WTI crude oil has dropped to $72.5 per barrel, slightly breaching the lows from June this year, marking the lowest price level since February. The declines from Friday and today have broken the upward trend line. Maintaining current levels might indicate the formation of a double low pattern, with a neckline around $84 per barrel. However, taking into account current fundamentals, the full formation of the pattern is practically impossible. Nevertheless, a technical rebound to around $78 per barrel cannot be ruled out.

Source: xStation5

Recession Fears? What Does This Mean for Oil?

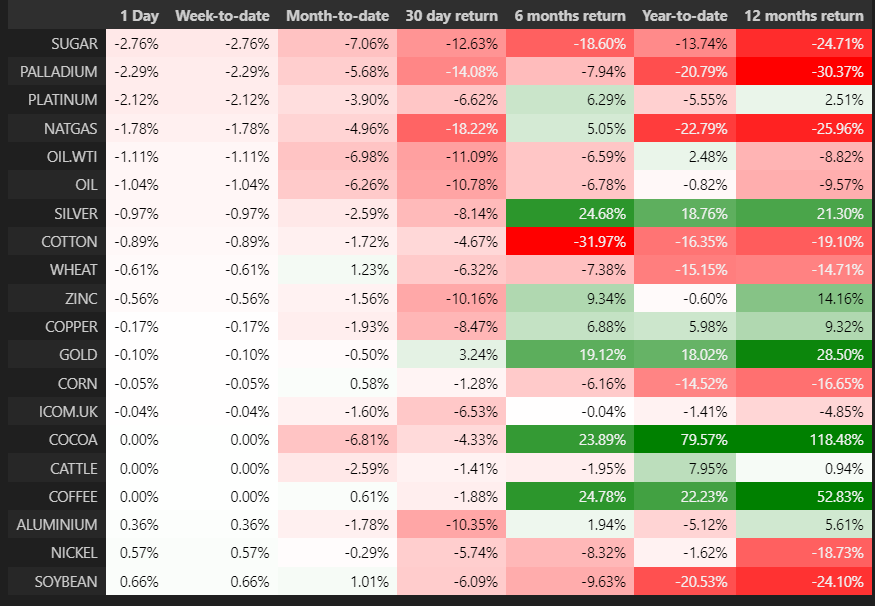

The magnitude of movements in the stock market can provide insights into the actual risk of a recession. On the other hand, if we look at the commodities market, significant movements are not observed today. However, some markets, such as oil and industrial metals, have long indicated a persistent recession risk, primarily related to the situation in China. Meanwhile, the market is now concerned about recession risks due to significant weakening in the US labor market and the unwinding of yen-financed carry trades.

The unemployment rate in the US has risen to 4.3%. During previous recessions, we observed a similar rebound in the unemployment rate. The Fed might already be late with rate cuts, which is why the market has started to price in a high probability of a 50% cut. To calm the market, clear communication from the Fed is needed, indicating that data is in line with expectations and the economy remains strong.

Source: Bloomberg Finance LP, XTB

As seen, oil is losing about 1.5% today, which is not unusual considering the movements in the stock market, particularly in Asia. However, it is worth noting that oil has dropped by about 8% since Thursday, following a previous rebound driven by increased geopolitical risk. Currently, geopolitical risk has less impact on oil prices, although a significant reaction from Iran to recent events could change the situation. Additionally, it is important to note that the US is currently in hurricane season. This could lead to reduced production in the Gulf, but the greater risk now appears to be reduced fuel production and decreased exports, which is already seen as negative for prices.

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.