CBOE VIX volatility index futures (VIX) are down nearly -0.7% today, extending strong downward momentum. The decline is being driven by several factors that make equities and risk assets appear attractive to investors despite historically high valuations.Today, futures on US indices such as US100, US500 gain 0.1 - 0.15% but US30 and US200 are almost 0.3% higher.

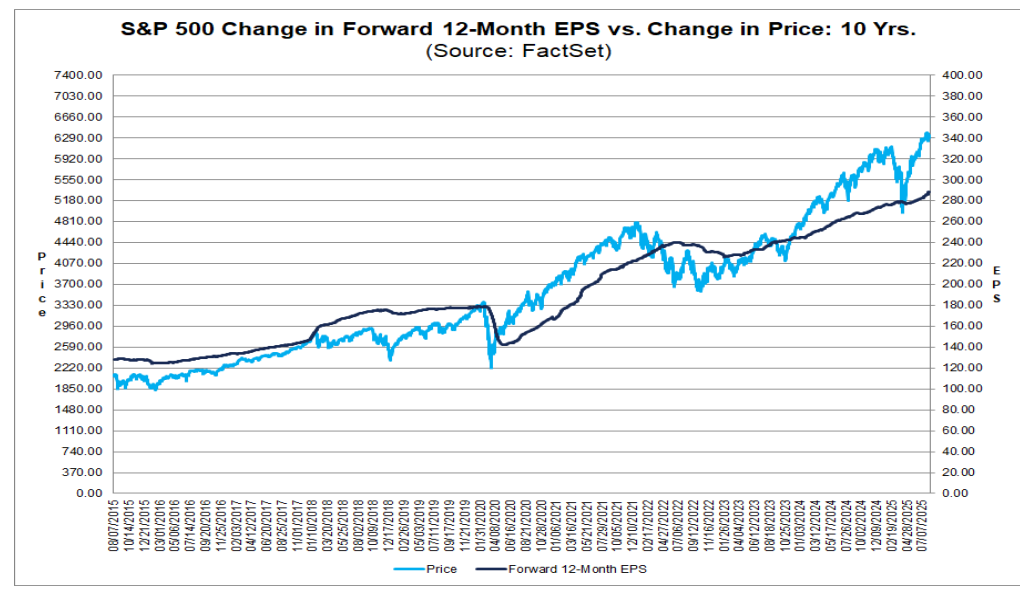

- The forward 12-month price-to-earnings ratio for S&P 500 companies stands at 22.1, versus the 5-year average of 19.9 and the 10-year average of 18.5. Now, investors are hoping that the Putin–Trump summit in Alaska will ease geopolitical tensions and perhaps trigger a sharper decline in energy commodity prices — especially if a peaceful resolution is truly reached in Ukraine and the U.S. eases sanctions on Russian resources, including oil. Such a scenario would reduce the inflation risk.

According to the Bank of America FMS survey, 78% of fund managers expect U.S. interest rate cuts within the next 12 months, while the probability of recession has dropped to its lowest since January 2025. Allocations to equities are also increasing. The survey sees the highest odds for the Fed chair position going to Waller, closely followed by Kevin Hassett. The biggest risks remain a trade war and higher inflation, which could prevent the Fed from cutting rates.

VIX chart (H1 interval)

VIX futures are trading within a downward price channel, with potentially strong resistance likely to emerge around 17.3 (50-period exponential moving average – EMA50).

Source: xStation5

After each of the last two VIX rollovers, the index has returned to a strong downward trend, and expectations of U.S. rate cuts mean investors see little need to “hedge” volatility, despite potentially favorable seasonal patterns for the index in the coming weeks.

Source: xStation5

First, the U.S. earnings season has been very solid, with Big Tech companies reporting rising revenues and profits, easing concerns over “stretched valuations.According to FactSet, S&P 500 companies’ earnings rose by an average of 11.8%, and as many as 81% of firms reported both earnings and revenues above Wall Street forecasts. Forty companies issued positive guidance for the next quarter, compared with 38 that issued negative outlooks.

Source: FactSet

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.