US jobs data for October (12:30 pm GMT) may provide some hints on what Fed will do at the end of the year. Fed made it clear that the labor market remains strong and it may need to be cooled down a bit, in order to cool down inflation. As such, Fed may actually want to see a lower employment gain, pick-up in unemployment rate and significant deceleration in wage growth. Is such an outcome possible?

What markets expect from today's NFP release?

-

Markets expects employment gain of 200k, compared to previous month's increase of 263k. Economists' estimates range from 80k to 300k increase

-

ADP data for October pointed to a 239k jobs increase

-

Market consensus points to a pick-up in unemployment rate from 3.5 to 3.6%. However, it is still far off 4% level forecasted by Fed for 2023

-

Wage growth is expected to decelerate from 5.0 to 4.7% YoY. However, pace of wage increases is still far above Fed's inflation target of 2.0% (wage growth that would be in-line with Fed's inflation target is seen at 4% YoY)

-

ISM employment subindices pointed to a cooling of US labor market. US jobless claims remained above 200k in October, what suggests lower employment increase than in September

-

Seasonal patterns suggest that October's NFP reading should be much worse than September's

-

JOLTs for September showed increase leading to an increase in ratio of open jobs to unemployed to 1.86 (mid-year peak near 2.00)

What will be key for Fed?

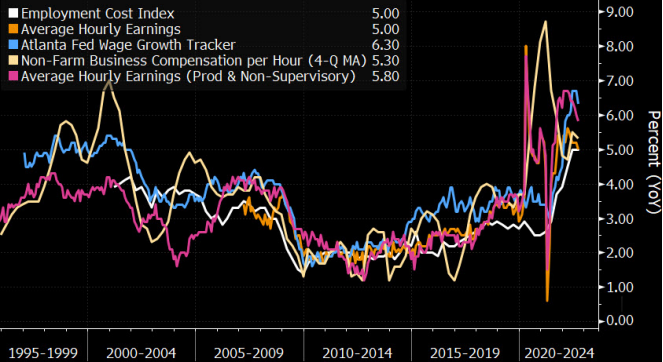

Fed expects unemployment rate to increase to above 4.0% next year. However, deceleration in wage growth looks to be much more important. A number of indicators, like NFP wage growth data of Atlanta Fed wage index, suggest that peak in wage growth may already be behind us. On the other hand, wage growth still remains above 4%, a level that is often seen as in-line with Fed's 2% inflation target. As such, wage growth data will be key part of today's report as far as future Fed policy is concerned. Unemployment rate will be the second part in terms of importance and employment increase will be the least important.

Wage growth indices signal that peak in US wage growth may already be behind us. Source: Bloomberg

Wage growth indices signal that peak in US wage growth may already be behind us. Source: Bloomberg

How will markets react?

Should NFP wage data meet expectations or come in below them and employment sees moderate increase, USD may continue to weaken. However, if wage growth fails to slow, USD may regain some ground it has lost today and yesterday. Lower wage growth will exert smaller upward pressure on inflation and therefore need for big rate hikes may be smaller. This should support stock market indices. On the other hand, if today's NFP data fails to show cooling down of US jobs market, indices may remain under pressure and continued pullback started on Wednesday.

If NFP reports shows cooling down of US labour market, EURUSD may climb back above 0.9800, what will support seasonal rebound scenario. Lack of pick-up in unemployment rate and strong wage growth may see the pair move towards 0.9650. Source: xStation5

If NFP reports shows cooling down of US labour market, EURUSD may climb back above 0.9800, what will support seasonal rebound scenario. Lack of pick-up in unemployment rate and strong wage growth may see the pair move towards 0.9650. Source: xStation5

US100 would need to finish today's trading in the 10,950-11,000 pts area in order to brighten outlook for the next week. Downward momentum on US100 is strong however and a strong NFP report (with high wage growth) would support a bearish scenario. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.