While there are a number of central bank rate decision scheduled for this week, it seems that Bank of Japan decision tomorrow during the Asia-Pacific session will be the most interesting one. This is because the Japanese central bank is expected to hike rates out of the negative territory! Let's take a look at what market expects, as well as what could be seen as a hawkish or dovish surprise!

Stars finally align for a Bank of Japan hike

Bank of Japan can be seen as the least active of major central banks. The bank has kept its main policy rate at -0.10% since early-January 2016. There was no aggressive pandemic-related cuts in Japan, and there was no aggressive post-pandemic hiking either. That's because Japan has struggled for a long time to achieve its 2% goal, forcing BoJ to engage in massive easing in an attempt to fuel inflation. Global post-pandemic jump in inflation was also present in Japan, but there were concerns that it will not last, and that inflation will return to sub-target levels. However, results of this year's annual wage talks resulted in the biggest pay hikes in decades, what greatly boost the chance of wage-price cycle commencing. This is what Bank of Japan wanted to see for a long time and combining it with recent rather hawkish comments from BoJ members, there is a high chance that Japanese central bankers will decide on the first rate hike since 2007 this week.

Outcome of this year's wage negotiations hints that Japanese CPI inflation may finally reach 2% target on a more sustained basis. Source: Bloomberg Finance LP

Outcome of this year's wage negotiations hints that Japanese CPI inflation may finally reach 2% target on a more sustained basis. Source: Bloomberg Finance LP

Markets expect end of negative interest rates in Japan

Bank of Japan will announce its next rate decision tomorrow during the Asia-Pacific session. There is no exact timing for the announcement, but based on the past decisions, it usually comes around 3:00 am GMT. Press conference of BoJ Governor Ueda usually begin around an hour or hour-and-a-half following rate announcement.

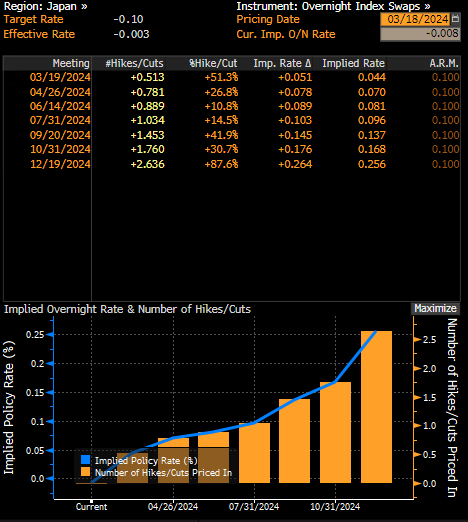

Money markets are currently pricing in a 50% chance of Bank of Japan delivering a 10 basis point rate hike tomorrow. Those odds were as high as 70-80% last week, but it seems that as the decision draws closer, investors are having second thoughts. It should be said that it is not the first time when markets hope for an end of ultra loose policy in Japan, therefore recent pullback in expectations may reflect concerns that BoJ will disappoint once again.

While the majority of economists in Bloomberg survey expects rates to be left unchanged at -0.10%, it should be noted that those forecast were mostly released before last week's results of annual wage talks. Since Friday, there were a number of revisions to estimates and almost all of them point to either a 10 basis point rate hike, to 0.00%, or a 20 basis point rate hike, to 0.10%.

Source: Bloomberg Finance LP

What could be seen as a hawkish surprise?

Markets are positioned for a BoJ rate hike that would end a period of negative interest rate tomorrow. Having said that, a hawkish surprise would require more than 10 basis point of tightening. Should BoJ deliver a 20 basis point rate hike, as some institutions expect, JPY would likely gain. However, BoJ officials have warned that any rate hikes would likely be gradual, therefore a hike larger than 10 basis points is not the base case scenario. A hawkish surprise could come from yield curve control (YCC). More precisely, lack of it. While discontinuing YCC is expected this year, a decision to abandon the tool as soon as at tomorrow's meeting would be seen as a hawkish surprise, and would also benefit JPY.

What could be seen as a dovish surprise?

A no hike would for sure be a dovish surprise, given how big expectations for a hike are. In a dovish scenario, Bank of Japan could dismiss the results of last week's wage negotiations, and say it prefers to wait until pay hikes for small and medium companies are announced. This would be somewhat reasonable given that small and medium companies account for around 70% of all companies in Japan, and last week's talks related mostly to larger companies. This would mean that rate hikes could come closer to the middle of the year. Keeping rates unchanged may put pressure on the Japanese yen.

A look at USDJPY

Japanese yen began to gain as it became more and more evident that Bank of Japan will hike rates, with USDJPY dropping from around-151 to below-147 in the first half of March. However, the move lower was halted later on and the pair recovered a large part of losses since.

Taking a look at USDJPY chart at D1 interval, we can see that the early-March correction was halted at the 200-session moving average (purple line) and the pair began to recover later on. USDJPY is currently attempting to break above the 50-session moving average (green line) in the 149.00 area. A rate hike that is bigger than 10 basis point or the announcement that YCC will be discontinued may see the pair resume a downward move, with recent lows and the aforementioned 200-session moving average being the first potential support. On the other hand, failure to deliver even a 10 basis points of tightening could be seen as a major disappointment and may push the pair towards recent highs above 150.00 mark.

Source: xStation5

Economic calendar: US retail sales and PPI data in focus on Wall Street 🗽

Morning wrap (14.01.2026)

Daily summary: Dollar dominates FX trading as odds of US intervention in Iran rise (13.01.2026)

Powell’s Bet Countered❗️ USD Rebounds After Remarks From St. Louis Fed President 💸

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.