The beginning of the week on Wall Street is marked by a growing disparity between market segments. Nasdaq recorded gains thanks to strong demand for companies related to artificial intelligence. Amazon shares jumped 4% after announcing a partnership with OpenAI, and Nvidia and Micron Technology also gained value after a series of high-profile industry deals. At the same time, data center company Iren signed a multi-year $9.7 billion deal with Microsoft, giving the tech company access to Nvidia GB300 graphics processors. It is worth noting that technology companies benefit from high margins, global scale, and access to groundbreaking AI solutions, which continues to drive growth among a select group of leaders.

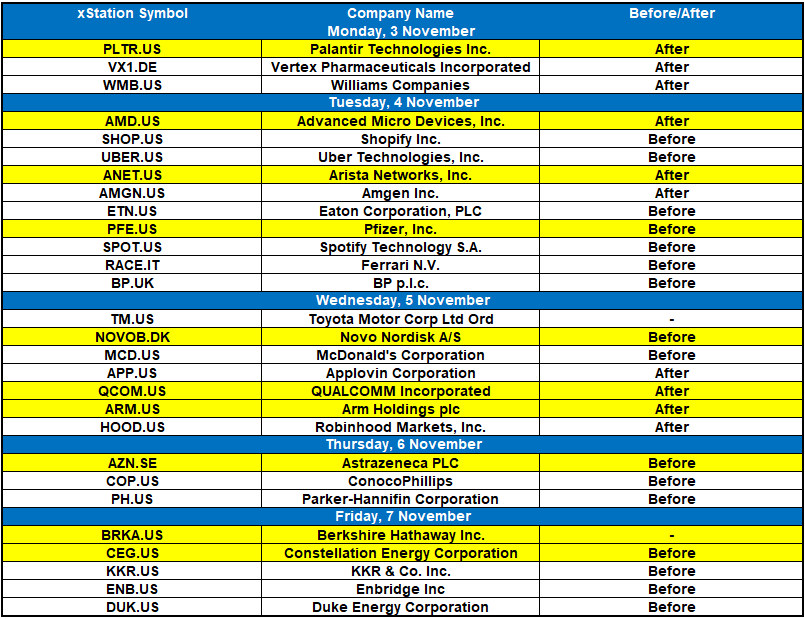

At the same time, broad market indices and industrial companies are lagging behind. Today, more than 400 companies in the S&P 500 are posting declines, and the Dow Jones index is already down nearly 0.8% in value. This deepens the trend of stratification, in which the performance and valuations of the entire market are increasingly dependent on a few technology giants. The poor performance of traditional companies, the high sensitivity of smaller companies to capital costs, and neutral consumer sentiment show that a possible correction in the AI group of companies could have a significant impact on the entire market. The results to be announced this week, including those of McDonald's and Palantir, will be a good opportunity to verify whether market sentiment reflects the real condition of the economy or continues to discount optimistic scenarios related to artificial intelligence.

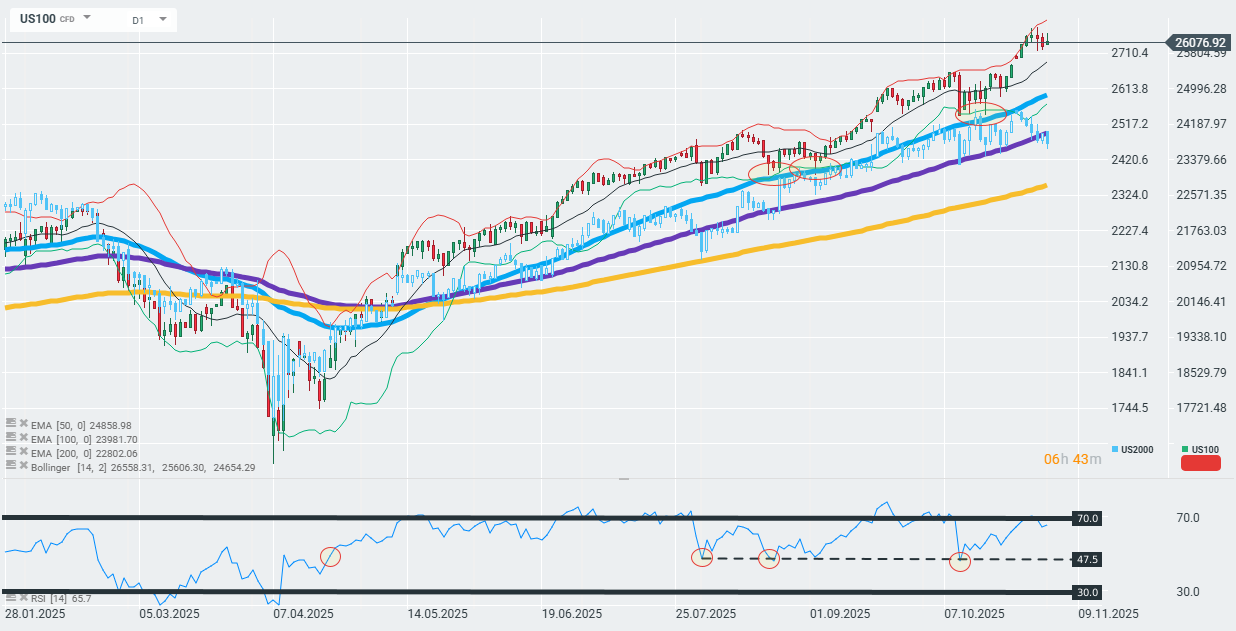

The US100 and US2000 have been following completely opposite paths for nearly two weeks. Importantly, however, both instruments remain above the 50-day EMA. Source: xStation

Company results scheduled for this week. Source: XTB

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.