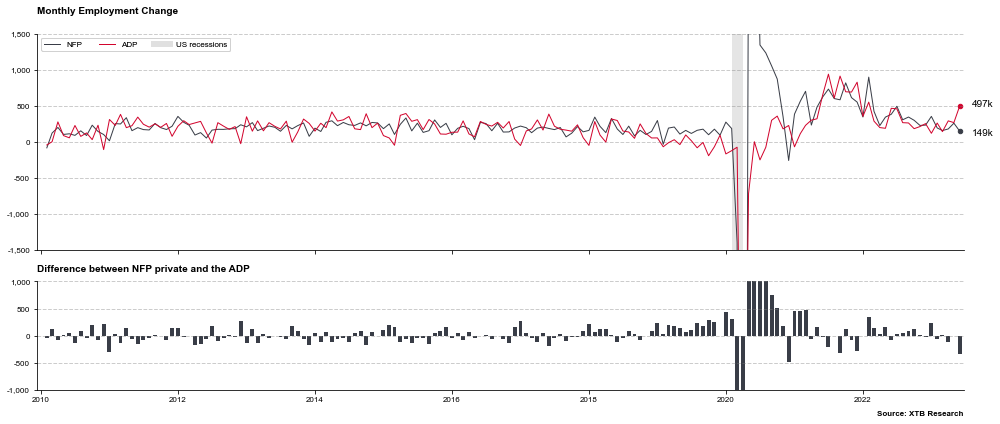

Fitch downgrading US credit rating from AAA to AA+ is the main story of the day. However, investors should not forget about more 'regular' events scheduled for today that also have a chance to move markets. A key macro report of the day is scheduled for 1:15 pm BST - ADP jobs report for July. Report is expected to show a 190k employment increase, following an almost half a million increase in June (+497k). However, it should be noted that last month's ADP reading turned out to be a poor predictor of NFP as the official jobs report showed an employment gain of just 209k (149k for private payrolls). A better-than-expected report could trigger a hawkish reaction in the markets - USD gains and equity losses. However, any reaction is likely to be short-term with investors more focused on Friday's NFP data.

There was a massive mismatch between ADP and NFP data for June. ADP showed an almost half a million increase in employment while NFP showed just 149k increase in private payrolls. Source: Bloomberg Finance L.P., XTB

US dollar and US equity index futures weakened following Fitch downgrade announcement yesterday in the evening. However, moves on the FX market have been completely erased already and now EURUSD is trading below pre-announcement levels. Meanwhile, US index futures also recovered part of losses but still trade around 0.7% below pre-announcement levels.

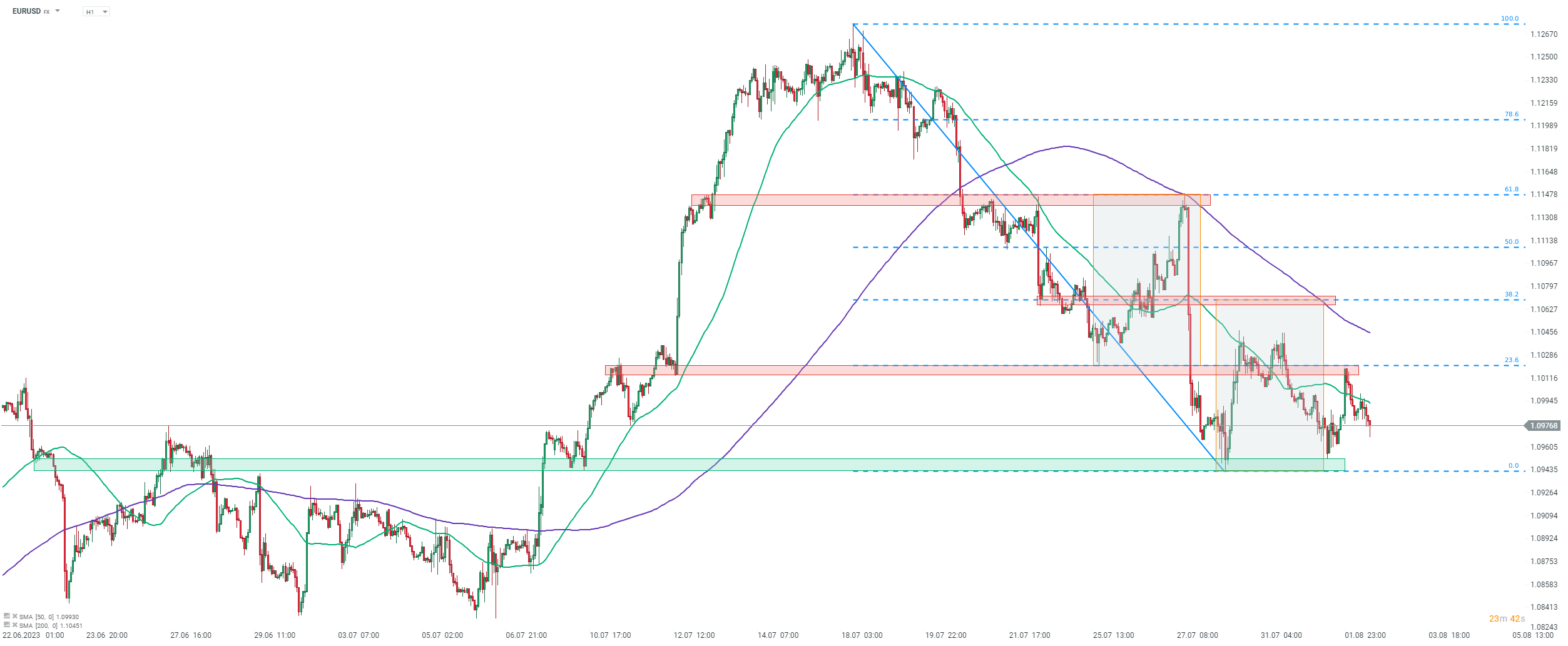

EURUSD

EURUSD jumped following Fitch downgrade and tested the 23.6% retracement of the downward move launched in mid-July. Bulls failed to break above and the pair started to pull back. Gains were fully erased later on and the pair trades at daily lows at press time. A positive ADP surprise could trigger some short-term USD bids. The near-term support to watch can be found in the 1.0950 area.

EURUSD at H1 interval. Source: xStation5

US500

S&P 500 futures (US500) gapped lower when overnight trading resumed, responding to Fitch downgrade (orange circle). While index recovered part of losses after trading was launched, another wave of selling arrived with European cash session open. Index slumped further and bulls managed to halt declines after a test of the 4,560 pts price zone, marking the lower limit of the ongoing trading range.

US500 at H1 interval. Source: xStation5

US500 at H1 interval. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.