Gains following the Fed’s decision evaporated quickly as disappointing results from Oracle (ORCL.US) soured sentiment and hit technology stocks hard. Investors shifted their focus away from the prospect of further rate cuts and back toward tech-sector fundamentals, where concerns are resurfacing about stretched valuations, excessive spending on AI infrastructure, and slow returns on invested capital. AI-linked stocks came under pressure after Oracle’s earnings release: Nvidia and AMD slipped about 1%, while CoreWeave dropped nearly 4%.

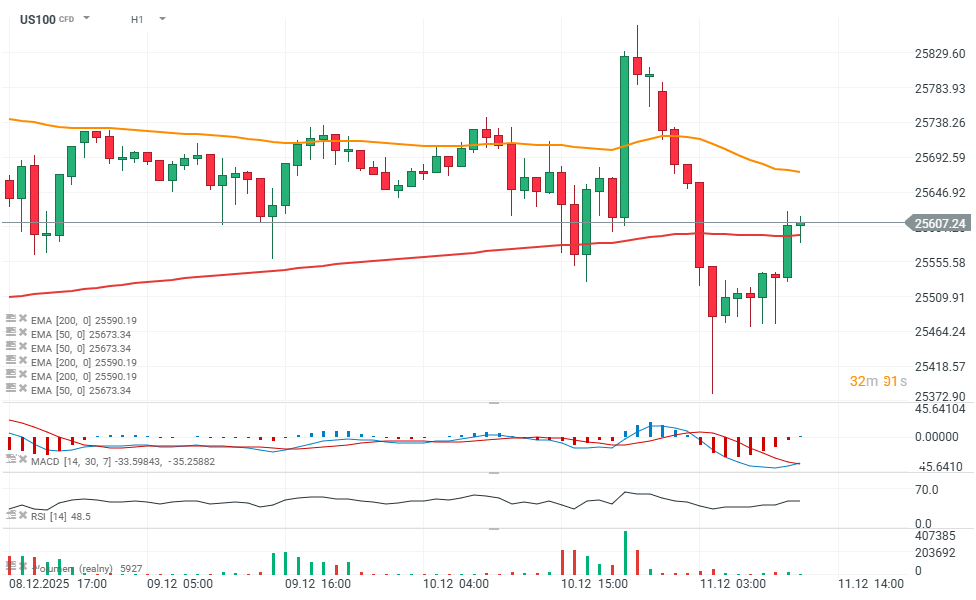

- Nasdaq 100 (US100) futures fell more than 1.5% at the day’s low, dragging Asian tech stocks lower. Currently, the US100 is down roughly 0.8%, while the US500 is retreating by 0.6%. In Asia, shares of SoftBank strongly tied to OpenAI sank more than 8% in Tokyo.

- Oracle shares plunged over 10% in after-hours trading after second fiscal quarter revenue fell well short of market expectations. The weakness is particularly painful given Oracle’s positioning in the AI boom and growing concerns about inflated valuations across the sector.

- The company revealed a surge in spending on AI data centers and hardware infrastructure, but results suggest that monetization is progressing more slowly than investors hoped. The imbalance between rising costs and slower revenue growth is raising fresh concerns.

