Recent weeks have seen a rapid reversal of sentiment and the short-term trend on the stock market. Over the past three weeks, the broad S&P 500 index has lost more than 5%, and the Nasdaq 100 has lost more than 7%.

- Although there is no single direct cause for this correction, and the US earnings season has been fairly solid, it seems that the main reasons remain: uncertainty about the state of the economy, in the absence of the latest data (government shutdown), high stock valuations, and the risk of excessive concentration of capital in a narrow group of selected companies' shares.

- Investors are beginning to price in less optimistic scenarios and are uncertain about the continued AI bull market, as we can see, for example, in the declines in CoreWeave (CRWV.US) and Japan's Softbank — perceived as the “most aggressive” players in the artificial intelligence infrastructure industry.

- Concerns about the impact of the government shutdown on the economy, weaker consumer sentiment, and a weakening labor market. One clear indication of such weakness is the recent results of Home Depot (HD.US), which is clearly warning of an economic downturn.

- In these circumstances, the FOMC has begun to signal in recent weeks that a rate cut in December is not as certain as it seemed to the market until recently. The chances of a rate cut in December have fallen from around 40% last week to 20% this week. Stock valuations reacted “allergically” to this scenario.

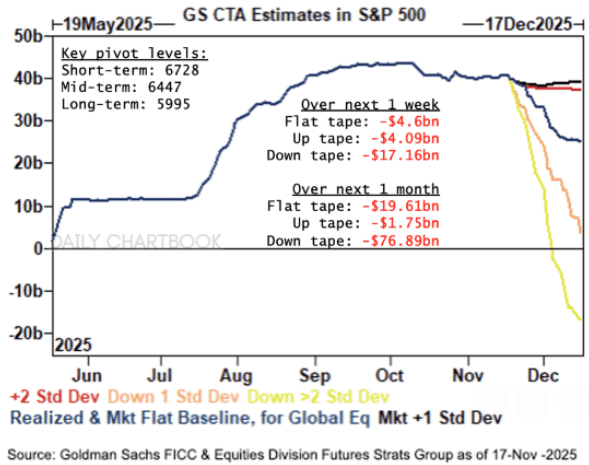

After the S&P 500 index fell below 6,728 points, CTA funds joined the sellers. Due to the specific nature of their activities and strategies, they did not contribute to the declines as long as the index remained above the 50-day EMA. Now, however, so-called “systemic strategies” are complicating Wall Street's chances for a sudden reversal of sentiment and a rebound, as CTAs have to sell “along with the market". In the short term, Nvidia's results and the FOMC's position, which the central bank will communicate on Wednesday, remain indicators for the further direction of the market.

Źródło: Goldman Sachs FICC

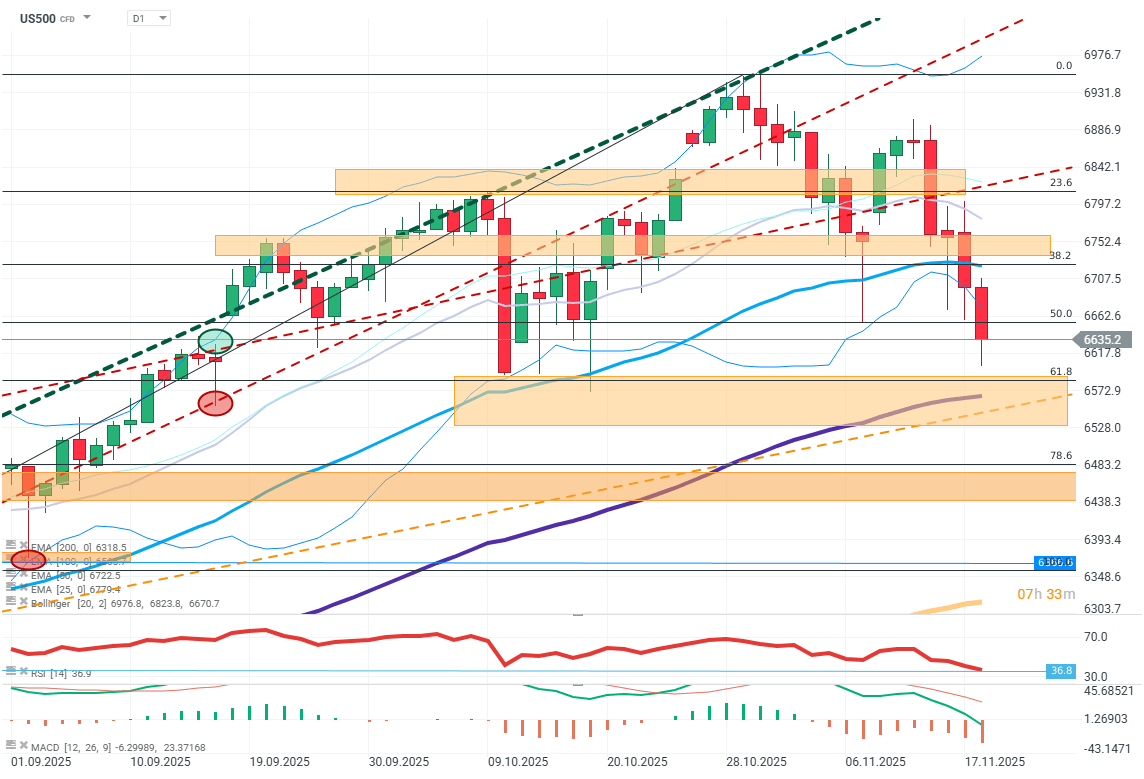

US500 (D1)

Futures on S&P 500 (US500) loses more than 1% today, falling below EMA50.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.