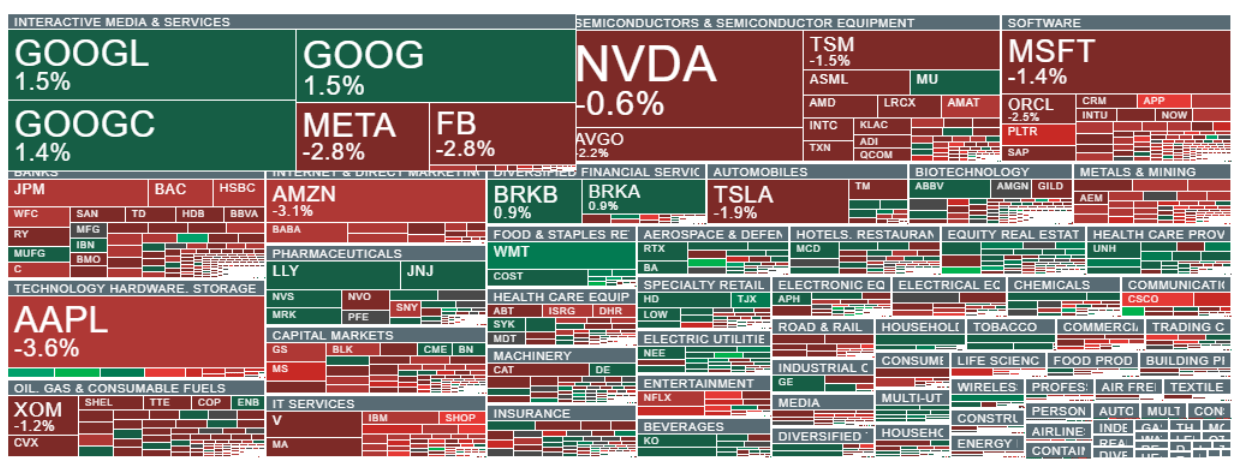

The mixed open in US indices has turned into a broader sell-off, with Nasdaq 100 (US100) futures down nearly 1.5%. While there is no single clear catalyst behind the move, several factors stand out.

- First, Google (GOOGL.US) is expected to release an updated Gemini 3 Deep Think model (Alphabet is also the only “Big Tech” name not falling today). A potential “success” of the release may amplify what markets have dubbed the “Anthropic effect”—a narrative that in recent days has driven selling across parts of the tech complex, particularly software. The market appears to be shifting from “what good can AI do for companies?” to “which companies can AI realistically disrupt?”, and price action suggests a “sell first, ask questions later” phase—especially across IT and SaaS-style business models.

- Second, Cisco delivered guidance for the current fiscal year that came in below expectations, overshadowing a solid quarter and partially undermining the idea that hardware names are automatic AI winners regardless of valuation. The move has also pressured peers, with Arista Networks (ANET.US) pulling back ahead of its quarterly report due after the US close today.

- Third, the latest US labor-market data have eased recession and slowdown fears, but at the same time they may reduce any urgency for rate cuts—potentially pushing the first meaningful easing window out to at least May. That is not necessarily supportive for Wall Street, which not long ago was positioned for a relatively aggressive easing cycle this year.

Finally, Goldman Sachs data published over the weekend suggested that CTA funds (systematic, trend-following strategies) are likely to be net sellers of US equities this week in virtually all scenarios (regardless of whether the S&P 500 rises or falls). In a continued downside scenario, their selling could accelerate further, adding a mechanical flow-driven headwind.

US100 (D1)

US100 has recently found support around the 200-day EMA. A renewed move toward 24,350 could point to a deeper correction and greater selling pressure. The 24,850 area remains a key support zone, defined by two prior price reactions—one in early December 2025 and the latest in early February 2026.

Source: xStation5

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.