NFP report for October is a key release of the day! Report will be released at 12:30 pm BST today and is expected to show a weaker jobs growth than in September. Data for September was very strong and while expectations for October are lower, they are still pointing to a decent growth in US employment. However, some worrying signs can be spotted in other US labor market reports.

ADP report released on Wednesday pointed to a lower-than-expected jobs increase of 113k (exp. 150k) while the employment subindex in the US services ISM report unexpectedly dropped below the 50 points threshold in October, signaling that employment in the sector is contracting. However, it should be noted that NFP reports have been constantly defying market concerns over the past months and kept beating expectations. Having said that, it cannot be ruled out that we will once again see solid jobs data today even as other labor market measures are flashing warning signs.

What market expects from the NFP report for October?

- Non-farm payrolls. Expected: 180k. Previous: 336k

- Private payrolls. Expected: 150k. Previous: 263k

- Unemployment rate. Expected: 3.8%. Previous: 3.8%

- Wage growth (monthly). Expected: 0.3% MoM. Previous: 0.2% MoM

- Wage growth (annual). Expected: 4.0% YoY. Previous: 4.2% YoY

Other US labor market data for October

- ADP report: 113k vs 150k expected (89k previously)

- Challenger report on lay-offs: 36.84k vs 47.46k previously

- Services ISM employment subindex: 46.8 vs 50.6 expected (51.2 previously)

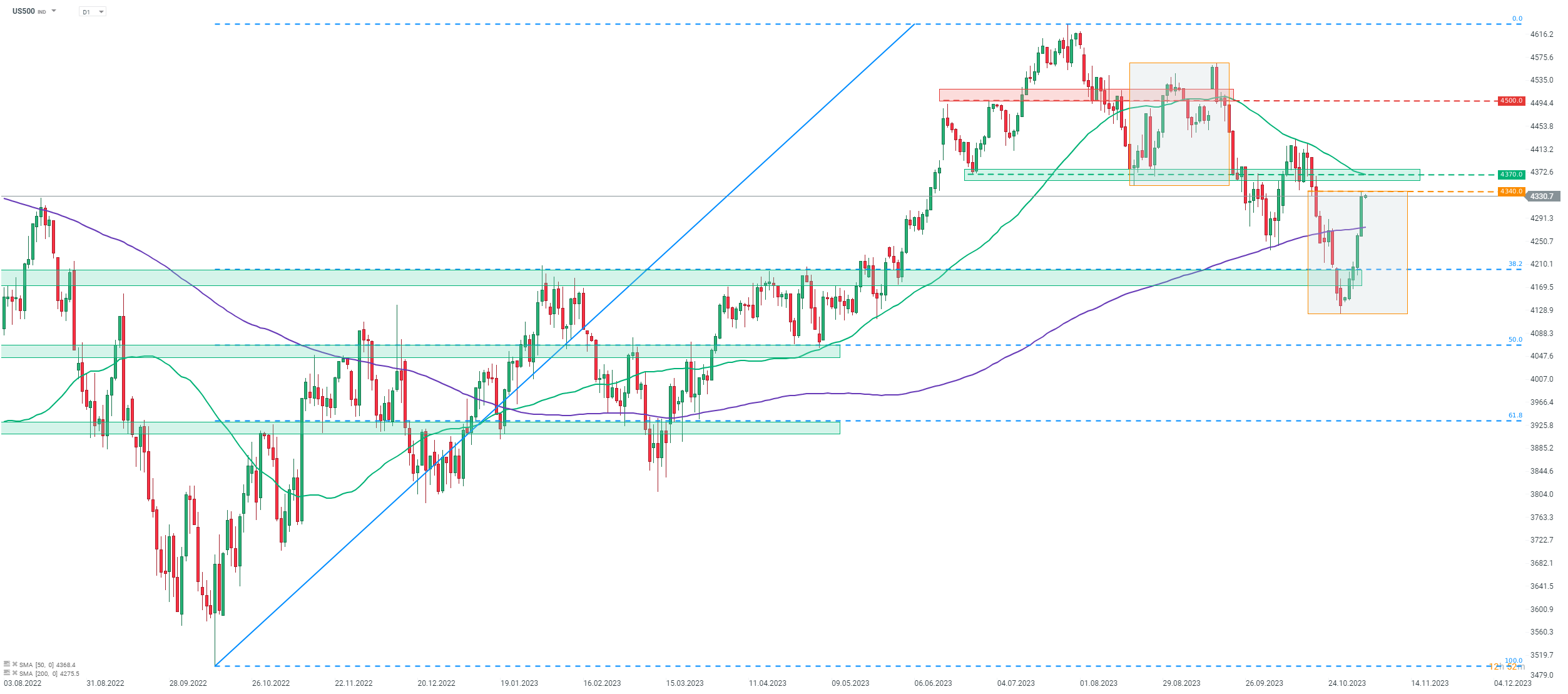

S&P 500 futures (US500) are trading in a strong upward move this week. The index is trading around 5% higher week-to-date and at the highest level in two weeks. Recovery rally has encountered the first major obstacle - the upper limit of the Overbalance structure in the 4,340 pts area. A break above would hint at trend reversing from bearish to bullish. However, the attempt at breaking above this area made yesterday failed to result in a breakout and whether the index 'makes it or breaks it' will likely depend on today's NFP data.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.