The Q4 2025 earnings season on Wall Street is shaping up materially better than investors were expecting as recently as late December. With roughly one-third of S&P 500 companies already having reported, the picture is increasingly clear.

- According to FactSet data as of January 30, 2026, most companies are delivering results ahead of expectations, with a solid hit rate on both earnings and revenues.

- At the same time, revisions to 2026 earnings-per-share estimates are running above historical norms and are stronger than what we saw in 2025. This backdrop supports the bullish camp and strengthens the argument that the S&P 500 could return above the 7,000 level relatively quickly. Below, based on FactSet figures, we outline the key datapoints that help frame what this earnings season is really telling us.

Source: BofA Global Research

FactSet scorecard: results vs. expectations remain firmly positive

So far, about 75% of S&P 500 companies have beaten EPS forecasts, and 65% have surprised positively on revenue. That mix suggests expectations were set conservatively—particularly given persistent concerns around input costs and tariffs—while corporates, at least at this stage, are showing stronger operational resilience than the market priced in.

From an index-level perspective, the standout point is the blended year-over-year earnings growth rate of 11.9%. If that pace holds through the remainder of reporting season, the S&P 500 would log a fifth consecutive quarter of double-digit earnings growth—a strong signal that the earnings cycle continues to support equities.

Just a month earlier, on December 31, consensus implied 8.3% earnings growth for Q4—well below today’s ~11.9%. The gap highlights that this season is not merely “not disappointing”; it is actively pushing expectations higher. Importantly, this improvement is broad enough to show up at the sector level: six sectors are now tracking stronger earnings outcomes than they were at year-end, largely thanks to positive EPS surprises.

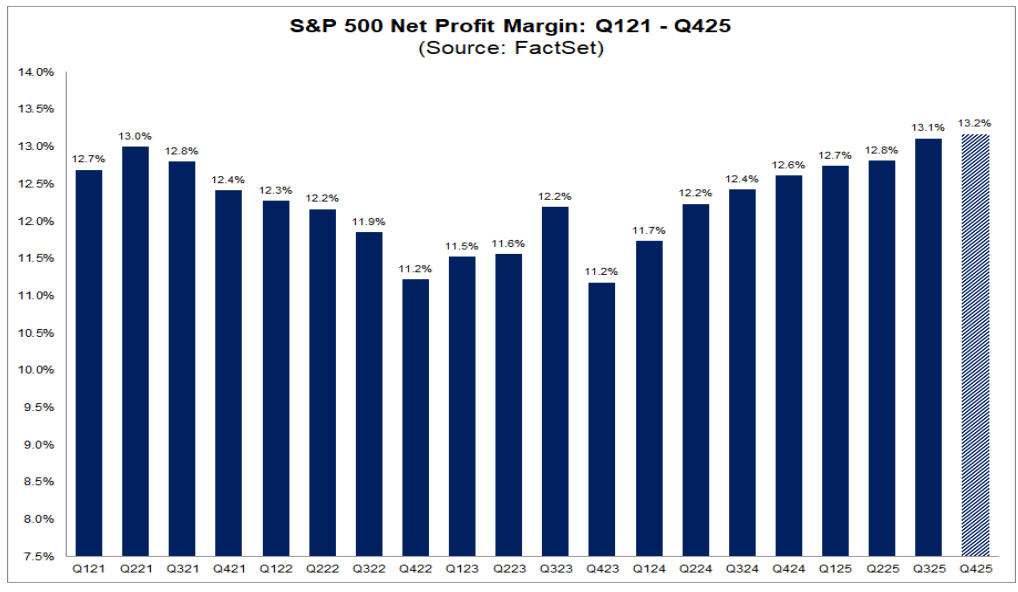

Net margins: the most striking feature of the season

The most impressive element so far is profitability. Despite ongoing debates around tariffs, labor costs, logistics, and pricing pressure, the S&P 500 is currently reporting a blended net profit margin of 13.2% for Q4.

If that holds, it would represent the highest net profit margin recorded since FactSet began tracking this metric in 2009, edging out the prior record of 13.1%, which was set—remarkably—just last quarter. In other words, margins are not cracking under cost pressure; they are sitting at historic highs, challenging the narrative that costs are rapidly eroding corporate profitability.

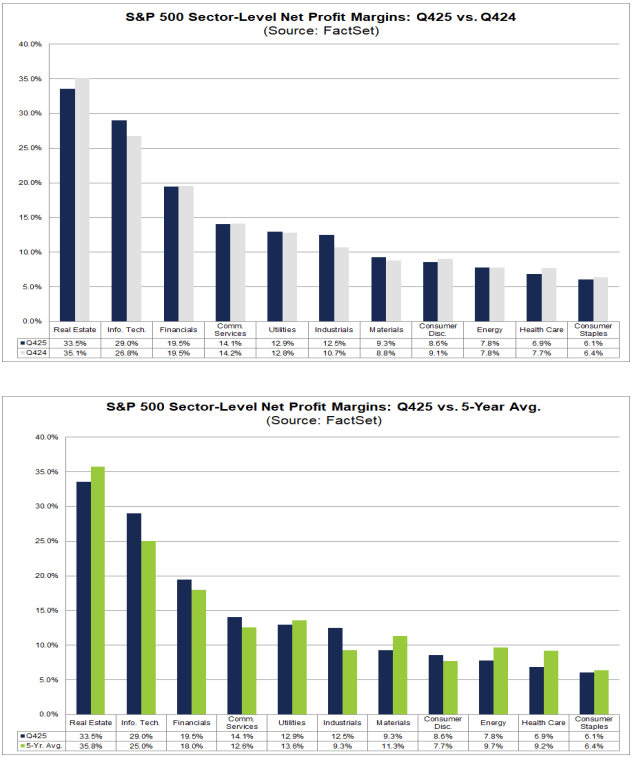

Sector view: technology and industrials are doing the heavy lifting

On a year-over-year basis, margin expansion is concentrated—but where it shows up, it’s meaningful:

