- US stock market sentiments are mixed today; US500 and US100 fluctuate around all-time highs

- US CPI in line with expectations; Fed Logan sees a cautious rate cuts in the future; actual Fed Fund Rate one step closer to neutral

- Fed Kashkarki sees a softer labour market conditions with Fed in a good position to support growth if needed

- 10-year treasury yields 'sticky' at 4.43% today; US dollar gains; Bitcoin-related stocks Coinbase and Microstrategy little changed despite Bitcoin surge above $92k

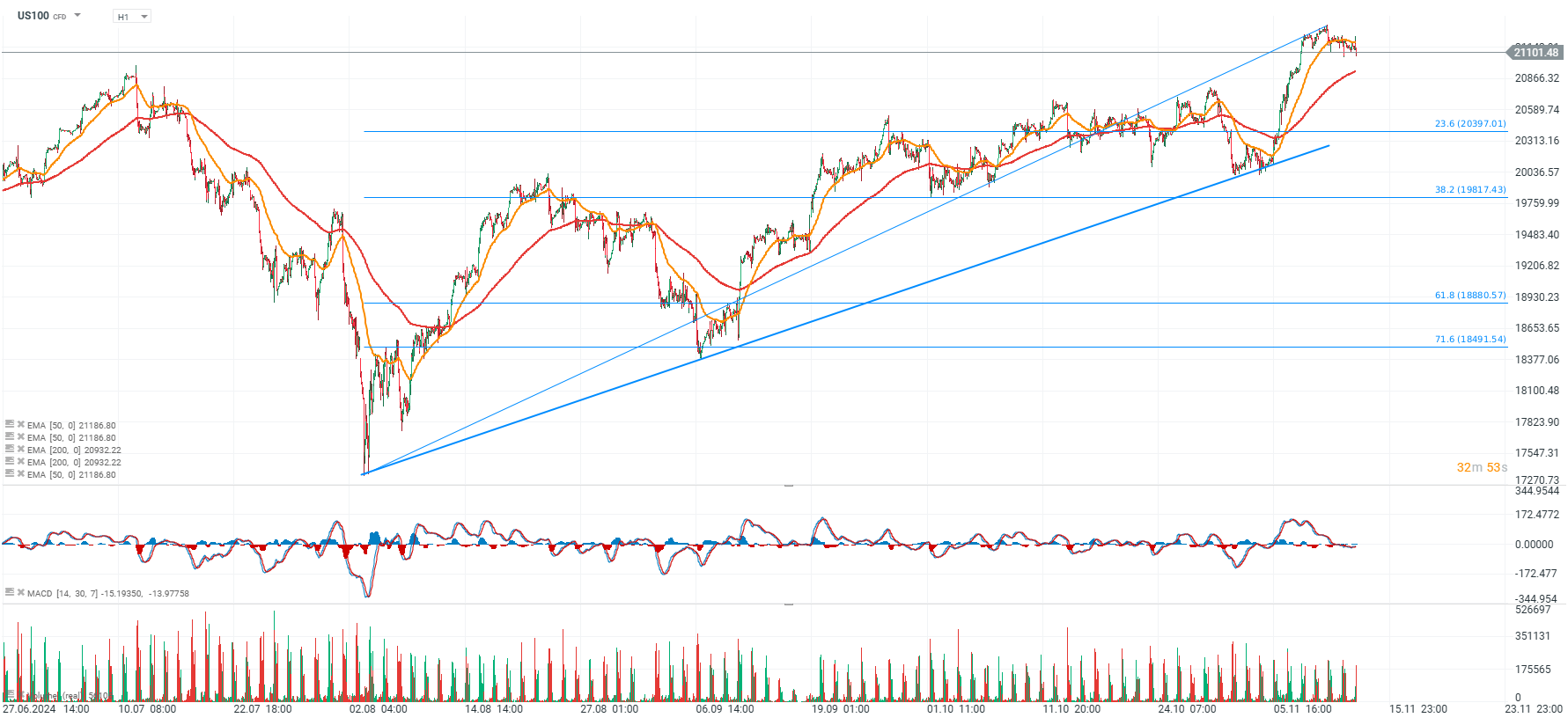

US100 (D1 interval)

Source: xStation5

Source: xStation5

Overall sentiments on US stock market session today are mixed. Source: xStation5

US stock market news

- Amgen (AMGN.US) rises 4% after the drugmaker says its phase 1 study results on MariTide don’t suggest bone safety concern and don’t change its conviction.

- Coty (COTY.US) declines 2% after the beauty company was downgraded to hold from buy at TD Cowen, which noted limited near-term catalysts.

- CyberArk Software (CYBR.US) is up 7%, after the security software company reported third-quarter results that beat expectations and raised its full-year forecast.

- MARA Holdings (MARA.US) slips 4% after the Bitcoin mining company reported third-quarter revenue that missed expectations.

- Spire Global (SPIR.US) soars 27% after the space-based data and analytics company agreed to a sell its maritime business to Kpler for about $241 million. We can see also soaring today shares of Momentus (MTUS.US) and RocketLab (RKLAB.US)

- Cava Group (CAVA.US) jumps 17% after the Mediterranean restaurant chain increased its annual projections for comparable sales.

- The biggest US-based lithium miner and EV supplier, Albemarle (ALB.US) surges 7%, continuing the rebound as big lithium miner Liontown plans production cuts, potentially benefiting

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.