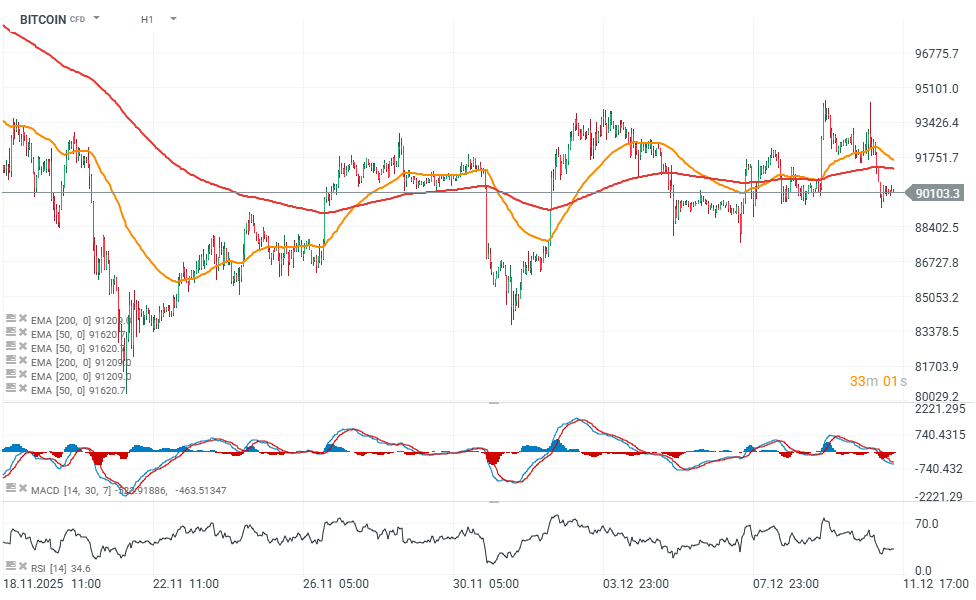

- Bitcoin is down more than 2.5% today, erasing its post-Fed jump from $94,000 back toward $90,000 — a clear sign of risk aversion returning to the market.

The US100 is attempting to stabilize after the sell-off and has moved back above the 200-hour EMA. Despite late-autumn volatility, the Nasdaq 100 is still up nearly 22% this year, while the MSCI Global Equity Index remains more than 20% higher year-to-date, on track for its best annual performance since 2019.

Source: xStation5

Bitcoin erased Fed-related gains almost instantly as US futures rolled over.

