The US dollar is trading lower against the majority of other major currencies ahead of the release of key jobs data. US index futures are trading little changed on the day. NFP report for August can seal the deal on QE taper but a strong reading would be needed. Meanwhile, ADP data released on Wednesday missed expectations significantly and showed a mere 374k jobs gain (exp. 615k). The two reports have often diverged in the previous months then there is still scope for a bullish surprise. Data is likely to be debated extensively next week as a number of Fed members is scheduled to speak. 6 US central bankers are set to deliver speeches on Wednesday alone!

Market expectations

-

Non-farm payrolls. Expected: 750k. Previous: 943k

-

Unemployment rate. Expected: 5.2%. Previous: 5.4%

-

Wage growth. Expected: 4% YoY. Previous: 4% YoY

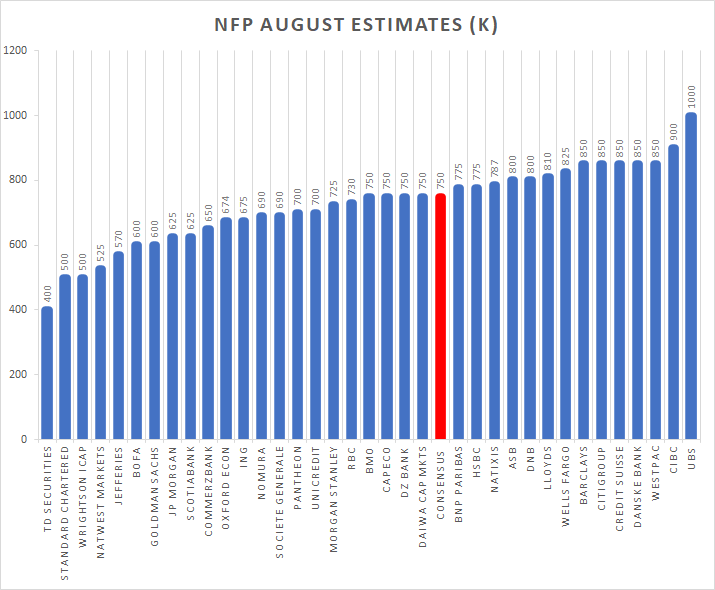

August NFP forecast compilation from Newsquawk. As one can see, the range of estimates (400-1000k) is wide. Interestingly, neither of institutions included in the ranking expects as weak reading as ADP data showed (374k). Source: Newsquawk Twitter

August NFP forecast compilation from Newsquawk. As one can see, the range of estimates (400-1000k) is wide. Interestingly, neither of institutions included in the ranking expects as weak reading as ADP data showed (374k). Source: Newsquawk Twitter

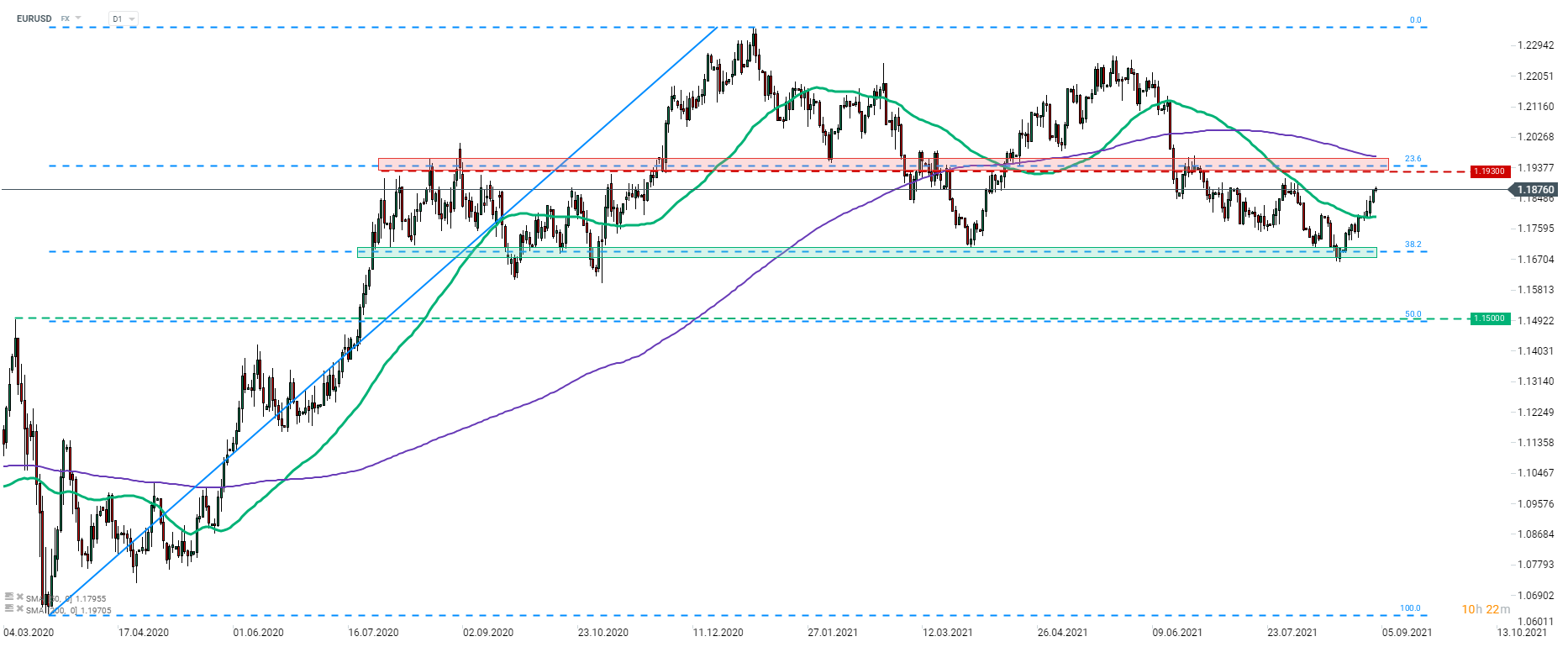

EURUSD continues to climb higher on USD weakness. The pair is slowly approaching the resistance zone at 1.1930, marked with previous price reactions and the 23.6% retracement of upward impulse launched in March 2020. Source: xStation5

EURUSD continues to climb higher on USD weakness. The pair is slowly approaching the resistance zone at 1.1930, marked with previous price reactions and the 23.6% retracement of upward impulse launched in March 2020. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.