FOMC rate decision turned out to be in-line with market expectations - US central bank delivered a 50 bp rate hike to 4.25-4.50% range. Decision to hike rates by 50 bp was unanimous, signaling that none of Fed members saw a need for an even smaller 25 bp rate hike after yesterday's CPI print. This can be seen as somewhat hawkish.

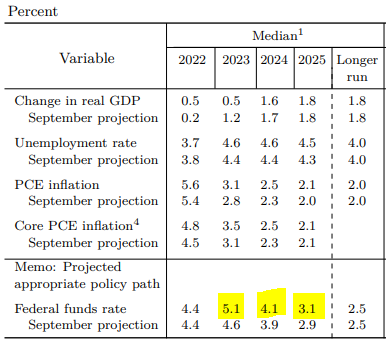

Details of the statement as well as revisions of economic projections are hawkish as well - median forecast for end-2023 level of rates moved from 4.6% in September projections to 5.1% in December projection. Median for end-2024 moved from 3.9% in September to 4.1% now. Also headline and core PCE inflation forecasts were revised higher for 2023 and 2024, signaling that Fed may need to keep tight policy for longer. There was also a massive revision to 2023 GDP forecasts - down from 1.2% growth to just 0.5% growth.

FOMC members see rates peaking above 5% in 2023. A major downward revision to the 2023 GDP forecast is also noteworthy. Source: Federal Reserve

FOMC members see rates peaking above 5% in 2023. A major downward revision to the 2023 GDP forecast is also noteworthy. Source: Federal Reserve

Reaction of the market also shows that decision was seen as hawkish - US dollar gained and equities dropped. S&P 500 (US500) erased daily gains and is now trading 0.6% lower on the day. The index tested psychological 4,000 pts area but bulls did not manage to break below, at least not yet. EURUSD dropped to a 1.0630, erasing most of today's gains. Gold pulled back and tested $1,800 per ounce area but no break below occurred. Upcoming Powell's presser (start - 7:30 pm GMT) is likely to be a source of additional volatility on the markets.

US500 plunged following the FOMC decision, erasing daily gains and testing 4,000 pts area. While bulls managed to defend the area for now, volatility on the markets is elevated and is expected to remain so throughout Powell's presser. Source: xStation5

US500 plunged following the FOMC decision, erasing daily gains and testing 4,000 pts area. While bulls managed to defend the area for now, volatility on the markets is elevated and is expected to remain so throughout Powell's presser. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.