What looked like the beginning of a recovery rally, quickly turned out to be another dead cat bounce. In spite of US indices gaining slightly at the beginning of yesterday's Wall Street session, moods quickly deteriorated and US stocks took another hit. There are a few reasons that have contributed to the drop in equity markets

-

Continued pick-up in US yields and growing risk of Fed removing excess liquidity

-

Netflix (NFLX.US) plunged 20% in after-hours trading as Q4 2021 subscriber figures disappointed and forecast for Q1 2022 was seen as unambitious

-

Cryptocurrencies joined tech sell-off with Bitcoin dropping below $40,000

-

A large number of single stock option contracts expires today what may have forced dealers to hedge positions and in turn magnify recent moves in the markets

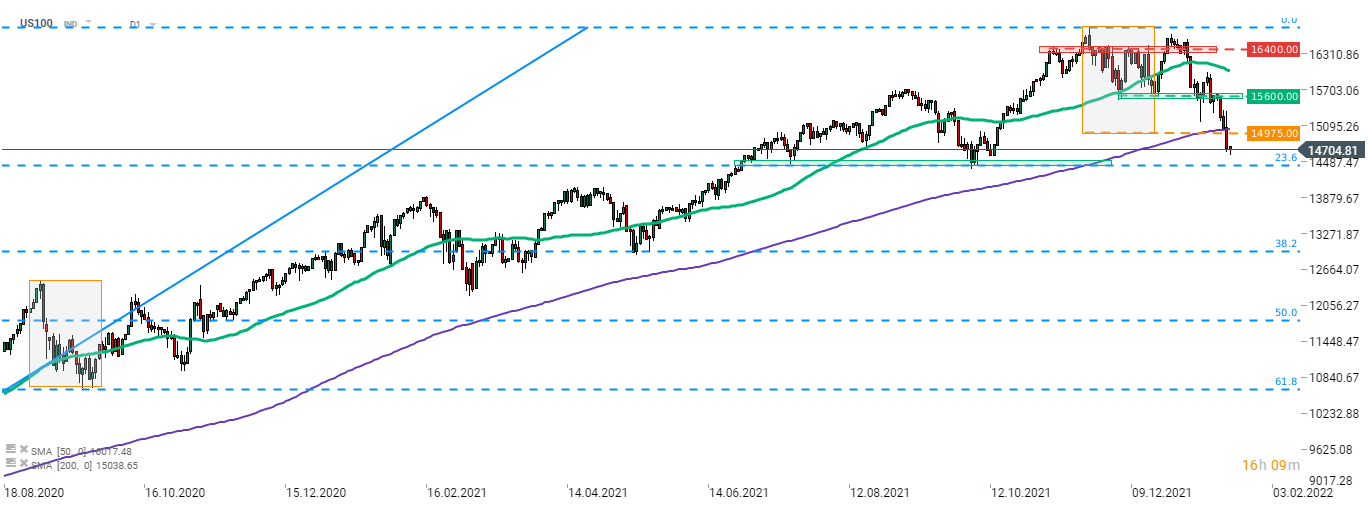

Taking a look at the Nasdaq-100 (US100) chart, we can see that the index plunged below the psychological 15,000 pts area and continues to move lower. Index broke below the lower limit of the Overbalance structure at 14,975 pts and 200-session moving average (purple line), signalling that more weakness may be ahead. The next support zone to watch can be found at the 23.6% retracement of the post-pandemic recovery move in the 14,420 pts area.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.