Futures on Chicago wheat (WHEAT) at the CBOT are down nearly 1% today ahead of the release of updated supply, demand, and ending stocks projections in the USDA WASDE report, scheduled for 6:00 p.m. CET. Wheat prices continue to face pressure from cheaper Russian exports, where the reduction of the export tax to zero has translated into even lower FOB values. The move was likely intended to allow Russian exporters to push prices down further and secure contracts across markets in the Middle East, Africa, and Asia. Notably, Argentina’s Javier Milei has also decided to reduce export taxes on wheat, introducing yet another highly competitive player to the global agricultural market.

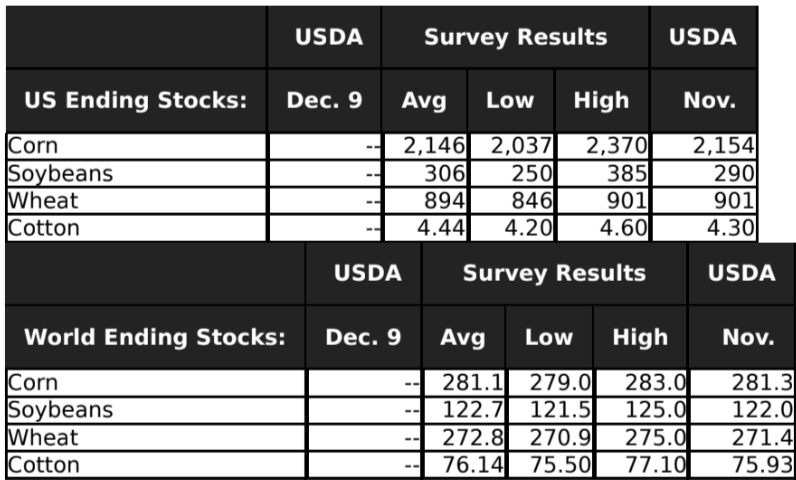

Expected WASDE figures

Source: Bloomberg Finance L.P.

Key Facts

-

Wheat from the Black Sea region remains the primary benchmark for global pricing. Russian 12.5% protein wheat continues to outcompete Ukrainian 11.5%, with both origins trading within a narrow range, though Russia maintains a clear pricing advantage.

-

Declines in Chicago SRW and Kansas HRW (March) futures reflect a market lacking a clear catalyst and still weighed down by global supply pressure, primarily from Russia.

-

French milling wheat weakened again, highlighting soft EU demand and ongoing export challenges due to aggressive Black Sea pricing.

-

Demand in Southeast Asia is beginning to recover, with private buyers in the Philippines reportedly purchasing several cargoes of feed wheat. The Pacific Basin continues to absorb supply despite volatility in freight markets.

-

In Australia, APW and ASW prices strengthened as the Australian dollar gained value.

-

Russian export offers for January–February shipment remain exceptionally competitive at 229–233 USD/t FOB, and the export tax cut to zero further solidifies Russia’s role as the global “market maker.”

-

In the EU’s Black Sea region (e.g., Constanța), prices remain stable, but liquidity is extremely thin.

-

Protein premiums across Europe (France, Germany, Poland, Baltic states) remain virtually unchanged, reflecting a calm physical market with no upward pressure on higher-quality wheat. Export premiums in the U.S. Gulf remain stable as well, both for Chicago and Kansas classes.

WHEAT (D1 interval)

The chart shows weakening sentiment in the wheat market, with prices struggling to hold within a narrow 530–450 range since November 21. A breakdown below 530 could open the door to a deeper decline, while a move above 545 would increase the likelihood of a test of local highs around 560.

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.