-

Information Technology has lifted net margins to 29.0% from 26.8%

-

Industrials has improved to 12.5% from 10.7%

On the other side of the ledger, multiple sectors are seeing margin compression. One of the clearest examples is Real Estate, where net margins have slipped to 33.5% from 35.1%. Energy is essentially flat year over year at 7.8%. It’s also worth noting that this is not a universal margin boom. Only five sectors are currently above their five-year average net margins, led again by Technology and Industrials, while sectors such as Health Care and Real Estate remain below their longer-term norms.

Source: FactSet

Quarter-on-quarter: mixed signals beneath the record headline

On a sequential basis (Q4 vs. Q3), the picture is more uneven. Only three sectors are expanding margins quarter over quarter, led by Industrials (12.5% vs. 10.5%). Most sectors are seeing sequential pressure, with Utilities among the largest drags (12.9% vs. 17.1%).

This suggests the record index-level margin is not the result of broad-based improvement everywhere; instead, it reflects the fact that a few large, highly profitable segments are maintaining exceptional profitability and carry enough weight to lift the aggregate S&P 500 number.

Q1 2026 guidance: constructive, but not euphoric

Company commentary on the next quarter looks steady rather than exuberant:

-

17 companies have issued positive EPS guidance

-

7 companies have issued negative EPS guidance

That’s not a “boom” signal, but it does imply management teams still see more room to execute than risk of a clear deterioration.

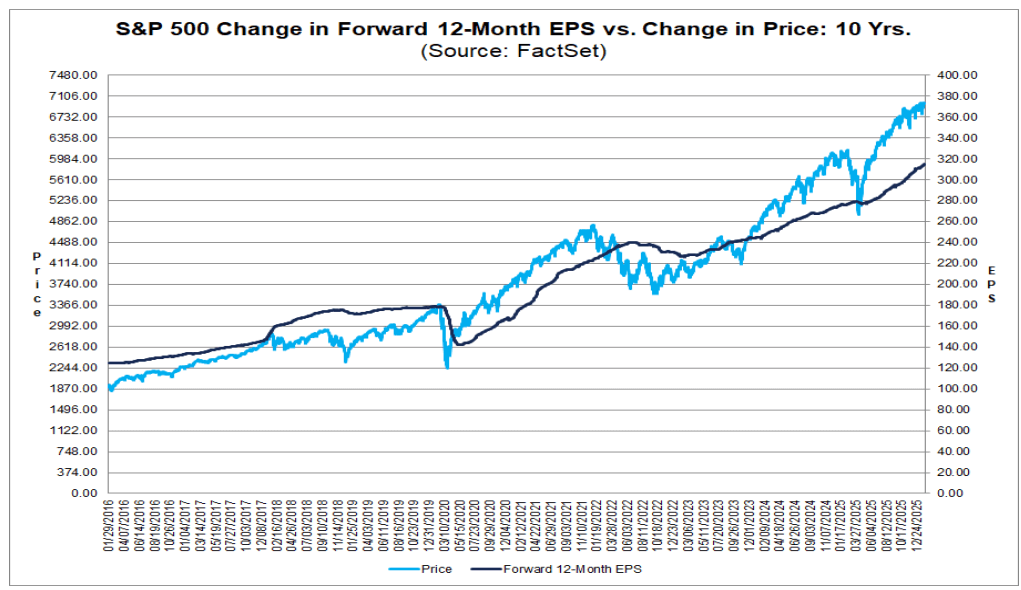

Valuation: investors are paying a premium for this earnings strength

The flip side is valuation. The S&P 500’s forward 12-month P/E is 22.2, which is meaningfully above both the:

-

5-year average (20.0)

-

10-year average (18.8)

The market is already paying up for sustained margin strength and continued earnings growth. Put differently: fundamentals are strong, but the tolerance for disappointment is limited—any earnings stumble later in the season could carry a larger price impact than it would in a lower-multiple environment.

Source: FactSet

2026 outlook: margins expected to climb even further

Consensus expectations imply margins could be even higher in 2026, with projected net profit margins around:

-

13.2% (Q1 2026)

-

13.8% (Q2 2026)

-

14.2% (Q3 2026)

-

14.2% (Q4 2026)

If the market can continue to deliver on that trajectory, high valuations may remain defensible—but it would require ongoing cost discipline and sustained pricing power. The key takeaway so far: Q4 2025 is shaping up as another quarter of solid earnings growth and record profitability, not a season defined by margin compression. The bigger risk for equities isn’t the earnings backdrop itself—it’s that, at current valuation levels, investors will demand near-perfect execution, especially heading into the 2026 quarters.

US500 technical snapshot (D1)

S&P 500 futures (US500) have quickly reclaimed the 50-day EMA on the daily chart and are once again hovering near 6,950. Strong earnings momentum continues to underpin the bullish narrative and helps offset negative momentum impulses.

Source: xStation5

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

PayPal shares slide 5% as Semafor denies Stripe acquisition rumors📉

US dollar strengthens, pressuring EUR/USD, silver and Bitcoin 📉

Oil surges almost 2% amid US - Iran tensions 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.