Monetary policy decision announcement from the European Central Bank at 12:45 pm BST is a key event of the day. President Lagarde will hold a press conference 45 minutes later at 1:30 pm BST. Interest rates will be left unchanged and no one seems to question it. However, this time attention will be on the Pandemic Emergency Purchase Programme (PEPP). This is an emergency programme that was launched during the pandemic and is currently running at a pace of €80 billion per month. However, this programme runs simultaneously to a "normal" Asset Purchase Programme (APP) that is running at the pace of €20 billion per month.

ECB prepares tapering announcement?

Investors will look for hints whether ECB is ready to taper. Some expect that the European Central Bank may announce scaling down of PEPP to €60 billion per month in the final quarter of 2021, down from the current €80 billion per month. It would be a very hawkish message as it would hint that the economy is no longer needing as much support. However, even if this is so, the ECB President Lagarde will likely try to assure markets that it is not the end of monetary stimulus and that the ECB keeps all options on the table. A less hawkish but still hawkish move would be to leave the pace of purchases unchanged but vow not to extend the programme beyond the current deadline of March 2022.

While inflation in the euro area is nowhere near as high as in the United States, a major acceleration occurred in Europe as well. The most recent CPI reading (for August) showed an acceleration from 2.2% YoY to 3.0% YoY. ECB is no longer targeting inflation "near or slightly below 2%" and has instead adopted a symmetric 2% target with some leeway for short-term deviations. Nevertheless, recent pick-up in price growth to the highest levels since 2011 is likely to raise questions in case ECB decides to stay on hold today.

Technical situation

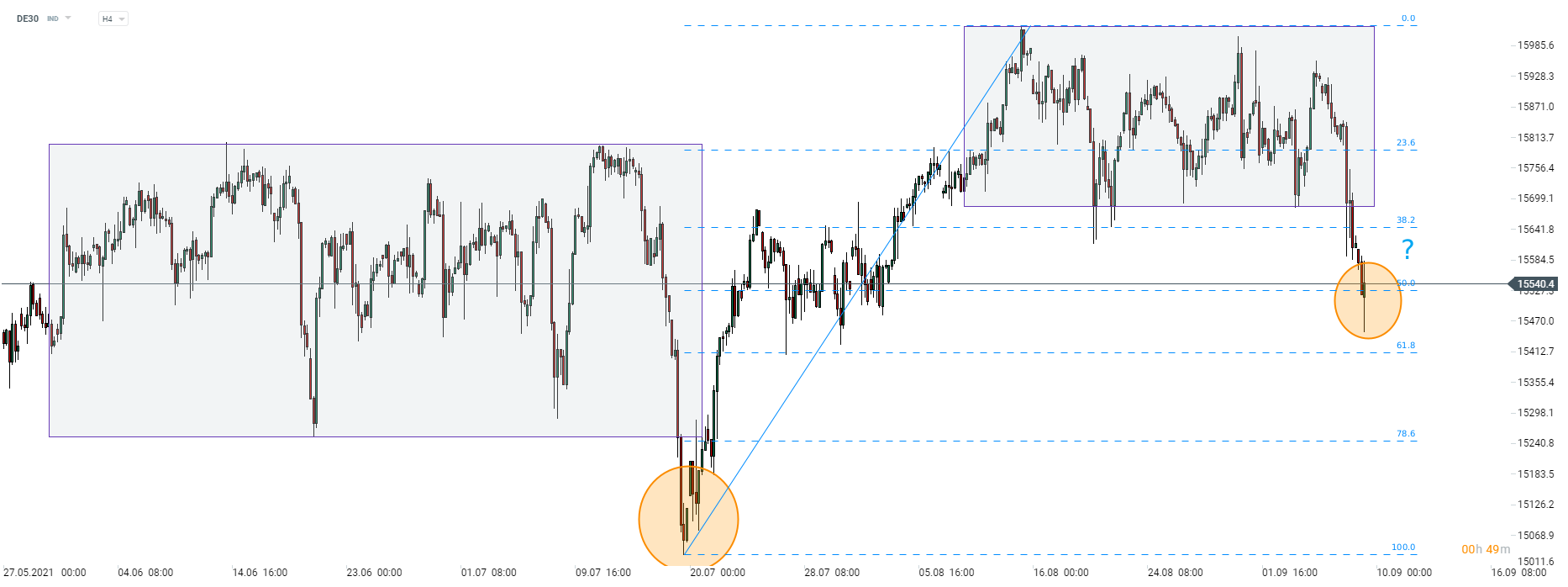

With markets taking into account the possibility of a major move from the ECB today, the decision may actually have an impact on the markets, especially DE30 and euro. When it comes to the German index, DE30 has dropped below the range of recent consolidation, threatening to deliver a large decline that could lead to trend reversal. However, note that previous such downside break from the June-July trading range turned out to be a false breakout and index rallied to fresh all-time high later on. The ongoing pullback has been halted today at 50% retracement of the upward impulse started in mid-July. Will today's ECB decision be a trigger for a similar recovery move as in late-2021? We shall see in the afternoon but equities may feel the pain if ECB decides to go through with lowering asset purchases.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.