Futures on Nasdaq 100 (US100) 3 hours after stock market opening after yesterday holiday pause defended 20,000 points level, where we can see firs strong support zone after the rollover.

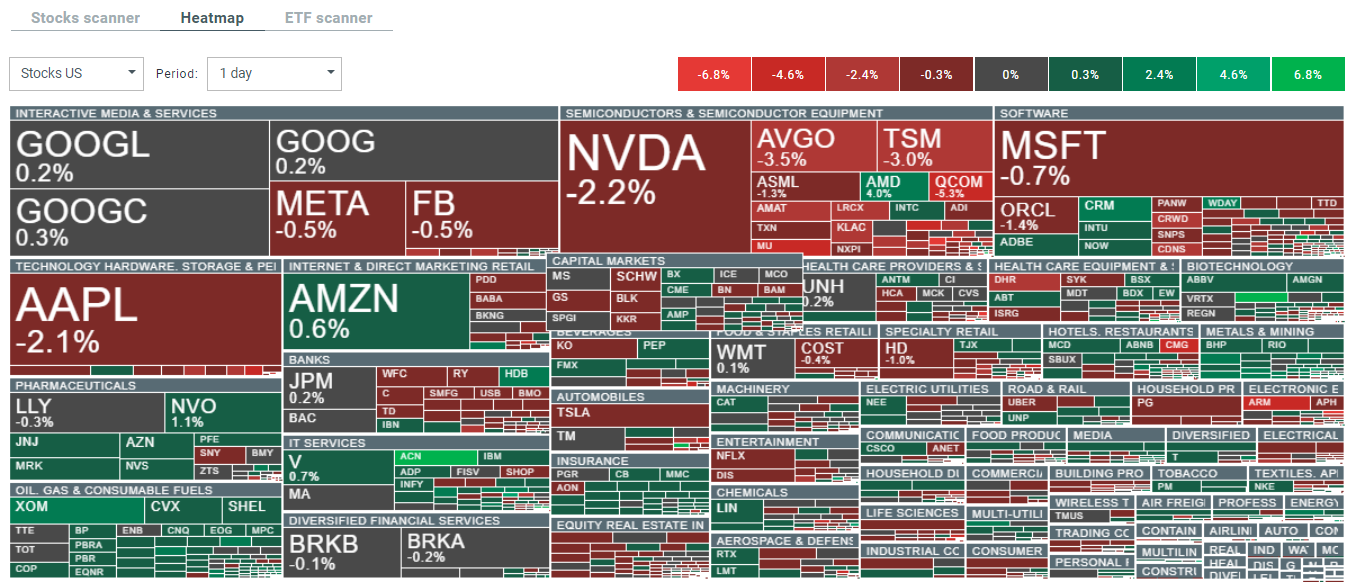

- We can see higher selling activity among AI (especially semiconductor stocks) with Nvidia (NVDA.US) erasing early almost 3% gains; now the stock of the biggest company in the world is losing more than 2%.

- Despite planning wafer price hike and higher recommendations from analysts (Bernstein) citing AI catalysts, we can see also TSMC (TSM.US) stock dropping by almost 3%. The possible reason of the decline is possibly profit realization, after US stock market reached record high.

- President Putin signing the agreement with North Korea said that 'Russia is thinking about possible changes to its nuclear doctrine' as NATO is moving to Asia, creating a security threat to the country. We can see higher selling, trading volume today on US100 contract.

US100 (M1)

Source: xStation5

Source: xStation5

What Bernstein sees for TSCM?

- Bernstein lifted price targets for TSMC’s to NT$1,080, from NT$900 (to $200 from $150 before, for US ADR-s). Now, analysts are expecting TSMC to surpass its 2024 guidance, driven by high-end phone demand and advanced technology wafers. The company's data center AI revenue is on the rise however, an unexpected boost has come from AI's influence on smartphone upgrades.

- Bernstein says that 3nm and 5nm production in company runs with full capacity and Q3 2024 revenue will beat guidance with revenues rising 25% YoY in 2024 and EPS rising 28% on yearly basis (and 26% increase in 2026, due to chipn-on-wafer-on-substrate (CoWoS) technology adoption and Intel's Lunar Lake as well as the price hikes for advanced AI chips.

- Bernstein suggested that TSMC with forward price-to-earnings (P/E) ratio of 20 times still trades with 25% discount to average forward P/E of companies from SOX semiconductors index, which is now a new 'record high' premium for TSMC 'peers' from the index - despite rapid growth in TSMC business, and earnings growth.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.