rating with $180 price target, highlighting "multi-billion dollar advancements"

-

Wedbush emerges "even more bullish" after CES announcements

-

KeyBanc Capital Markets (overweight, $180 PT) emphasizes Blackwell chip production progress

Looking Ahead

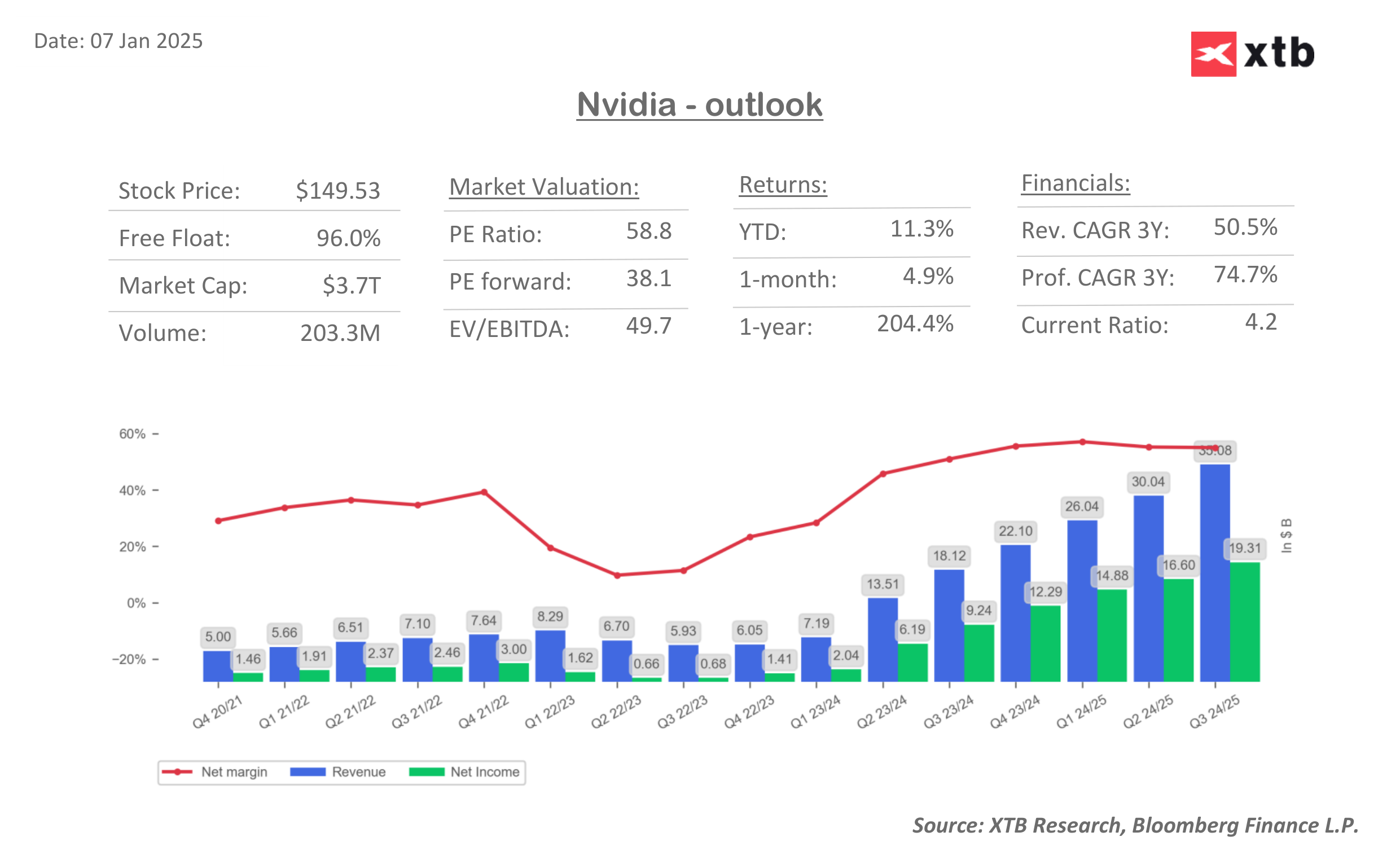

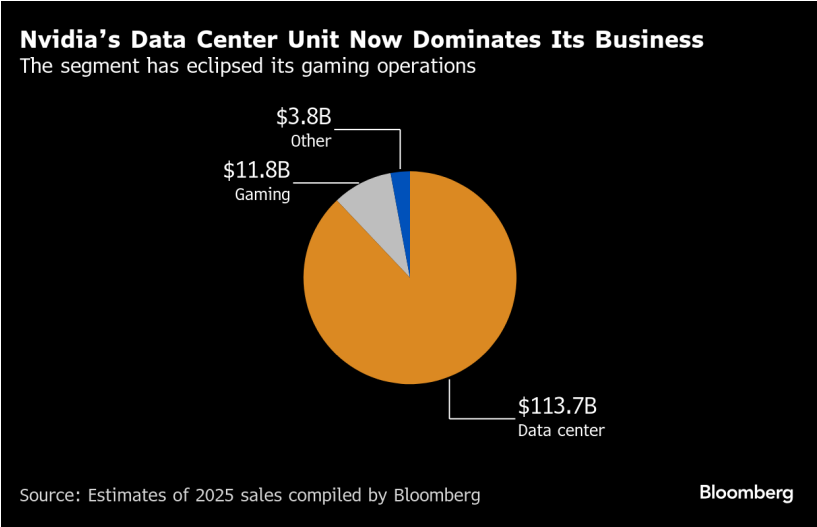

The focus now shifts to whether Nvidia's latest innovations can maintain the company's remarkable growth trajectory, with its stock up 204% over the past 12 months. The expansion into robotics, autonomous vehicles, and personal AI computing suggests multiple new revenue streams beyond its core data center business, which currently generates the bulk of its $35.1 billion annual revenue.

2025 Sales Estimates. Source: Bloomberg

Investors are particularly watching for details about the next-generation Blackwell platform, expected to be fully unveiled at Nvidia's GTC conference in March, which could provide another catalyst for both the stock and broader tech sector.

US100 (D1 Interval)

The Nasdaq-100 index, represented by the US100 contract, is trading above the early December high of 21,668. This level serves as support for bulls and coincides with 23.6% Fibonacci retracement level.

For bears, key downside targets include the 38.2% Fibonacci retracement level, followed by the mid-November high at 21,255 and 50-day SMA at 21,179.

The RSI is started bullish divergence from key support level that has historically acted as a retracement zone, potentially signaling a pause or reversal in the current trend. Meanwhile, the MACD continues to narrow with potential bullish crossover. Source: xStation

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.