NFP report for May will be released today at 1:30 pm BST. It is highly unlikely that this report alone will change the outlook on Fed's policy in the coming months. Of course, a massive drop in employment could discourage Fed from hiking rates but the probability of a negative reading is seen as low. There have been some hints that jobs figures may be weaker than expected but attention is likely to be focused on wage growth data. Should wage growth dynamics reverse, Fed may reconsider 25 basis point rate hikes instead of 50 basis point rate hikes. What to expect from today's report?

-

ADP report showed jobs gain of just 128k while market expected 300k

-

Market expects NFP report to show 320k jobs gain in May, after a 428k jobs gain in April

-

Goldman Sachs points that May tends to be a weak month according to seasonal patterns

-

Goldman Sachs expects jobs gain of 225k, given a big drop in job advertisements

-

JOLTS dropped by almost 0.5 million in April, to 11.4 million. Demand for work remains strong but a drop in the number of newly opened positions is significant

-

BLS survey was conducted when jobless claims sat at around 220k per week, compared to 180k in April

-

Market expects unemployment rate to return to pre-pandemic 3.5%

-

Wage growth is expected to slow from 5.5 to 5.2% YoY in May. Wages growth is seen at 0.4% MoM in May, after 0.3% MoM increase in April

-

Capital Economics suggests that a slight cooldown on labour market and pick-up in jobs supply may point to wage growth peak being reached

-

However, wage growth near 5% will continue to exert upward pressure on price growth

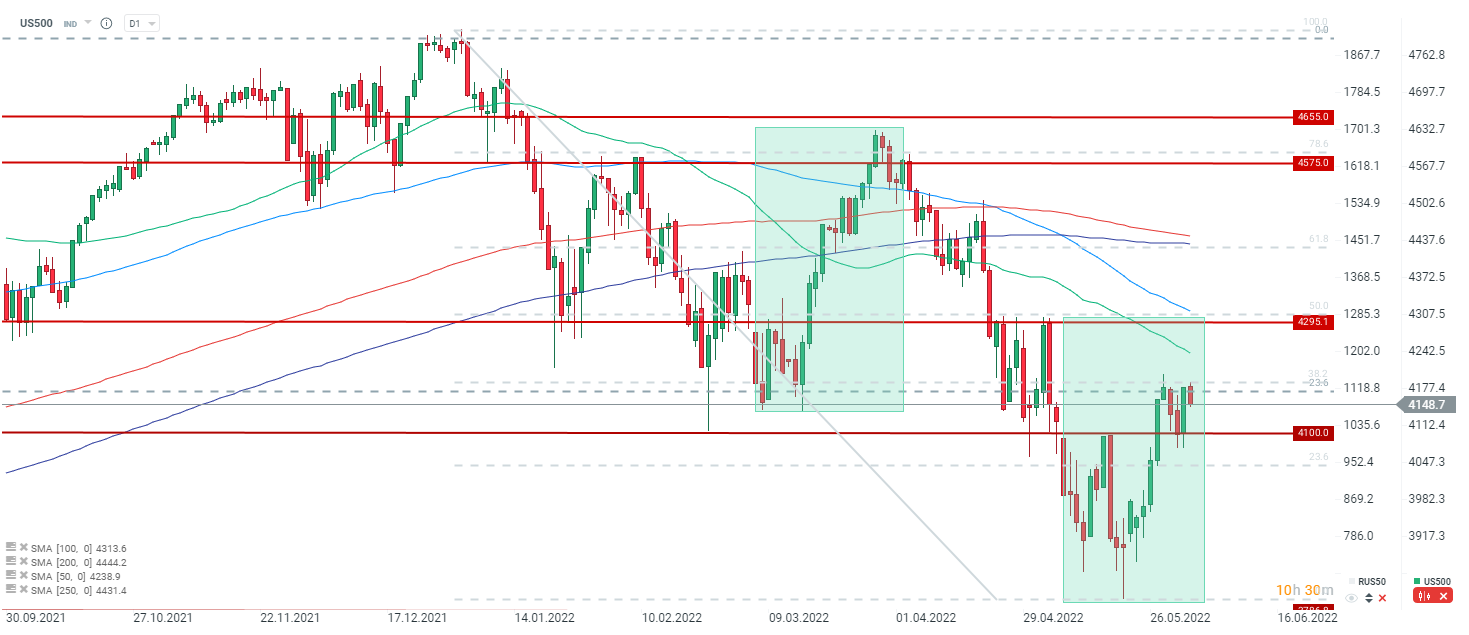

EURUSD returned towards recent local highs, what may be related to weaker data readings, especially ADP reading yesterday. However, it will be wage growth that is most important for index or USD traders. If wage growth had peaked by now, it would be a bullish sign for equities. US500 continues to struggle with breaking above a 4,200 pts resistance zone.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.