Source: xStation5

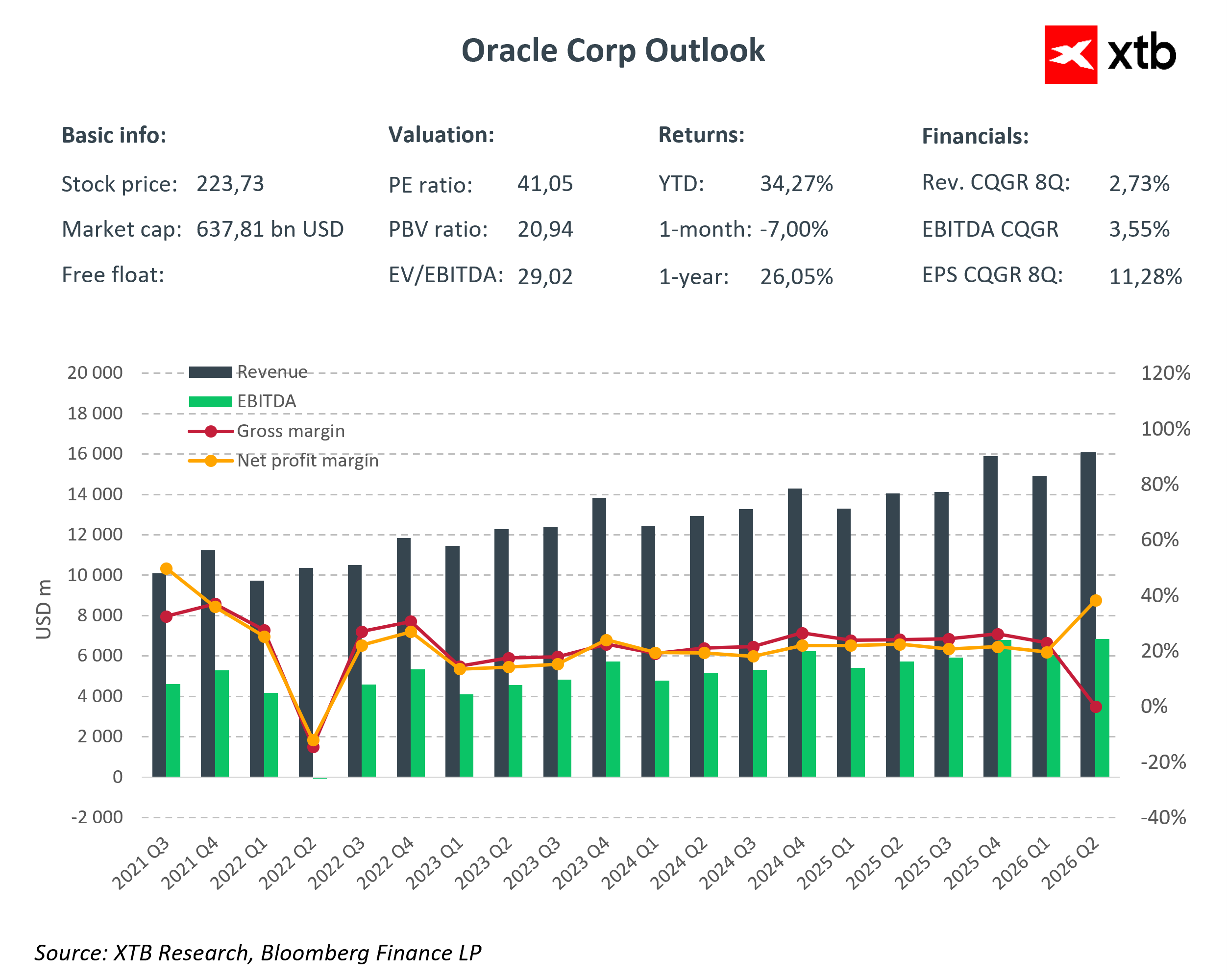

Oracle worries Wall Street - but should it?

Instead of calming markets, Oracle’s quarterly report reignited debate over whether AI-infrastructure spending has gone too far. Is the concern justified? Recall that in September, Oracle secured a high-profile five-year, $300 billion compute-capacity contract with OpenAI, sending the stock sharply higher in a single session. Following that announcement, Larry Ellison briefly became the richest person in the world. Over the past six months, the company signed around $385 billion in additional contracts, including with Nvidia and Meta Platforms yet optimism around the stock is fading.

- In the latest quarter, Oracle delivered earnings of $2.26 per share, far above the $1.64 forecast, but quarterly revenue came in at $16.06 billion, missing expectations of $16.2 billion. Despite the disappointment, Oracle still posted 14% revenue growth and a remarkable 68% jump in Oracle Cloud Infrastructure (OCI) sales to $4.1 billion, while total cloud revenue reached $7.98 billion (vs. $7.92 billion expected). Still, that wasn’t enough to satisfy Wall Street.

- Net income rose to $6.14 billion from $3.15 billion a year earlier. Software revenue fell 3% to $5.88 billion, below the expected $6.06 billion. Despite higher net income, free cash flow in the November quarter was a negative $10 billion — far worse than the projected -$5.2 billion.

- For the next quarter, the company expects earnings of $1.70–1.74 per share and revenue growth of 19–21% year-over-year. The consensus stood at $1.72 per share and $16.87 billion in revenue, implying around 19% growth. Oracle also raised its planned annual CAPEX by $15 billion to $50 billion — a 40% increase — compared with $21 billion in the previous fiscal year.

- Signed but not yet recognized revenue surged to $528 billion, an astonishing 438% increase year-over-year and a notable jump from $455 billion last quarter. The pipeline is enormous and still expanding, and Oracle expects an additional $4 billion in revenue in fiscal 2027.

- OpenAI has committed to spending more than $300 billion on Oracle’s infrastructure over five years, a cornerstone of Oracle’s position in the AI ecosystem. The challenge for markets is that this aggressive build-out of data centers and AI infrastructure has boosted orders — but also significantly increased the company’s debt burden.

- Oracle insists it will maintain its investment-grade credit rating and says part of the financing will come from customers supplying their own chips for installation in Oracle’s data centers, as well as suppliers offering chips under leasing arrangements. New commitments lifted projected annual capital expenditures to around $50 billion (up from $35 billion estimated in September), compared with $21 billion last fiscal year.

- The company addressed analyst reports suggesting Oracle may need more than $100 billion to complete its infrastructure expansion. Oracle argues its real financing needs will be lower.

During the quarter, Oracle appointed Clay Magouyrk and Mike Sicilia as its new CEOs and introduced a suite of AI agents designed to automate finance, HR and sales processes. GAAP and adjusted earnings were boosted by a $2.7 billion pre-tax gain from the sale of its stake in chipmaker Ampere, which SoftBank agreed to acquire for $6.5 billion. Oracle explained that it sold Ampere because producing its own chips is no longer seen as strategically necessary. The company now aims to use whichever chips its customers prefer. Oracle shares fell 23% in November the stock’s worst monthly performance since 2001. The price remains roughly 30% below the September peak, though it is still up more than 30% year-to-date, outperforming the Nasdaq.

Source: xStation5

Source: XTB Research, Bloomberg Finance L.P.

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Market wrap: European and US stocks try to rebound rebound 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.