US wheat prices dropped below local lows from late February and March last week and are now at their lowest levels in 4 years, heading toward the 500 cents per bushel mark. The price declines in the US are driven by two factors:

- Export data is not impressive, indicating that the dollar remains strong and does not encourage larger purchases from the US. Moreover, harvests in other regions around the world, especially in Russia and Australia, look better, which does not increase demand for American wheat

- The harvests in the US also look good. So far, 76% of the winter wheat has been harvested, and today at 9:00 pm BST we will learn more data about last week. We will also learn about the quality of the spring wheat. Last week, the share of the best quality wheat in the USA reached 77%, which is close to the highs of recent years. More importantly, in North Dakota – a key state in the Plains region where wheat is grown, production prospects per acre have risen to the highest level in history.

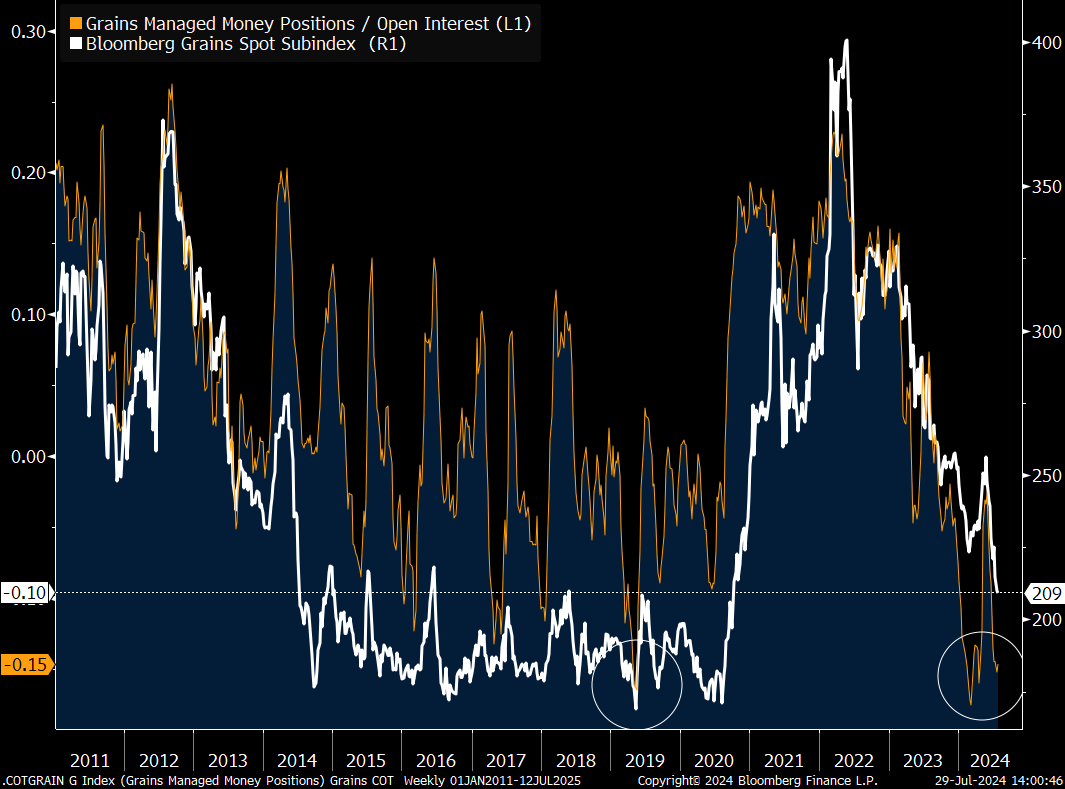

It is also worth noting the still relatively low oil prices, which mean lower production costs and less profitability for processing agricultural raw materials into biofuels (mainly corn and soybeans in the US). Since the supply of corn and soybeans is expected to be higher, the demand for wheat (mainly for feed) also decreases. Therefore, we are observing a clear increase in short positions across the entire grain market relative to the number of open positions.

Short positions on grains, opened by hedge funds, relative to all open positions in the market. Source: Bloomberg Finance LP, XTB Research

Wheat has reached its lowest point since August 2020. Looking at speculative positions, extremely low positioning for wheat is behind us, but other commodities like soybeans and corn are being sold heavily. The next significant support level for wheat is at 500 cents per bushel, and from a technical standpoint – the local lows from 2020, which are around 490 cents per bushel. Source: Bloomberg Finance LP, XTB Research

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.