FOMC decision was expected to be a key event of the week. However, a sell-off that arrived on the markets at the beginning of this week showed that developments around Chinese developer Evergrande may be a much bigger risk for the markets. Nevertheless, the Federal Reserve remains the most important and impactful central bank in the world so its actions should not be ignored. Let's take a look at what to expect from today's announcement.

Focus on tapering

Interest rate will, of course, stay unchanged and no one expects a different move. However, the situation looks less certain when it comes to asset purchase schemes. There is a growing feeling in the markets that the Fed will finally announce a taper timeline today. There are some factors that back this view - inflation continues to run rampant and more Fed members begin to call for the launch of tapering this year. On top of that, today's meeting is a quarterly one and will be accompanied by the release of a new set of macroeconomic forecasts. Fed prefered to use those quarterly meetings to announce major policy changes in the past. Moreover, solid retail sales data for August proved that the US consumer and economy are strong. All of this supports higher dot-plot and better forecasts.

Having said that, the taper announcement today cannot be ruled out. However, factors that would support tapering were present in the previous months as well but Powell went to great lengths to assure investors that it is too early to withdraw monetary support. There are rumours that Powell may use recent issues in China to continue with a massive support for the economy.

Will China issues matter?

Some say that turmoil surrounding Evergrande and a risk that the company may collapse sending shockwaves through the markets may lead the Fed to stay on hold today when it comes to major announcements. While collapse of the Chinese developer and potential spillover effects are for sure one of the risks to the global economy, it should be noted that it remains uncertain whether those risks will materialize. Evergrande announced that it will not default and will make interest payments scheduled for tomorrow. There are also news circulating saying that Evergrande may be taken over by the Chinese government and restructured. Such a result would make any negative impact from the event limited, especially abroad. Having said that, Fed is more likely to focus on domestic factors today and, as we have mentioned before, high inflation and strong retail spending favour a hawkish move.

A look at the markets

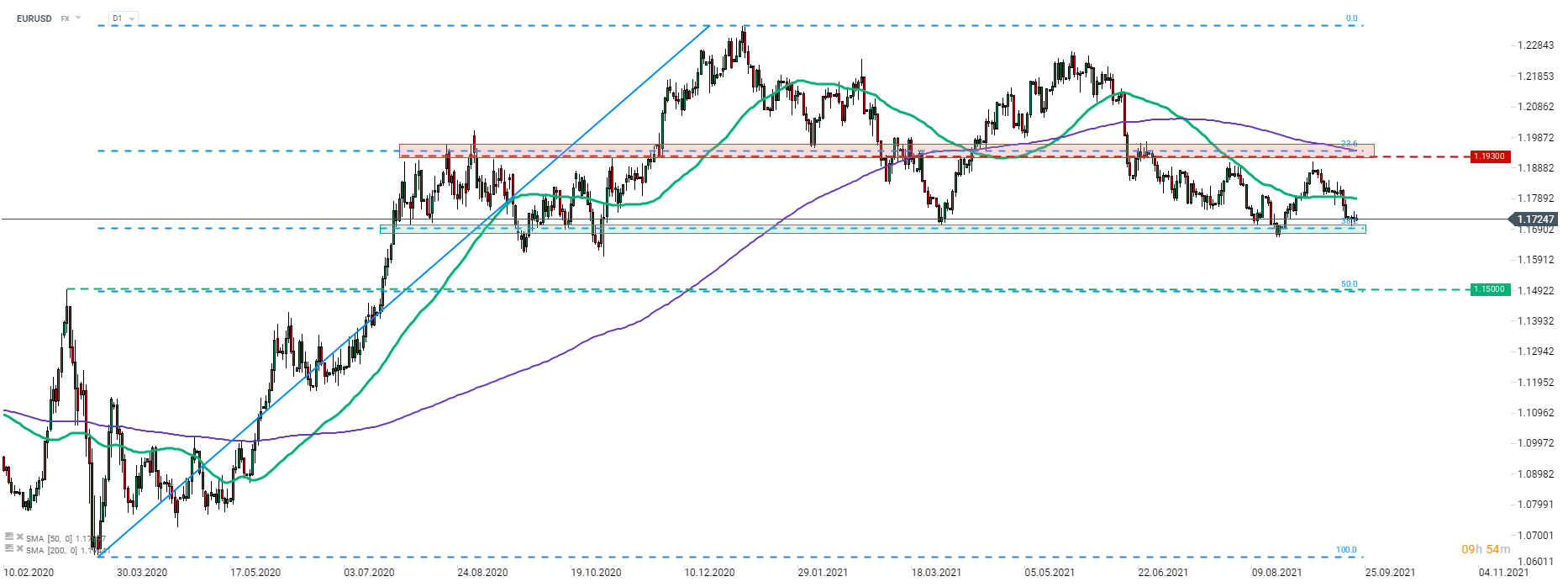

EURUSD

The main currency pair - EURUSD - has been stuck between 23.6 and 38.2% retracement of the post-pandemic recovery move recently. A lower limit of the range at 1.1700 was reached this week but sellers were unable to push the pair below. Hawkish announcement from Fed would boost USD and may lead to a break below the 1.1700 mark. Sticking to a dovish narrative could see EURUSD gain and move towards its 50-session moving average (green line).

Source: xStation5

Source: xStation5

GOLD

Gold has been struggling so far this month. Precious metal dropped almost $100 per ounce off its monthly high reached at the beginning of September. Sell-off was halted at the $1,750 support zone and price jumped $20 since. In case of a hawkish announcement from the Fed today, GOLD may find itself under pressure and the aforementioned $1,750 support will be on watch once again. On the other hand, lack of taper announcement would be viewed as a very dovish message and GOLD may look towards resistance near 50% retracement ($1,800 area). Source:

xStation5

xStation5

US100

When it comes to equities, tech sector is expected to be the most impacted by a potential taper announcement. US100 managed to halt recent sell-off near mid-August lows (14,800 pts area). The index trades significantly above its near-term support at 14,560 pts, marked with the 23.6% retracement and the lower limit of local market geometry. This will be the level that will be on watch in case Fed turns hawkish.

Source: xStation5

Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.