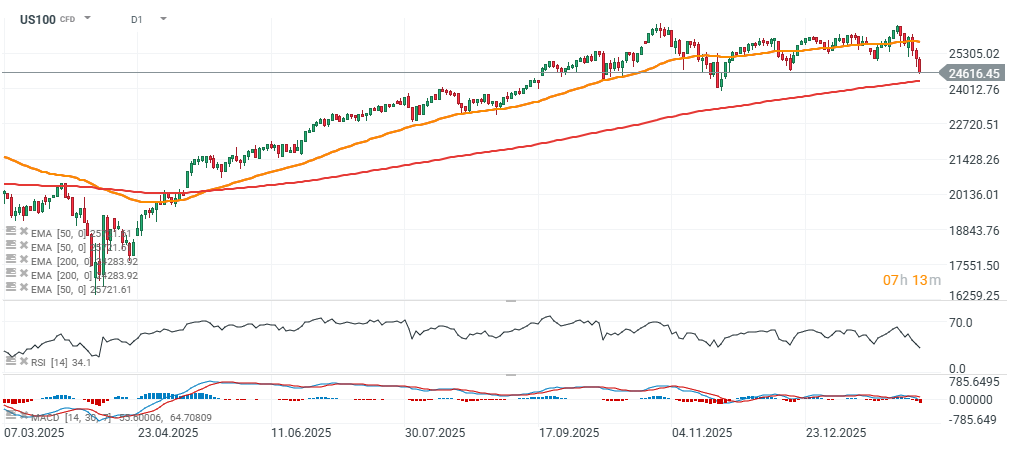

Nasdaq 100 (US100) futures are extending the early-week sell-off and are down more than 2% today. Weak sentiment in the technology sector has been further intensified by weaker-than-expected labor market data. Jobless claims rose more than forecast, while Challenger-reported layoffs surged by over 200% year-on-year in January. As a result, US100 is now trading only about 300 points above the 200-session exponential moving average (EMA200), marked by the red line. Cash indices are also under pressure: the DJIA and S&P 500 are down around 1.2%, while the small- and mid-cap Russell 2000 is down more than 1.3%.

Key US labor-market figures

• Initial jobless claims: 231k vs 212k expected and 209k prior week

• JOLTS (December): 6.54m vs 7.25m expected and 7.14m prior

• Challenger (January): 108.4k vs 35.5k in December

US100 (D1 timeframe)

The daily RSI for Nasdaq 100 futures is falling to around 34 today, a level not seen since the autumn correction. The EMA50 is located near 25,700 points.

Source: xStation5

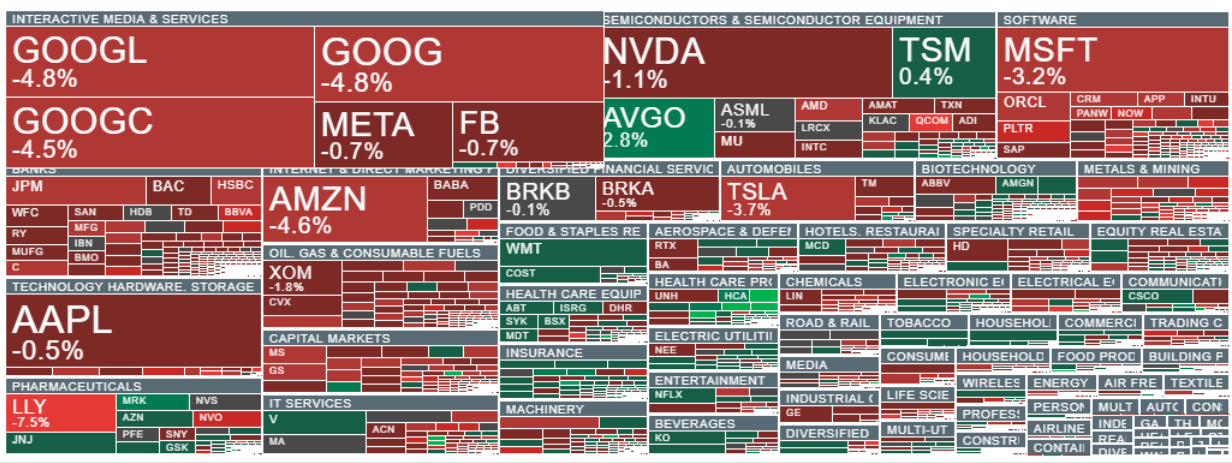

Negative sentiment in the software space has now spread across the broader tech sector, and the pullback is visible across almost all sub-sectors. Semiconductors are also declining, with Broadcom (AVGO.US) and TSMC (TSM.US) standing out as the only notable gainers. Heavy losses are seen in major names: Amazon and Alphabet (down nearly 5%), Microsoft (down more than 3%), and Tesla (down nearly 4%). Sentiment is also weak in financials and banking, where concerns over loan exposure to the software sector and a broader deterioration in market mood have triggered profit-taking. Recent gains are reversing in obesity drug maker Eli Lilly (LLY.US) as well, with the stock down more than 7%.

Source: xStation5

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

PayPal shares slide 5% as Semafor denies Stripe acquisition rumors📉

US dollar strengthens, pressuring EUR/USD, silver and Bitcoin 📉

Oil surges almost 2% amid US - Iran tensions 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.